When is Google's stock split? Alphabet, the parent company of Google, will make the 1:20 split on July 15…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

PayPal brought an EPS of $1.22 vs. $1.01 and revenue of $6.03 vs $5.90 beating the market expectations. Also, the CEO of the company announced that they are moving towards a digital wallet that’ll allow crypto asset transfers. Nevertheless, the forecast-beating data and the new market expansion plan were not enough to push the stock through the local resistance level or even make it come closer to $275. The price is trebling above the local support of $245, below all the MAs, and doesn’t seem exactly bullish at the moment.

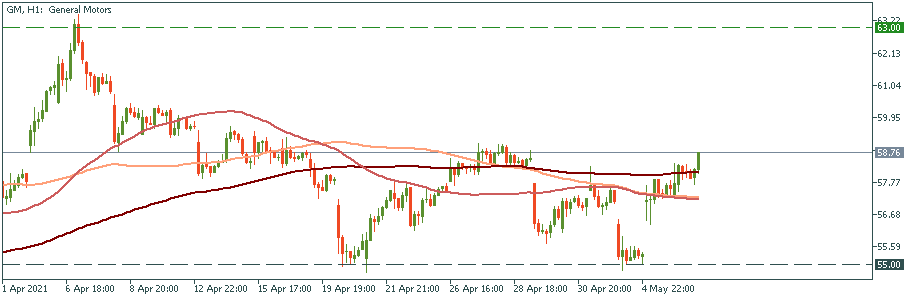

General Motors performed far better than PayPal against the forecasts. The estimation of the market was an EPS of $1.04 and revenue of $32.67. While the actual revenue was $32.47, the EPS resulted to be $2.25 –more than twice as much as the market expected. That impressed observers enough to make the stock bounce off the local lows of $55 and make it cross all the MAs challenging local highs. The all-time high of $63 is now a feasible target for bulls.

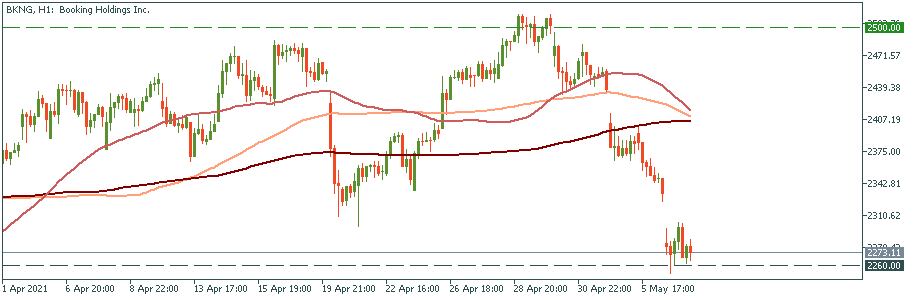

Booking Holdings was having a different struggle during the first quarter of the year. As the travel was most hit by the virus, observers were expecting a loss in line with the industry-wide damage. Booking managed to report losses less than the market estimates: an EPS of -$5.26 was brought against the expectation of -$5.97, and revenue of $1.24B beat the forecast of $1.2B. Despite the positivity of the report, the stock price did not rise nor did it even stay afloat around $2340 when the report was out. Instead, it dropped to $2260 reflecting the disappointment of investors and presenting a fragile short-term outlook.

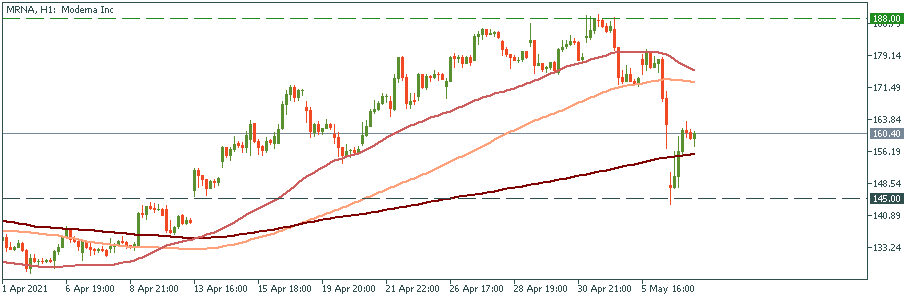

Moderna’s plunge was spectacular. It beat the EPS expectation of $2.6 with the actual figure of $2.84 but revenue missed the target: $1.94B vs a greater forecast of $2.23B. Apparently, the disappointment was big enough to make the stock price plunge to $145 erasing gains of the last three weeks. Although it quickly recovered some of the losses rising to $160, the resistance zone of the all-time highs of $188 is far away once again.

When is Google's stock split? Alphabet, the parent company of Google, will make the 1:20 split on July 15…

The bullish movement in the stock market is gaining speed, and Bitcoin ETFs are closer than they might seem. What do we need to know for the next trading week?

On Wednesday, September 22, Microsoft will be holding a product launch. The event starts at 18:00 GTM + 3.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later