The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Now traders follow the economic events with new vision as inflation in the US seems like decreasing. Let’s see what releases will influence the market due to that factor.

November 15, 15:30 GMT+2

The US Bureau of Labor Statistics will announce the Producer Price Index on Tuesday, November 15, at 15:30 GMT+2. It's a leading indicator of consumer inflation as producers' expenses are usually passed on to consumers. If results are lower than expected, it might mean that the inflation growth is slowing down. As a result, the Fed may conduct a more dovish monetary policy pushing the USD down.

As an example, we can look at the USDCAD chart. Since the beginning of November, the USD has been falling slowly. CPI release showed a decline in inflation, аnd the USDCAD lost almost 2400 points. PPI will prove it one more time.

Last time, the actual data exceeded expectations, 0.4% vs. 0.2% expected. It was the first increase in three months and showed an 8.5% gain from last year. Prices paid to US manufacturers rose more than expected in September, indicating that inflationary pressures will take time to ease and that the Federal Reserve will continue aggressive rate hikes.

Instruments to trade: EURUSD, USDCAD, GBPUSD.

November 16, 09:00 GMT+2

The UK Office of National Statistics will announce its Consumer Price Index on Wednesday, November 16, 09:00 GMT+3. It’s the indicator of the overall inflation.

Inflation in the UK reached a 40-year high of 10.1% in September, and economists expect further growth through the end of the year. The Bank of England has recently raised interest rates in the UK by 0.75 percentage point, the biggest increase in 30 years. A year ago, the interest rate was 0.1%. Today it is 3%.

The BoE raised interest rates due to inflation, trying to maintain price stability. Traditionally, this means keeping inflation around 2%. Sometimes inflation, of course, deviates from this target, and small short-term fluctuations are normal. However, inflation has been above the target since mid-2021 and is now at a 40-year high of around 10%.

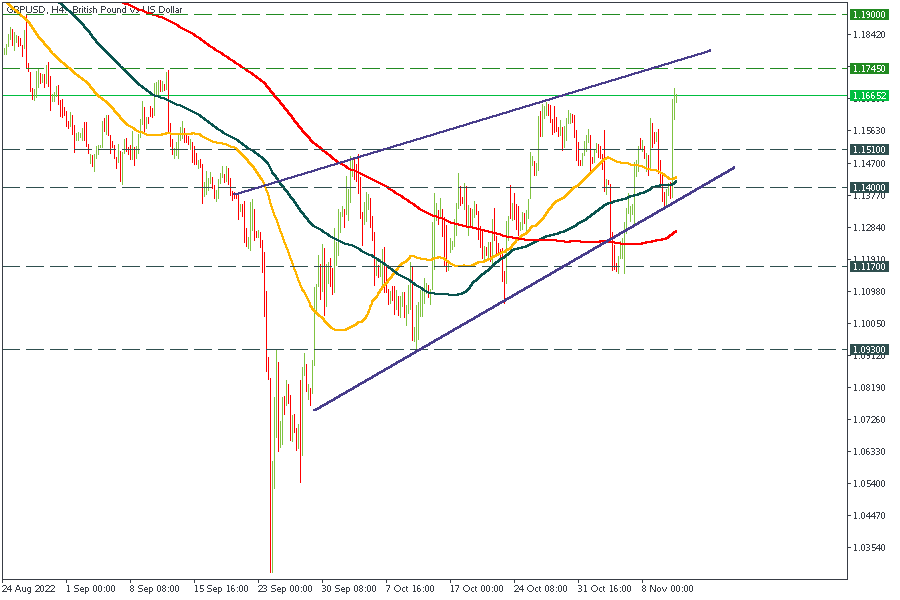

Now the GBPUSD is recovering, slowly but surely climbing up.

Instruments to trade: GBPUSD, GBPCAD, EURGBP.

November 16, 15:30 GMT+2

The US will publish Retail Sales and Core Retail Sales on November 16 at 15:30 GMT+2. Both indicators demonstrate a change in the total value of sales at the retail level. Core Retail Sales differ from the primary indicator, as the former does not count automobile sales.

The retail data helps track consumer spending, which accounts for most of the overall economic activity. If the economic activity intensifies, the country's overall economic health improves. In the previous release, Retail Sales and Core Retail Sales were mixed, 0.0% vs. 0.2% expected and 0.1% vs. -0.1%, respectively. Inflation is slowing down, so this release will show how the fight against inflation goes.

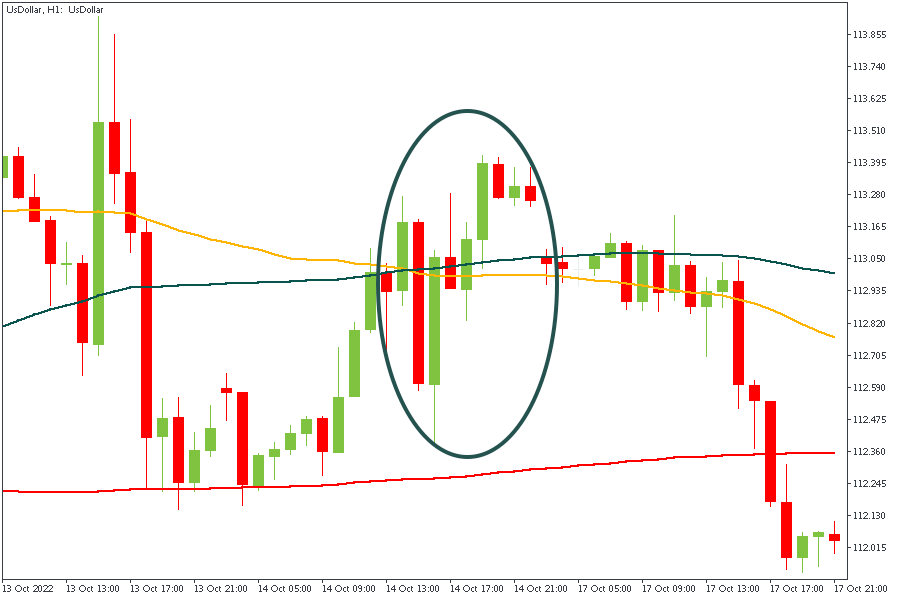

Last time, the release caused the fluctuations in the market. The US dollar index dipped down, and recovered quickly.

Instruments to trade: XAUUSD, EURUSD, USDCAD, USDCHF.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later