Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Today's risk-on sentiment in the markets was provoked by the anticipation of the trade negotiations between the US and China. The high-level talks resume in Washington as China's Vice Premier Liu He plans to meet with US trade representatives. Last week China made significant progress towards reaching a deal as it announced various concessions. These concessions included an extension of the suspension of retaliatory tariffs on US autos and regulation of the opioid fentanyl.

According to Myron Brilliant, executive vice president for international affairs at the U.S. Chamber of Commerce, 90% of the deal is done at the moment. However, the final 10% is the trickiest part that would require compromise.

What does the final 10% include?

That is, if these issues remain unsolved, the uncertainties will hurt the risk-on atmosphere in the market.

What about the currencies?

If the sides make positive progress today, the risk appetite in the market will push the NZD, the AUD and the emerging market currencies higher.

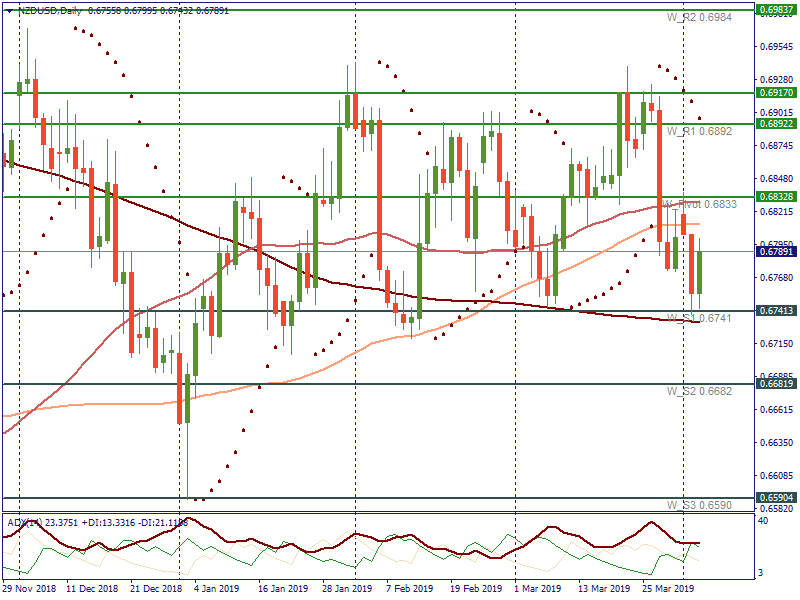

Let’s consider the key levels for the New Zealand dollar.

On the daily chart, the NZD/USD pair has bounced from the support at the weekly pivot at 0.6741, which lies close to the 200-day SMA. Up to now, the kiwi is targeting the resistance at the weekly pivot at 0.6833. If this level is broken, the next resistance will lie at 0.6892. In case of the risk aversion, the pair will fall below the 0.6741 level. The next key support will be placed at 0.6682. If we look at indicators, ADX shows the bearish pressure, while Parabolic SAR demonstrates the downward movement.

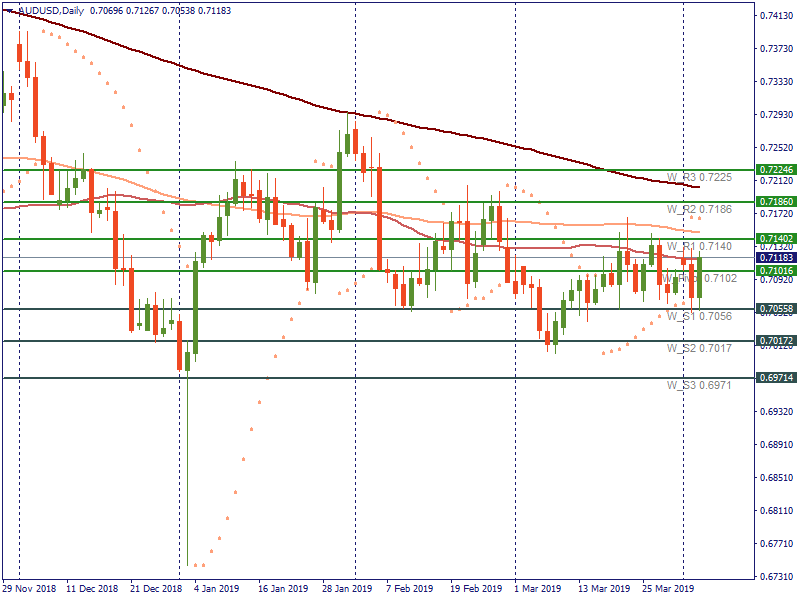

Now let’s look at the aussie.

Here, AUD/USD has been trading sideways since the middle of March on the daily timeframe. At the moment the pair is testing the 50-day SMA. Bulls are trying to push the pair above this level towards the weekly pivot resistance at 0.7140. The next resistance lies at 0.7186. If bears take over the market, the aussie will fall downwards below the central pivot at 0.7102 to the support at 0.7056. The next support is placed at 0.7017. Parabolic SAR shows an upward movement for the pair on this chart.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later