The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Friday rolls in, closing the first market week of the year 2020. Below, we briefly go through the opportunities this day offers for some key currency pairs in view of important events of the previous and coming days.

Of course, markets wait for the Non-Farm Payrolls (out at 15:30 MT time). The overall situation for the US dollar looks positive for various reasons. First, the fears of the conflict escalation with Iran have subsided, losing the focus of the audience and letting the risk appetite get back from safe-havens. Second, the US-China deal is on the way, with the Chinese officials planned to visit Washington DC next week and finally sign the deal on January 15. Third, the recent economic indicators released by the US authorities give a good impression, not to mention surprisingly strong data on the previous NFP.

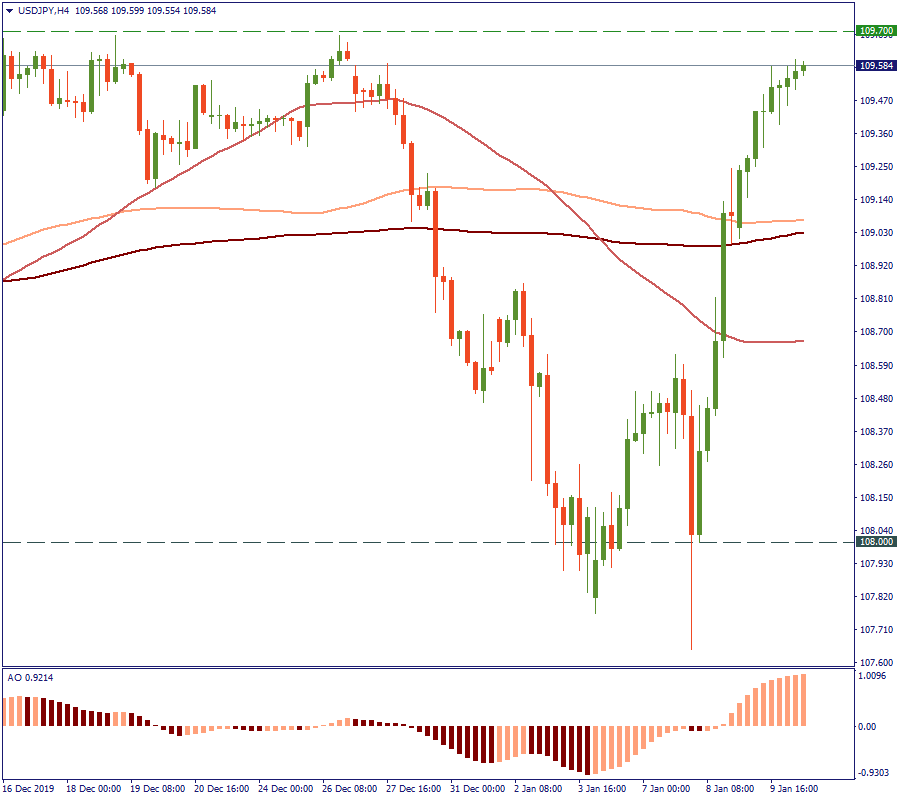

Hence, let’s see if USD manages to break some of the local barriers after the obstacles get removed from its way up. Against the JPY, 109.70 has been the resistance level capping the bullish moods since May 2019. Last, two months show that the currency pair has been testing this line again and again. Will today be the breakthrough?

Against the EUR, the price is testing the support of the 200-period Moving Average. Also, that is where the bottom line of the December uptrend is located – EUR/USD went into consolidation there at 1.1106. Will this trend be broken as well, leading to the reversal upwards? Let’s see what the NFP brings.

