Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

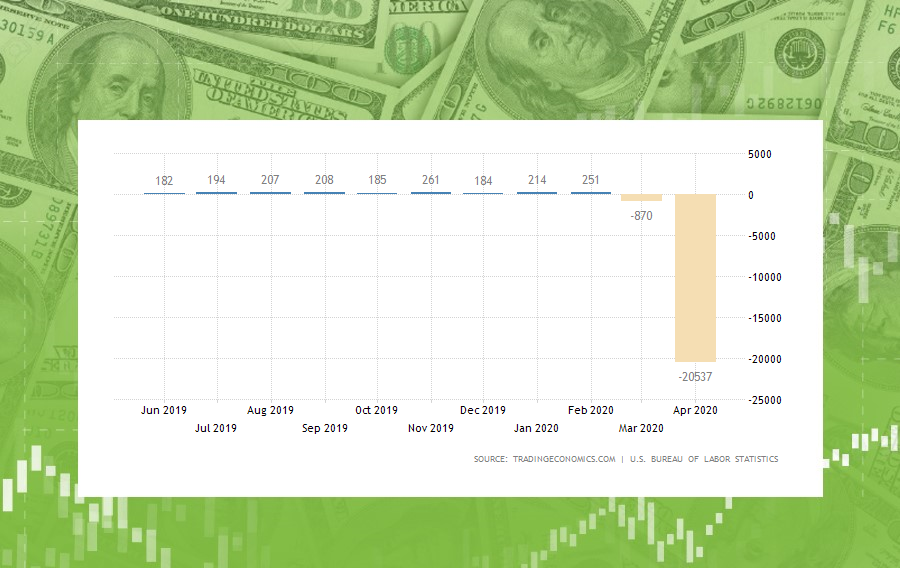

Today is the big day! Investors are waiting for NFP at 15:30 MT time. NFP shows the change in the number of employed people during the previous month, excluding the farming industry. Today it will reveal the employment change in May. It’s one of the most important indicators for all traders as it causes strong market movements. Here below you’ll find predictions from 10 major banks. Their forecasts vary from -2.2 million to -10 million. The most common one is -8 million.

RBC Economics provides economic analysis and forecasts to the largest bank in Canada - the Royal Bank of Canada and its clients. They anticipate a 2.2 million decline in payrolls after April’s 20.5 million drop and a further increase in the unemployment rate to 20%.

It’s the world's fourth-largest bank, located in San Francisco. Wells Fargo’s analysts believe non-farm payrolls will drop by 8 million and the unemployment rate will climb to 20%.

NBF is abbreviation for the National Bank of Fujairah in the United Arab Emirates. They expect the US employment to drop by 7.5 million.

The Canadian Imperial Bank of Commerce, commonly referred to as CIBC, is one of the "Big Five" banks in Canada. CIBC analysts suggest that around 6 million jobs were shed in May and the unemployment rate will rise by 18.6%.

The ING Group is a Dutch banking and financial services corporation headquartered in Amsterdam. The expect the huge 10 million drop in non-farm payrolls and a rise in unemployment to 20%.

Westpac is the Australia's first bank, located in Sydney. Its economists predict a 7.5 million decline in employment in May and the unemployment rate to peak at 20%.

Deutsche Bank is a multinational investment bank and financial services company headquartered in Frankfurt, Germany. Its analysts forecast a 6.1 million drop in nonfarm payrolls, with the unemployment rate rising to 19.1%.

Headquartered in Copenhagen, it is the largest bank in Denmark and a major retail bank in the northern European. Danske Bank’s analysts think that employment in the USA has dropped by 10 million. However, they mentioned that we may be too pessimistic.

TD Securities is a reliable Canadian investment bank. According to economists at TD Securities, the -8 million consensus for payrolls is too weak. Their forecast is -3 million. The TDS expects less weakness than consensus in the unemployment rate as well: a 2.8% rise to 17.5%, versus 19.5% for the consensus.

It’s an American multinational investment bank, headquartered in New York City. Analysts at Goldman Sachs expect a 7.25 million drop in payrolls and a jump to 21.5% in the unemployment rate.

Follow the NFP report at 15:30 MT time today and catch the market movement!

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later