Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

September 27, 17:00 GMT+3.

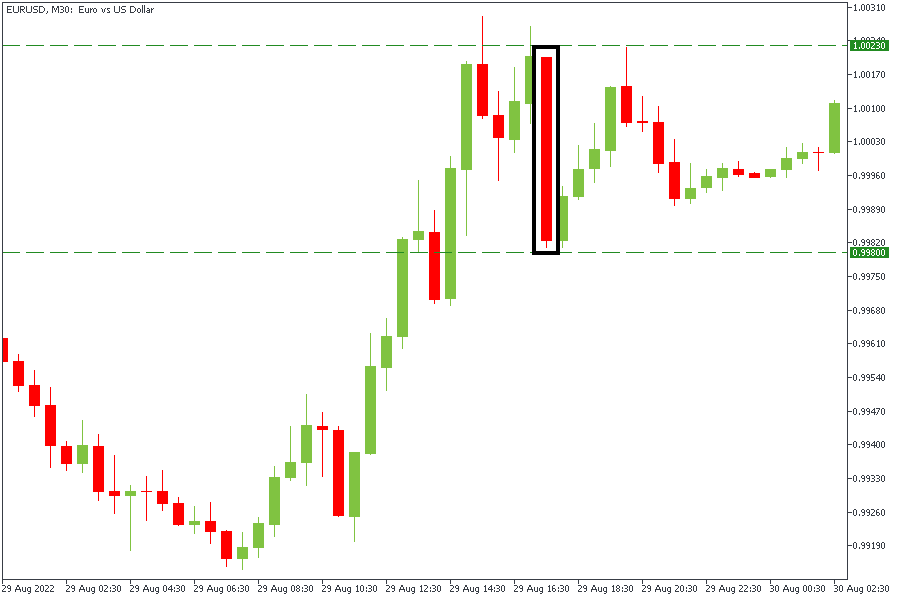

The Conference Board, one of the leading US research group organizations, will publish the CB Consumer Confidence on Tuesday, September 27, at 17:00 GMT+3.

The Consumer Confidence Index is a composite metric based on a household survey. The households give their opinion on the current and future economic conditions. If the indicator is high, consumers' financial confidence tends to be stronger.

The rising inflation and anticipation of the Fed monetary policy decisions are the main factors driving the USD now. American households might sensitively react to the changes in these factors. As a result, their views build the outlook for economic activity in the country.

Last time, the index increased to 103.2 after three months of declines. This happened because of the slowdown in US Inflation figures in August. This time the situation may be completely different, as high inflation is back in the game.

Instruments to trade: EURUSD, USDJPY, XAUUSD.

September 29, 15:30 GMT+3.

Canada releases the Gross Domestic Product (GDP) growth on Thursday, September 29, at 15:30 GMT+3. This is the leading indicator of economic activity that shows the change in the inflation-adjusted value of all goods and services produced by the economy.

While high inflation significantly impacts the economy, GDP data is also essential for traders to follow. The reason is the GDP figures’ slowdown amid the current economic situation. This is a sign of a recession and a negative factor for a local currency.

In August, the Canadian GDP growth was in line with the forecasts (+0.1%). The CAD did not have a big reaction to this update.

Instruments to trade: USDCAD, CADCHF, CADJPY.

September 30, 2022, 15:30 GMT+3.

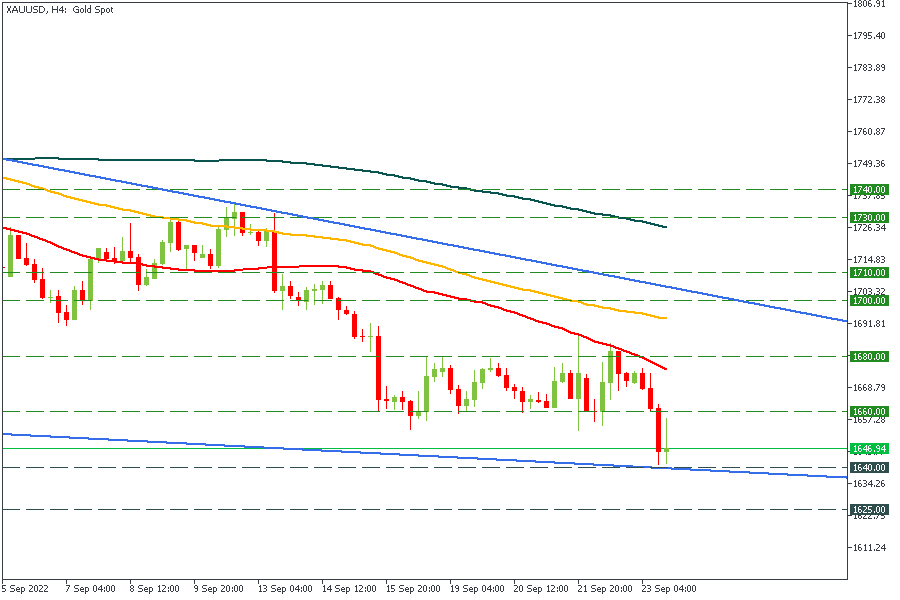

The United States will publish Core PCE Price Index on Friday, September 30, at 15:30 GMT+3. The indicator measures the change in the price of goods and services purchased by individual consumers, excluding food and energy prices.

Inflation keeps grabbing a lot of traders’ attention. While CPI seems more important due to its early release, the Core Price Index also provides essential insights into consumer spending behavior.

Last time, the release slid down by 0.1%, lower than the consensus of 0.2%. As CPI has already outperformed the forecasts this month and boosted the USD, PCE Price Index may repeat its success.

Instruments to trade: EURUSD, XAUUSD, USDJPY.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later