The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Pound Sterling is recovering against Dollar

GBP is moving up. Why?

The British pound has increased in value over the course of the past week in line with an ongoing improvement in investor sentiment.

Most investors believe the negative impact of the coronavirus will be softened by a generous package of support from global central banks and governments.

We have noticed this past week that investor appetite for 'risk on' assets such as stocks and commodities has returned. This, in turn, has a pass-through effect on the currency and the sterling.

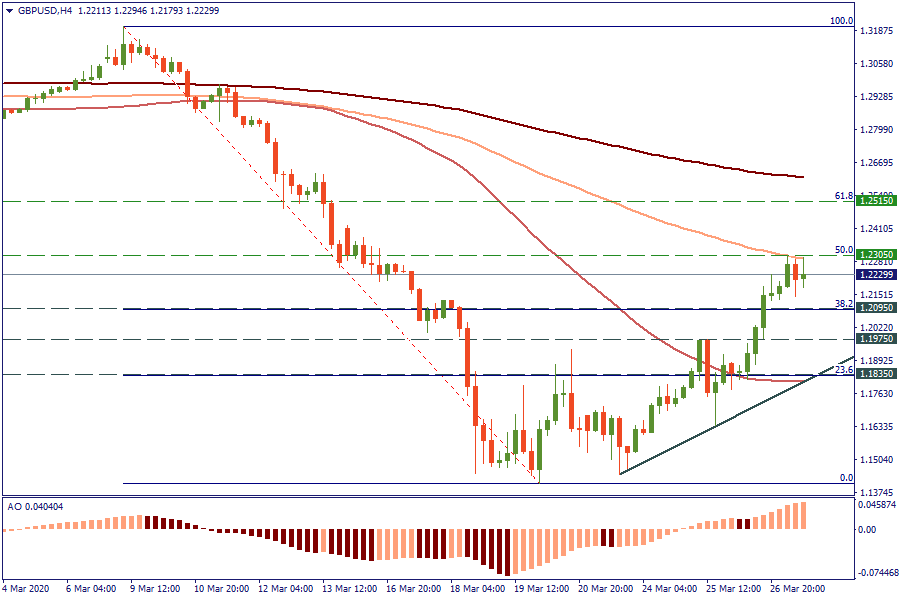

Let’s have a look at GBP/USD price chart with 4-hour timeframe starting from March 20.

The GBP/USD pair bounced aggressively higher, breaking through 38.2% Fibonacci retracement level. It regained the half of its positions already and stopped for a moment at the 1.2260 mark almost crossing the 100-period Moving Average. There is the question now if the GBP is so sustainable enough to climb to the 61.8% Fibonacci retracement level to reach the 1.2515 mark or not. Support lies at 1.2095 and 1.1975.

GBP vs USD

Being the critical driver of the GBP/USD rally, the dollar weakness is a crucial theme nowadays as the US currency took a significant tumble in the wake of the release of weekly labour market data that showed a record surge in unemployment claims.

Further aiding Sterling's advance was the decision by the Bank of England to leave interest rates and levels of quantitative easing unchanged at their scheduled March 26 meeting.

The decision was expected, considering that the Bank has already unleashed a sizeable support package for the economy via the decision to cut interest rates to the bone at 0.10% and inject an additional 200 billion pound into the economy. Moreover, the Bank also continues to stay ready to act by increasing its QE (quantitive easing) program, if need be.

Barclays’ forecast

However, UK high-street lender Barclays predicted the British Pound to depreciate through 2020. According to the bank, the US dollar and Japanese yen will be in a favorable position, while currencies such as sterling will likely suffer.

Barclays are forecasting Chinese economy to grow by 1.3% and expect contractions in the European (-5.5%), Japanese (-1.6%) and the US (-0.6%) ones.

According to Barclay’s, GBP/USD will end June at 1.16, the slide to 1.15 by the end of September and cost 1.14 by year-end.

The Pound-to-Euro exchange rate is forecast at 1.0750 by the end of June, 1.0870 by the end of September and 1.10 by year-end.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later