Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

All eyes on the US-China relationship that set the market mood. How is it today?

The day has started with an encouraging Chinese report. Industrial production increased by 3.9% that signalized a strong recovery in supply. However, the country still struggles with a weak demand: retail sales decreased by 7.5% and fixed asset investment contracted by 10.%. Investors are looking closely at China as it was the ‘first out’ economy from COVID-19. That’s why they can roughly predict the pace of a future recovery of other countries. The Chinese data reveals only little and gradual improvements in economic activity. Moreover, it has proved that the government stimulus really works.

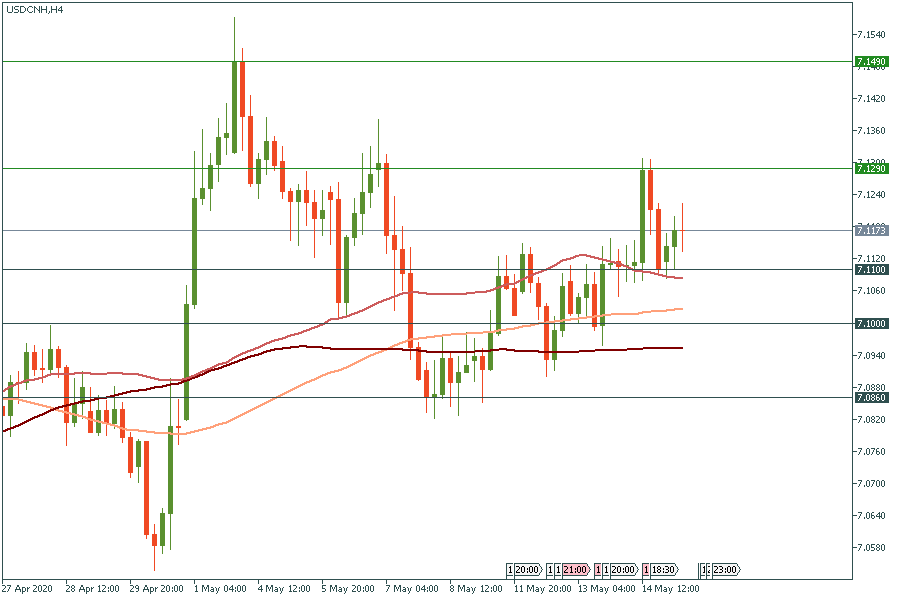

The worsening US-China relationship outweighed the mixed Chinese data. Donald Trump doesn’t have any intentions to improve the tough situation. He said that he could cut ties with China, it was the day after the US federal pension fund delayed investment in Chinese shares. That’s why the Chinese yuan didn’t react to the improvement in industrial output. If the price reaches 7.11, it can possibly fall further to 7.1. Resistance levels are at 7.129 and 7.149.

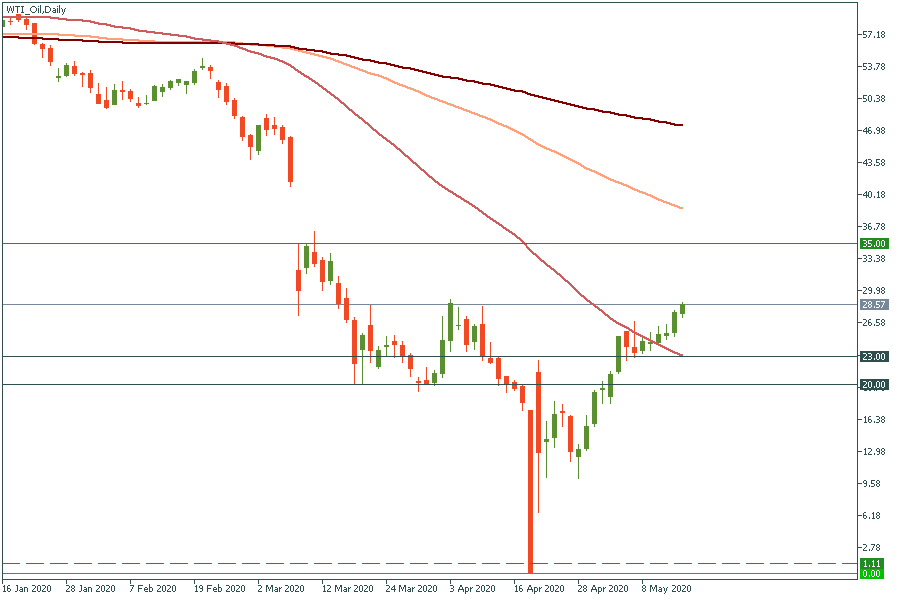

Despite the market uncertainty, the crude oil market has been slowly rebalancing as major producers cut supply. Also, economies started to reopen and, as result, demand has been gradually increasing. Elsewhere, Saudi Aramco decreased its sales to key buyers that also pushed the oil price higher. Nevertheless, oil is still down more than 50% this year. The way of recovery seems to be long and slowly.

Let’s look at the WTI oil chart. The price has been strongly ramping up since the end of April. It reached the recent April high at 28. The next barrier to the way up will be at 35. Support levels are at 23 and 20.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later