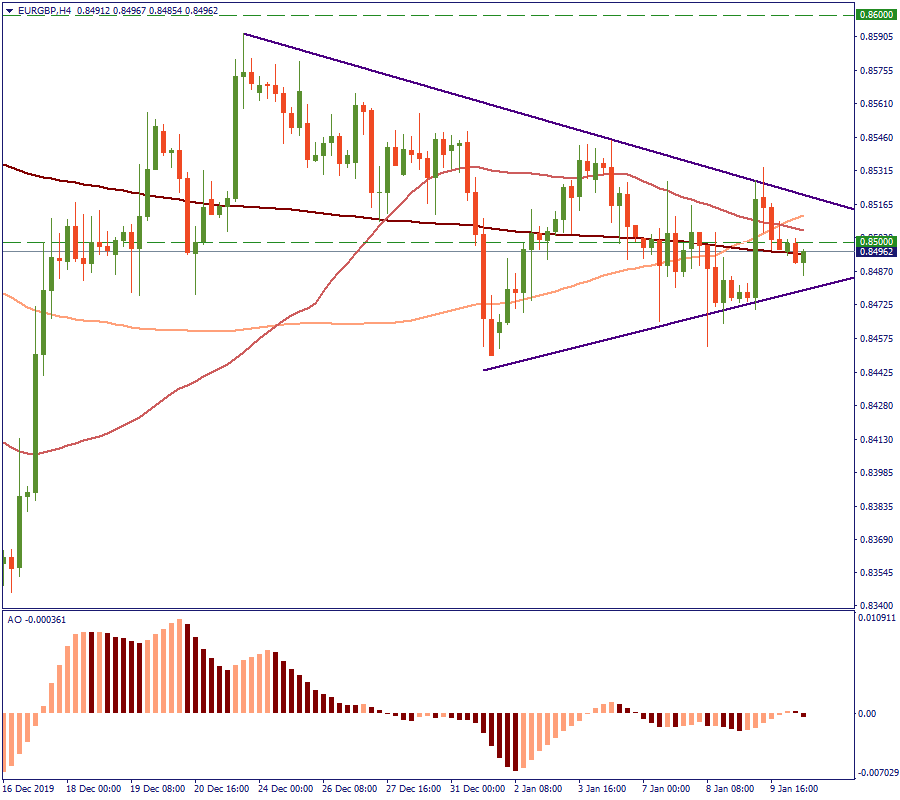

The future is finally decided. Boris Johnson’s EU Withdrawal Agreement has been approved in the House of Commons and passed to the House of Lords. 31Jan confirming the end of the relationship is now merely a formality. Now, all eyes will be on the course of negotiations between the UK and the EU. The European Commission President Ursula von der Leyen said it will be almost impossible to have all the points negotiated until the end of 2020, so the fears of a bad Brexit are amassing. On the other side, the Eurozone’s own economic indicators are not that good, although there are signing of the European economy picking up the pace. That’s why we see EUR/GBP struggling to decide where to go, right in the crossing area of the Moving Averages at the level of 0.8500. Which direction it will choose? So far, the table is tilted towards the EUR more.

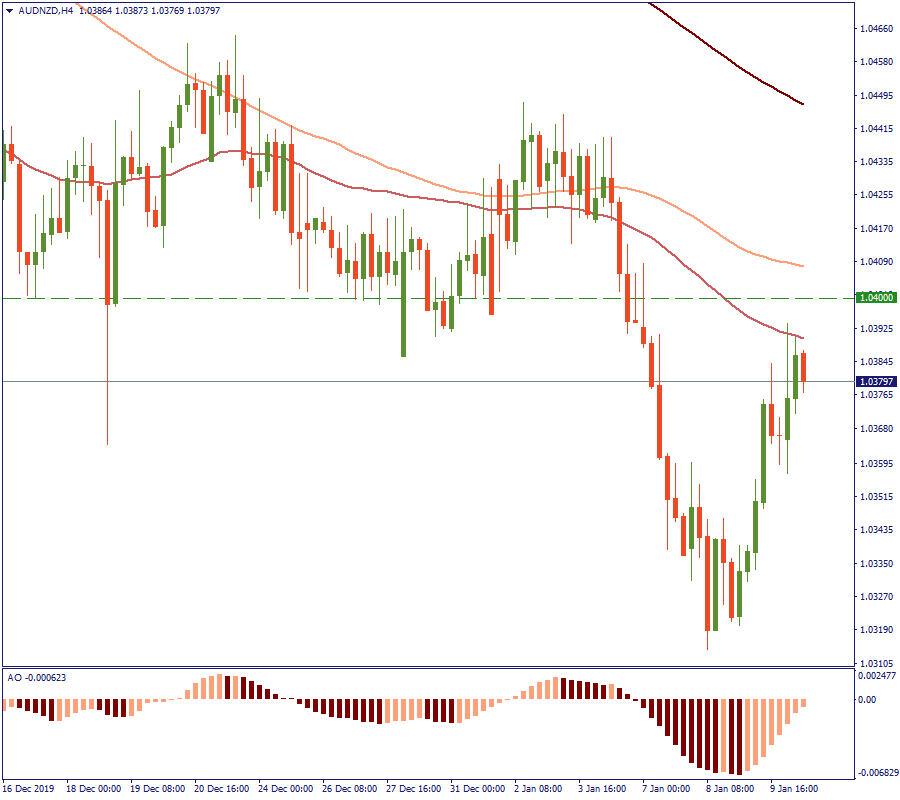

Against all odds, the AUD is rising. While the bushfires keep damaging the Australian economy and the rumors of the RBA going dovish in February are voiced out among the observers, the AUD/NZD grows to 1.038 to test the 50-period Moving Average. If that resistance is broken and the currency manages to climb above 1.0400 to challenge the 100-MA, it will move into the upper part of the downtrend prevailing during the last month and possibly challenging it later on.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later