Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The market continues to be in a risk-off mode. Time to gain on falling!

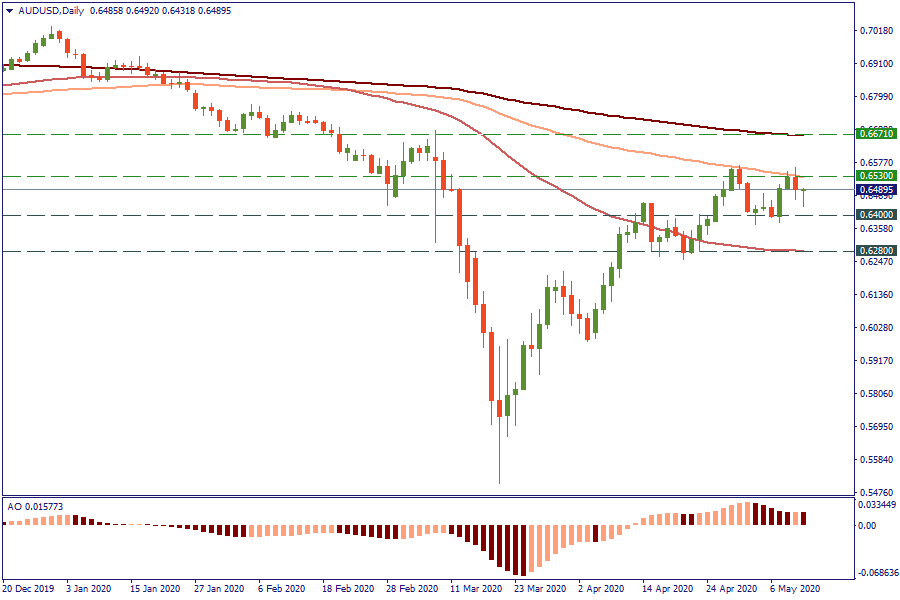

Almost 600,000 jobs were lost in April in Australia. Numbers were worse than analysts anticipated. As a result, AUD sank after its strong rally. Let’s look at the daily AUD/USD chart. The price has hit the 100-day moving average already twice. There is a still strong upward trend. However, no way AUD can break out this level soon in such a risk-averse market. If it manages to do it though, it will open doors towards 0.6635. Support are at 0.6375 and 0.626.

The US president wants rates to go below zero, but Jerome Powell, the Fed chairman, doesn’t even consider this tool. Yesterday Powell claimed that outlook is dire and there are downside risks ahead. He thinks extra government spending will prevent the country from the long-term recession. The Fed also began buying exchange-traded funds to supply more money to the market and discussed additional aids. USD surged as well as JPY.

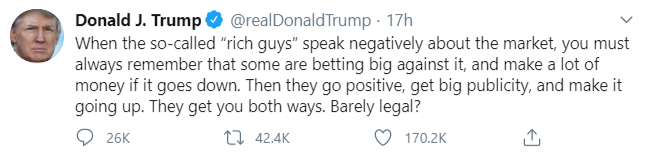

Stanley Druckenmiller, a billionaire investor, said that he didn’t remember the time when the risk of holding stocks so outweighed the potential profit. According to him, the market is flooded with liquidity and soon it will contract. Donald Trump, as always, impressed everybody with his straightforwardness.

However, Wall Street analysts don’t think the same. The S&P 500 has dipped this week, and economists expect the further downturn. Most analysts believe the market will be bearish this year.

The WTI oil price increased to $25 a barrel. Overall, it’s going up in May. It was caused by the drop in U.S. crude inventories, marking the first decline since January. However, analysts warn that oil prices could go negative again ahead of June contacts expiration.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later