The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Analysts anticipate the level of non-farm payrolls to increase by 162K jobs (vs. 75K previously). At the same time, the level of average hourly earnings is forecast to advance by 0.3% (vs. 0.2% previously) and the unemployment rate is expected to stay stable at 3.6%. If the NFP and average hourly earnings are higher and the unemployment rate is lower than the forecasts, the USD will go up. Be careful with your trades as the USD gets super volatile after the release.

CHECK THE STRATEGY OF TRADING THE NFP HERE

AND JOIN THE LIVE SESSION OF TRADING THE NFP WITH FBS ANALYST ON OUR FACEBOOK PAGE!

The USD has got stronger ahead of the release, but will the situation change after 15:30 MT?

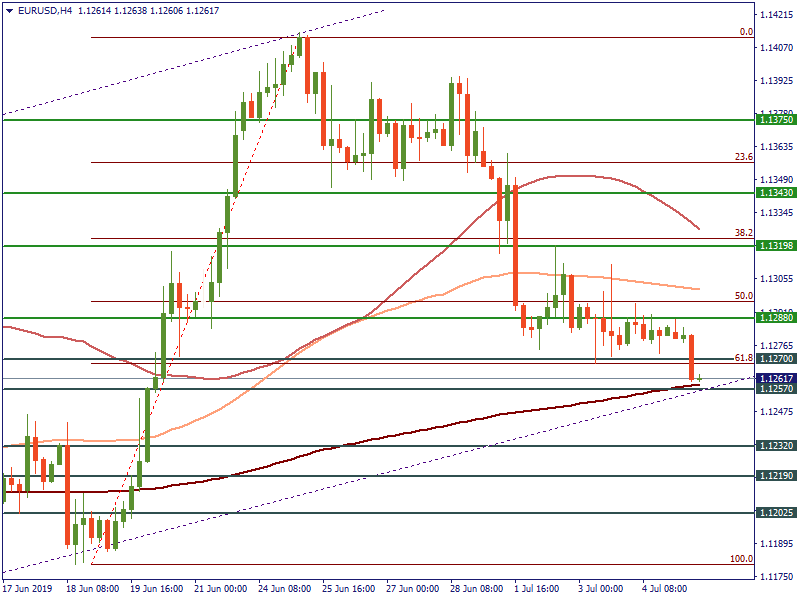

· On H4, EUR/USD has crossed the 1.1270 level (61.8% Fibo) and is currently moving downwards to the 1.1257 level, which lies close to the 200-period SMA and the lower border of the ascending channel. If the employment data is positive, the pair will fall below the 1.1257 level towards the next support at 1.1223. There is the possibility for EUR/USD to reach the next support at 1.1219 and test the next level at 1.1202, of bearish pressure is strong. On the other hand, if the employment data disappoints, EUR/USD will rise back to the resistance at 1.1288, jump above the 50% Fibo level and go higher to the next resistance at 1.1319.

· GBP/USD has been testing the lower border of the consolidation range at 1.2556 on H4. If the USD gets stronger on the release, the fall towards the next support at 1.2510 will be possible. From the upside, pay attention to the resistance levels at 1.2589, 1.2604 and 1.2635.

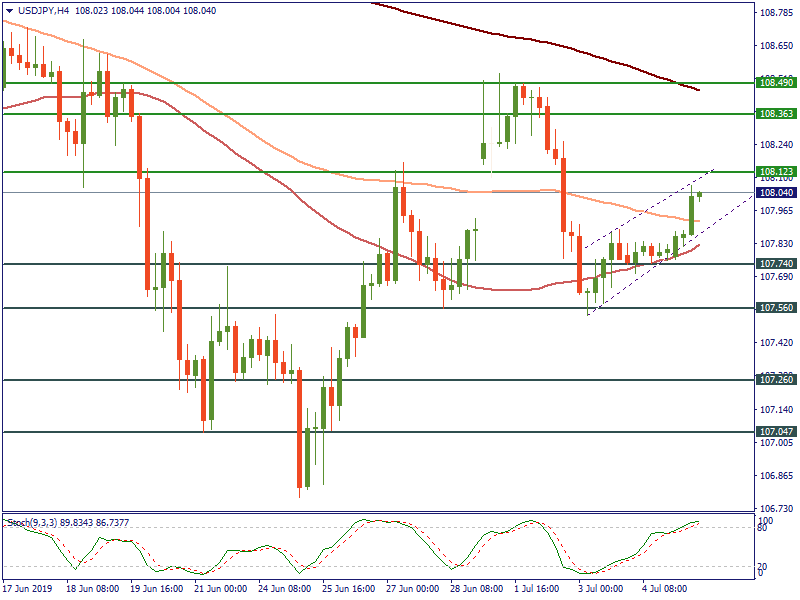

· USD/JPY has jumped above the 100-period SMA on H4 in anticipation of the release. The next resistance levels for the pair lie at 108.12, 108.36 and 108.49. In case of a negative release, USD/JPY will fall back to 107.74. If this level is broken, the next support will lie at 107.56. Stochastic indicator is about to form a crossover within the oversold zone, which may provide us selling opportunity.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later