Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Risk-off prevails on the market. Consider trade ideas that presented below.

Yesterday Jerome Powell, the Chairman of the Fed, made a rate statement and gave economic guidelines. All market participants waited for that big event. The Powell’s speech was quite dovish. He claimed that the Fed will continue pumping stimulus until the US employment comes back to pre-crisis rates. Jerome Powell was really clear to leave rates below zero for longer: “ We’re not even thinking about thinking about raising rates”. According to him, the Fed will use all its tools such as low interest rates and enormous amounts of bond purchasing as long as it takes. The economy faces “considerable risks” over the medium term, the Fed mentioned in its statement.

Fears of a second coronavirus wave and the caution from the Fed pushed stocks down. S&P 500 is trading near the 78.6% Fibonacci level at 3140. If it breaks it down, it will open doors towards the support at 3000. However, if risk-on comes back soon, stocks can rise again and meet the resistance at 3300.

Gold prices closed lower yesterday, the first time after three sessions going up. The Fed claimed that it will hold rates near zero at least through 2022. That makes gold a favorable asset for investors in the long term. However, the future risk-on as economies are recovering may weigh on gold prices. XAU/USD is moving down towards the support line at $1725. If it crosses it, gold may fall even deeper to the key barrier at $1700. The resistance is at $1750.

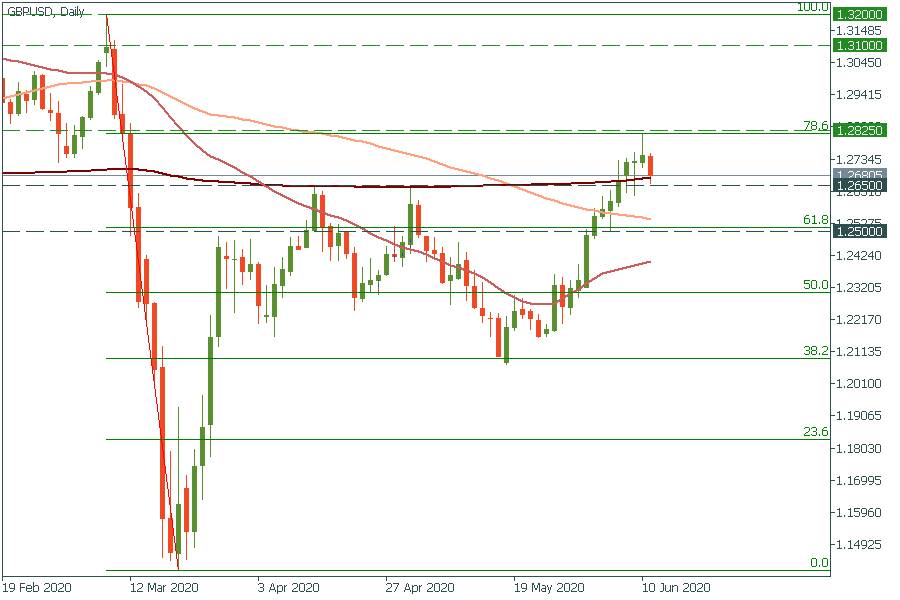

The Fed’s guideline for the future slow recovery has set risk-averse on the market. The British pound fell down yesterday. If GBP breaks through the 200-day moving average and the support at $1.265, it will be a pivotal moment for bearish traders as GBP may fall even deeper to the key 1.25 psychological mark after that. Nevertheless, if any positive news pushed the British pound up, it will meet the resistance at 1.2825.

American crude stockpiles raised to a record high. That’s why, investors have fears about the future oil oversupply. Let’s look at the WTI oil chart. The price fell yesterday to $38. If it continues dipping, it will meet the support level at $34 and then at $30. However, oil prices are unlikely to fall down so far. Economies are recovering and the oil demand will increase at the same race. The resistance is at $47.5.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later