When is Google's stock split? Alphabet, the parent company of Google, will make the 1:20 split on July 15…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

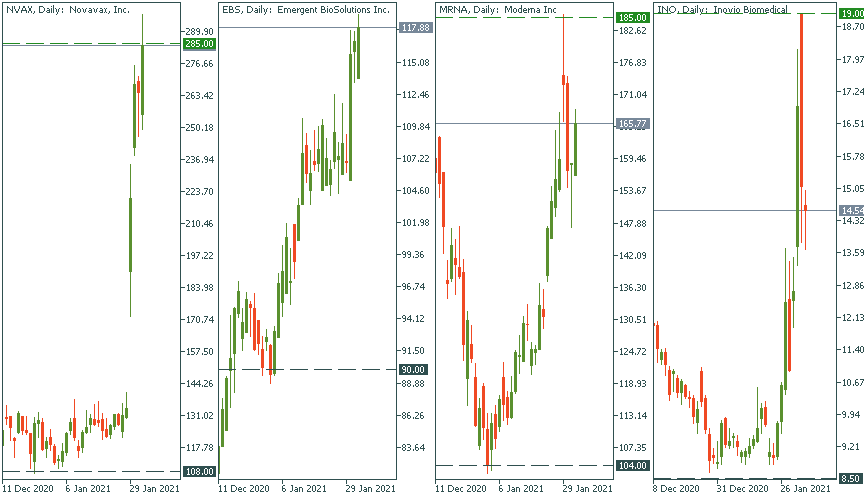

The virus situation seems to be improving. The UK passed the peak of infections, the US and Europe see improvements, too. Vaccines are being distributed all over the world. Not without obstacles but still, the process is unrolling. In this regard, it makes sense to look at the pharma stocks that all surged in 2020 on the pandemic.

Let’s put it like this: if you entered a position at the end of 2020, what would your profit be now?

Novavax is no doubt a champion here. It was floating above the support of $108 just a couple of weeks ago. Currently, it trades at $285 – that’s just slightly less than a 300% growth. All that is thanks to the vaccine production that appears to have taken a steady course and is expected to deliver the shots by summer.

Inovio made a slower rise but as spectacular. Starting at around $9 per share in the middle of January, it came to $19 right this week, ceding back below $15 however.

Moderna, the pharma company that was second after Pfizer in the race for vaccine delivery, dropped to $104 as the year began. However, since then, it gained more than 80% of value rising to $185 per share.

Emergent BioSolutions rose from $90 to $118 through the last several weeks taking #4 in the league of the pharma stocks.

All these stocks are at the forefront of the pharma industry now, and they will enjoy high demand through 2021 as even Pfizer CEO said that Covid-19 is “here to stay”. That means, in the long-run, you may bet on further growth – and further gains. At the same time, that doesn’t put away the necessity of technical analysis and being prepared to see corrections on the way – especially after these stunning leaps to the upside.

Finally, remember that you can trade stocks not only through MetaTrader 5 but FBS Trader, too!

When is Google's stock split? Alphabet, the parent company of Google, will make the 1:20 split on July 15…

The bullish movement in the stock market is gaining speed, and Bitcoin ETFs are closer than they might seem. What do we need to know for the next trading week?

On Wednesday, September 22, Microsoft will be holding a product launch. The event starts at 18:00 GTM + 3.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later