Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

EUR/USD seems weak. The pair is likely to reach the lows of August 19 at 1.1670, if it breaks through the psychological mark of 1.1700. On the flip side, if it manages to jump above the recent high of 1.1740, it may rally to the 50-day moving average of 1.1775.

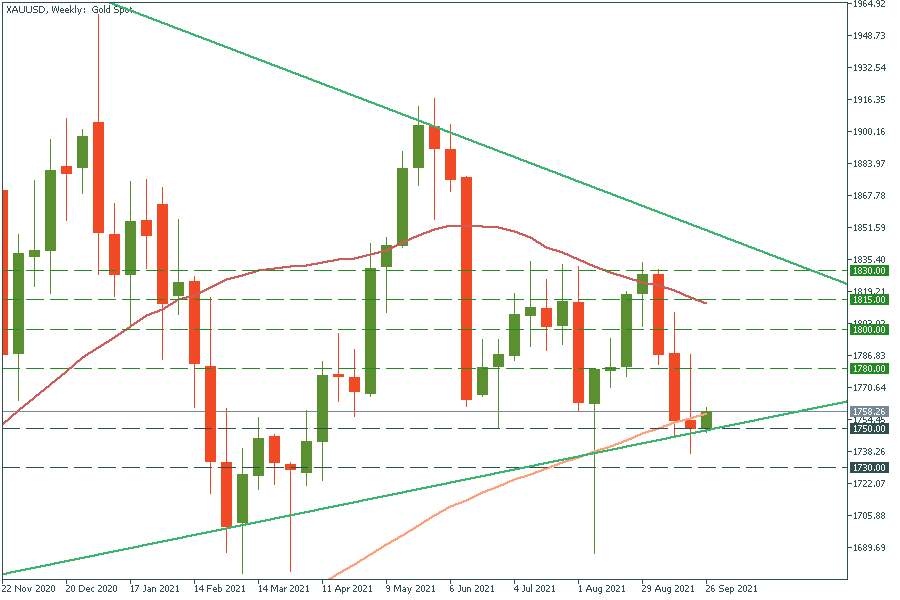

Gold has reversed up from the strong support level of $1750. It lies at both the lower line of the triangle pattern and the 100-day moving average. It may reach the resistance level of $1780 soon if the uptrend continues. The jump above it will push the pair up to the psychological mark of $1800.

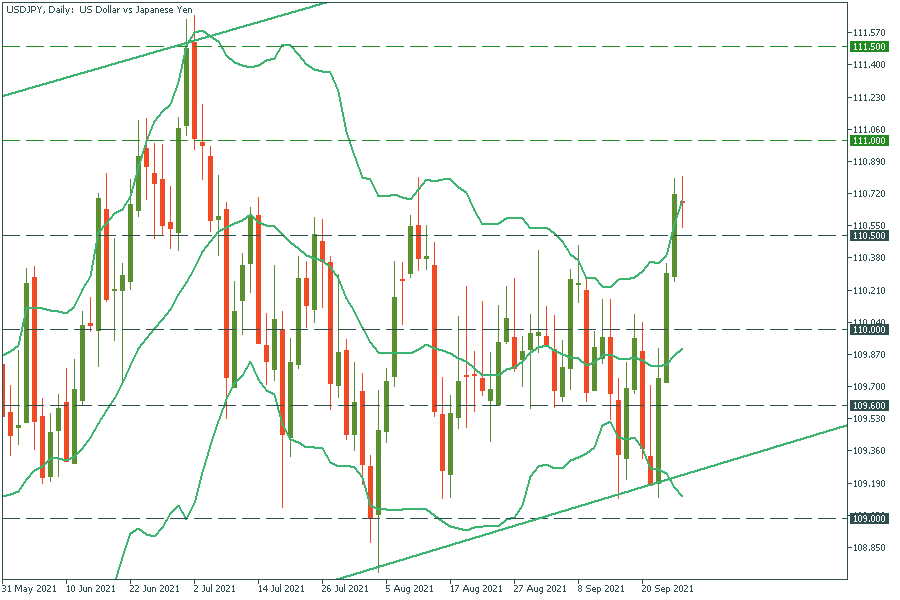

USD/JPY has jumped above the resistance level of 110.50 and pulled back. Indeed, the rally was quite fast and the pair needs a break. It can be just a short sell-off before further growth to 111.00. Support levels are 110.50 and 110.00.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later