Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

US Core CPI will be released this Friday at 15:30 MT time.

Instruments to trade: EUR/USD, USD/JPY, USD/CAD, GBP/USD

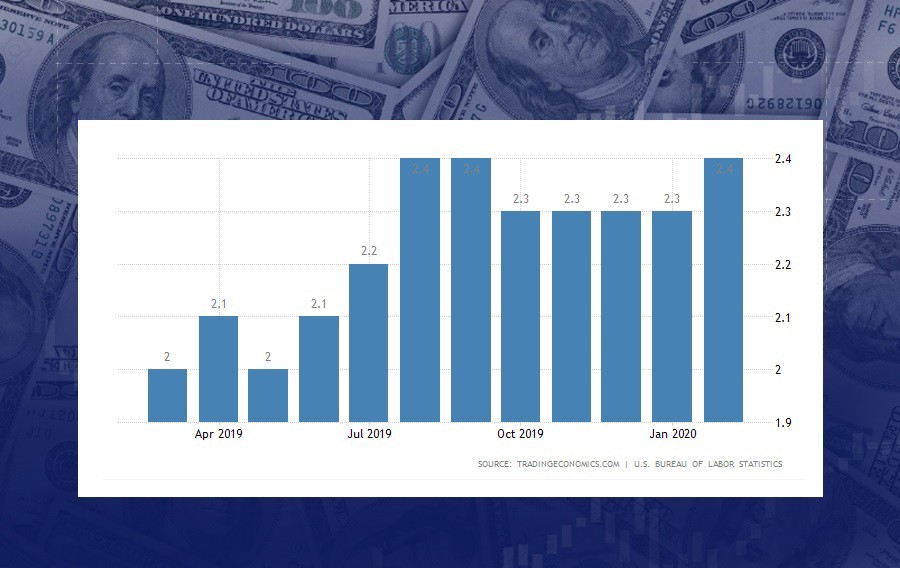

The US Core Consumer Price Index has been increasing at a steady 2.3% rate since October, with the only exception of 2.4% in February. On Friday, March inflation will be announced. The consensus for the upcoming figure is 2.3%. In general, the market will be happy if the inflation stays roughly where it is now – that would mean that no significant slump in consumer spending took place. Taking into account the troublesome state of the US economy, that would be the best scenario. If inflation turns out to be lower, that would mean that people spend less, demand less, hence the sellers will have to lower prices. Therefore, the overall economic activity would slow down its pace in this case. Given the fears of recession or even depression, a 2.3% growth of Core CPI in March would probably be the best possible news.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later