Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Safe-haven currencies such as the US dollar and the Japanese yen have started the week on the positive footing amid rising new virus cases, pushing riskier assets to the downside.

US-China tensions continue escalating. The US President Donald Trump approved Oracle’s bid to buy TikTok’s US assets, while US curbs on WeChat have been put on hold by a judge. Besides, investors are waiting for some development over fiscal stimulus in the USA as the impasse of the stimulus package in combination with upcoming elections weighs heavily on the US dollar. All eyes on Powell’s speech this evening.

Meanwhile, new virus cases are rising in the European Union. Even fresh restrictions have been imposed in Greece and Denmark. The European Central Bank has launched a review of its pandemic bond-buying program. It will decide for how long the PEPP will take place and debate the necessity of extra asset purchases.

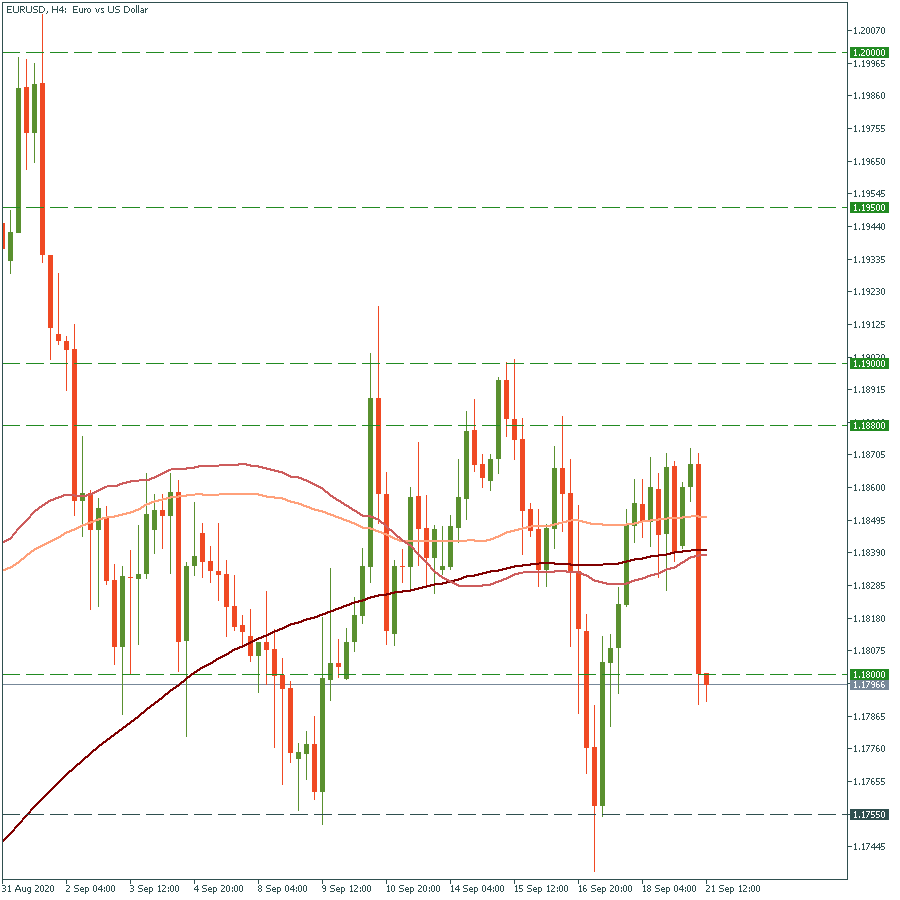

Let’s look at the EUR/USD chart. It has just broken the strong resistance of 1.1800. The move below the support of 1.1755 will push the pair even deeper to the level at the next round number of 1.1700. Resistance levels are 1.1800 and 1.1880.

S&P 500 has dropped to the lowest levels since August 5 as a massive sell-off of tech stocks has started. Amazon, Facebook, and Apple slumped dramatically. The move below the low of July 31 at 3 250 will drive the stock index lower to 3 200. On the flip side, if it jumps above the resistance of 3 330, it will push the price to the high of September 18 at 3 370.

Moving on to gold, it has been trading sideways. The move above the high of September 18 at $1 960 will drive the price to the next resistance of $1 970. Otherwise, if it drops below the support of $1 925, it will push the price to the next support of $1 910.

Finally, let’s talk about the British pound. It has been driven upwards by the upbeat comments of the European Commission President over Brexit. However, the fresh lockdown in the country added headwinds to the GBP. The move below the low of September 15 at 1.2830 will drive the price lower to 1.2780. Resistance levels are 1.2960 and 1.3015.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later