The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

It’s always curious to see psychology visualized. WTI oil price performance on the daily chart below shows pretty clearly how “round numbers” work in the market.

Since May last year, the price has been mostly contained between $50 and $60 per barrel. The last tip of the chart oversees the price movement down below thanks to the US-Iran escalation over the killing of the Iranian General Soleimani in Iraq. The ensuing three-day standoff with harmful (literally) missile retaliation from Iran created that tip through a $5-increment from $60 up to $65. Then the virus came, and the price dropped.

We have to note, though, that the downward reversal is not a direct consequence of the virus outbreak. The price bounced downwards because it was overheated already on the US-Iran conflict. Hence, many observers took it as a duly correction when it went from $65 back to $60 and then to $55.

Therefore, while the virus stroke the global community and started expansion, oil did not show any direct response as it was already in the downturn. That’s why there was not much discussion about it in January. But in February it descended from $55 to $50 per barrel, and that’s where the market started worrying. Specifically, OPEC. They were even thinking to move forward the emergency meeting to February but a temporary upward correction should have cooled them down a bit so they kept March 5 as the meeting date. Still urgent, though.

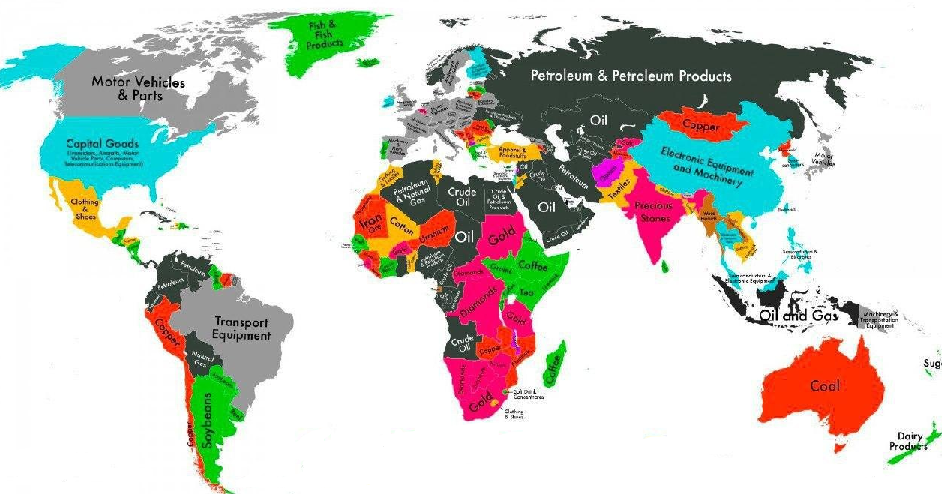

Very easy – profits. On the map below, dark grey represents countries that sustain themselves mostly on oil-related exports. OPEC cartel, except Russia and a few other countries, consists of those countries. And now, they see the only source of their income costing less than $50 per barrel – that’s a breakeven price level for most of them.

Source: CIA

That means they are looking at the face of a zero profit. To a lot of them, plus-minus several months of a situation like that means a difference between relatively stable state integrity and an outright revolution and disintegration. That’s why there is much more than just money at stake here. It is geopolitics. And there are numerous political and economic entities that directly benefit from this disaster. OPEC is definitely not one of them.

Apart from the US, there is mainly OPEC and Russia globally when we speak about oil. Before 2016, Saudi Arabia, the OPEC leader, after failing to bring Russia to the table, left the oil price float freely. Eventually, it dropped below $30 (WTI). Which was no good for Russia neither. So the two finally agreed to act together, and the price proved to get pretty stable since 2016. At least, no steep slumps down to no-profit zone. And that’s what Russian President Vladimir Putin confirmed on Sunday. Hence, a 1mln-barrel cut is now expected to be agreed on March 5 instead of earlier 600,000 barrels scheduled in December 2019.

The tricky question is whether it will help at all. To put a safety net for the downside of the oil price – probably, yes. To respond to the global drop in demand – a big question. Also, OPEC is not powerful enough to act alone. So we are going to observe the results of Saudi Arabia-Russia negotiation on Thursday and see where that brings the oil price.

The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

The Organization of Petroleum Exporting Countries will hold a meeting on June 2.

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later