Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The USD has started the week with gains after suffering huge losses in the previous months. The risk sentiment mostly depends on the pace of the vaccine rollout, the spread of Covid-19 cases, and, of course, Biden’s inauguration and US political changes. Besides, this week is full of significant economic releases. Among them are rate decisions from the ECB and the Bank of Canada, and PMI reports from the Eurozone, the UK, and the USA. Quite a lot! Let’s briefly discuss how the market will react and then move on to the technical analysis.

This report is based on a survey of German investors and analysts, which is set to rate the economic outlook for the country. Since Germany is the leading economy in Eurozone, this indicator has a huge impact on the EUR. If the data comes out better than market expectations, the EUR will surge. Otherwise – drop.

On December 9, the Bank of Canada left the rate at a record low of 0.25% as was expected. However, this time the bank may cut rates as it is unsatisfied with the too high CAD. If the recent strength of the USD can’t be sustained, the bank may really impose rate cuts, which will press the CAD down. If the BOC doesn’t make any changes, the CAD may move up.

The European Central Bank expanded its Pandemic Emergency Purchase Program (PEPP) by an additional €500 billion and extended it to 2022 during its meeting in December and left the rate at a record low of 0.0%. If the ECB confirms more easing is needed, the EUR will fall. Otherwise – the EUR will rise.

Purchasing Managers’ Index (PMI) is an indicator that measures the economic health of the manufacturing and services sectors. Traders pay close attention to whether the real numbers exceed market expectations or not as it will have a huge impact on the currency. If the actual PMI data is higher than the forecasts, the currency will strengthen. If the actual PMI data is lower than the forecasts, the currency will weaken.

EUR/USD dropped last week significantly. The pair has taken a break on Tuesday after falling for so long. It has bounced off the 50-day moving average at 1.2050. If it rises to the high of January 14 at 1.2170, the way up to the next resistance of 1.2220 will be clear. Support levels are 1.2050 and 1.2000.

USD/JPY has jumped above 104.00, but we wouldn’t expect that it will rally further as the long-term trend is bearish. Elsewhere, the pair has failed to cross the 100-period moving average so many times during the last year. Therefore, if it rises to the resistance of 104.50, it’s going to pull back to the downside. Support levels are at the recent lows of 103.50 and 103.00.

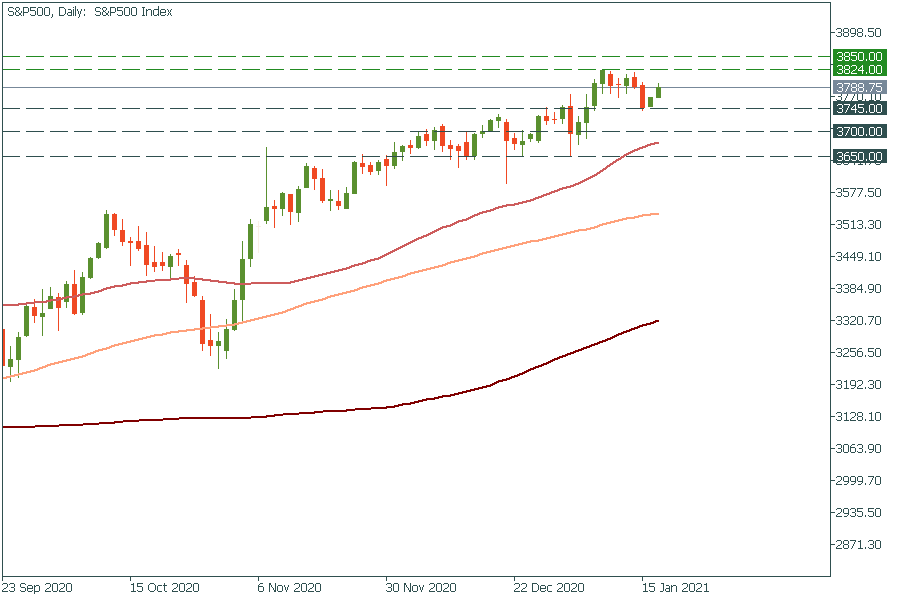

S&P 500 is heading upwards. If it manages to jump above the all-time high at 3 824, the way up to the next round number of 3 850 will be clear. Support levels are at the low of January 15 at 3 745 and the key psychological mark of 3 700.

Finally, let’s talk about gold. XAU/USD tries to rebound from its recent losses. If it closes above the 50-day moving average of $1 865, it will have all chances to rise to the key psychological mark of $1 900. On the flip side, the move below the support of $1 825 will press gold to $1 800.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later