Here is the digest with the most interesting news for today

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

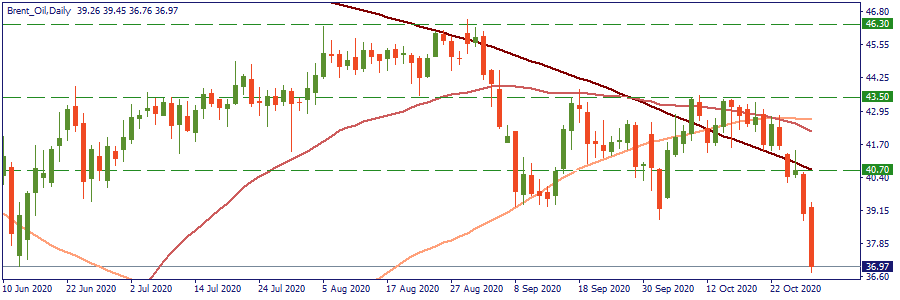

While we are making bets on who will be more favorable as the US president for the oil, the prices of Brent and WTI have fallen down. Just look at the chart of Brent – the price was pulled below the 200-day SMA yesterday. Today, it has confirmed its downward momentum by falling to the support at $36.4 (May’s low). If this level is broken, the next support will lie at $34. The first resistance level for bulls remains at $40.7.

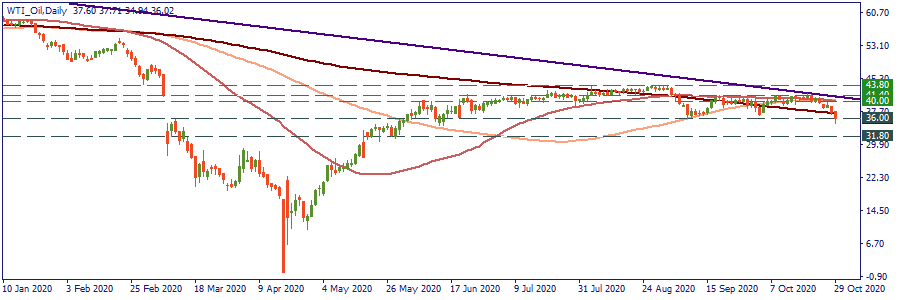

What about WTI? The price has already crossed the $36 level and is now confidently moving to the support at $31.8. To get back their positions, buyers need to push the price back to $40.

The negative drivers lie on the surface. Firstly, the new lockdown measures in Germany and France threatened the markets with lack of demand once again. Another negative factor affecting the oil prices is the oversupply of oil in Libya. Don’t forget about the potential return of OPEC+ production levels, which may pull the oil prices lower. As for the US oil, the weekly crude oil inventories published yesterday came out with a surprising increase of 4.3 million (vs. the forecast of 1.5 million). An unexpected build-up pushed added pressure to the oil prices as well.

Further attention of oil traders will be on the US election on November 3. According to researchers, Joe Biden’s victory will be bullish for oil due to his comments on cutting subsidies for fossil fuels. Therefore, the post-election reaction of oil prices will be under our particular attention.

Notice that you need to choose BRN-20Z and WTI-20Z to trade Brent and WTI.

Here is the digest with the most interesting news for today

Markets never sleep! Let’s be prepared for a beautiful trading experience by looking at the most important news of Tuesday!

The first week of November promises to be eventful, as we have the Fed meeting, the BOE update, and the NFP release. Read more details here.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later