Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Let’s look at main movements on the market today on May 26.

First of all, S&P 500 passed the 3000 mark! The market sentiment is really risk-on today. It’s mainly based on recovery dynamics and potential drug developments. S&P 500 is headed to the next retracement level at 3110. Support levels are at 2960 and 2815.

Nevertheless, tensions between Washington and Beijing remain in focus as the USA added 33 Chinese entities to a trade blacklist without warning. It’s better to keep an eye on future developments in their relationship.

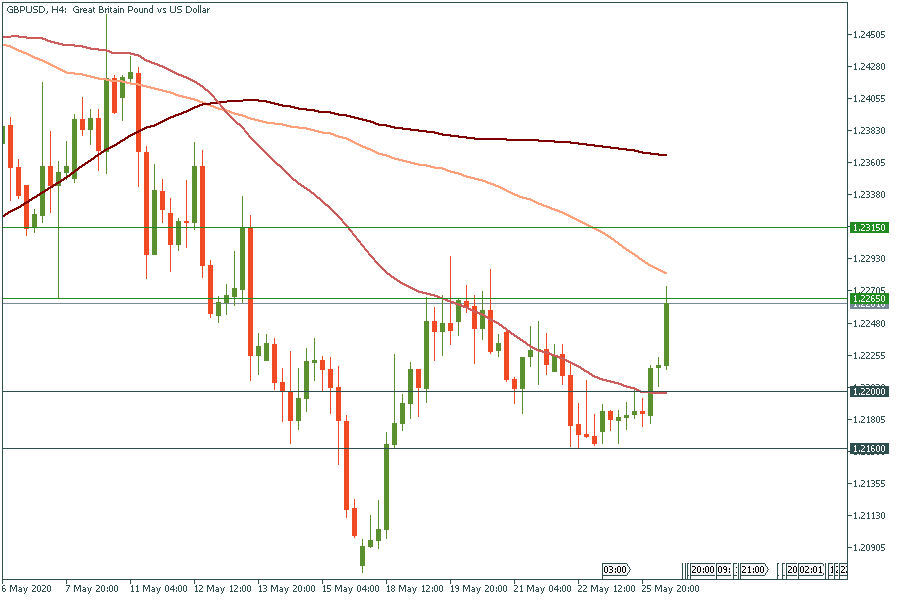

But, US-China disputes fail to weigh on risks as Donald Trump hasn’t yet pronounced the last word on the Hong Kong issue. The UK Prime Minister Boris Johnson announced the opening of all non-essential shops from June 15. All this played well for the British pound. It has just crossed the retracement level at 1.2265. Now it’s heading to 1.2315. Support levels are 1.22 and 1.216. However, analysts have bearish scenarios for pound in the long-term. Reasons are the end-June deadline to extend the Brexit transition period and the possibility of negative interest rates in the UK.

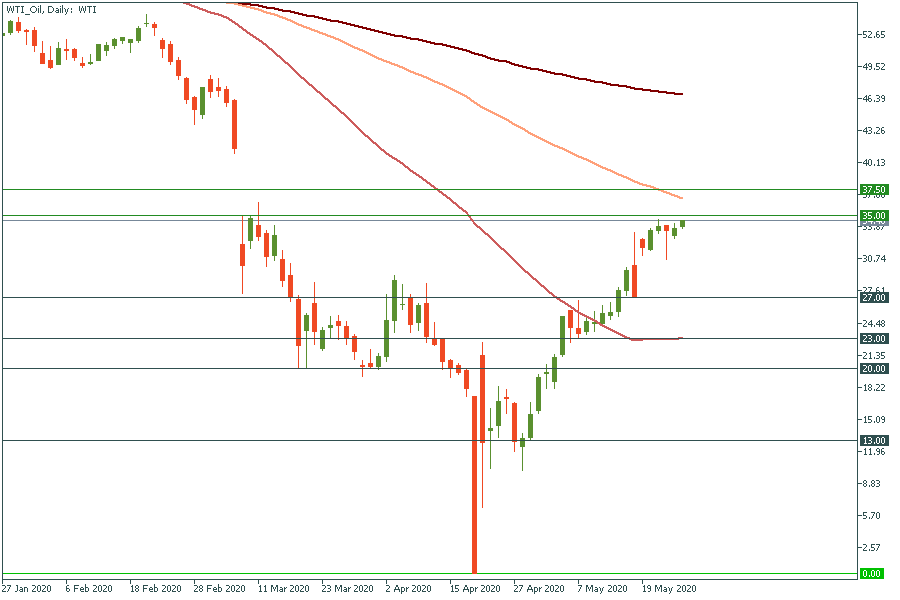

Let’s move on to the oil market. The WTI price approaches the retracement level at 35. The head of the International Energy Agency forecasted that the oil market will recover even before the global pandemic. According to him, the oil demand will rebound to its pre-crisis level in the absence of strong government policies, a sustained economic recovery and low oil prices. If the price breaks through 35, it will go further to 37.5. Support levels are 27 and 23.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later