Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

It seems that China may have defeated the pandemic as the coronavirus cases has dramatically fallen there. The country has come through the worst and is recovering now.

Today China Manufacturing PMI (purchasing managers’ index ) was released and it went beyond all expectations as the index was 52.0 with forecast of 44.9 while previous one was 35.7!

What does it mean for China?

It’s excellent for the Chinese yuan. Indexes above 50.0 indicate industry expansion as it’s widely assumed, but nowadays it doesn’t mean that Chinese economic activity has fully resumed. The country might avoid a recession but, anyway, will undergo a steep slowdown because of the virus shocks on production and demand. World Bank downgraded China’s 2020 GDP forecast to 2.3% versus 6.1% reported for 2019.

What does it mean for the world?

The whole world is suffering from the virus now and this shock will affect greatly almost every country as economies are all intertwined. As Michael Howell from London’s CrossBorder Capital Ltd. said, we should be ready for the turnaround of the lead economy. Who knows, maybe US dollar will cede its place to the Chinese yuan. However, this is an assumption, which may not hold up.

Technical analysis of USD/CNH

Let’s look at the USD/CNH chart. It’s now on 7.1060 mark crossing Moving Average of 50. The rebound of the Chinese PMI should strengthen the Chinese yuan. Despite that fact, we see the upward trend and the pennant, so, we can assume that, the graph should surge after it.

Chinese PMI affects Australian dollar

Moreover, the Australian dollar bounced back substantially from the Chinese PMI data. Often the Australian dollar acts as a Chinese-economy proxy bet. Moreover, 2.2 trillion dollar US stimulus package improved the global risk sentiment, what was beneficial for riskier currencies, including the aussie. However, worries about the financial downturn from the coronavirus support the US dollar's perceived safe-haven status.

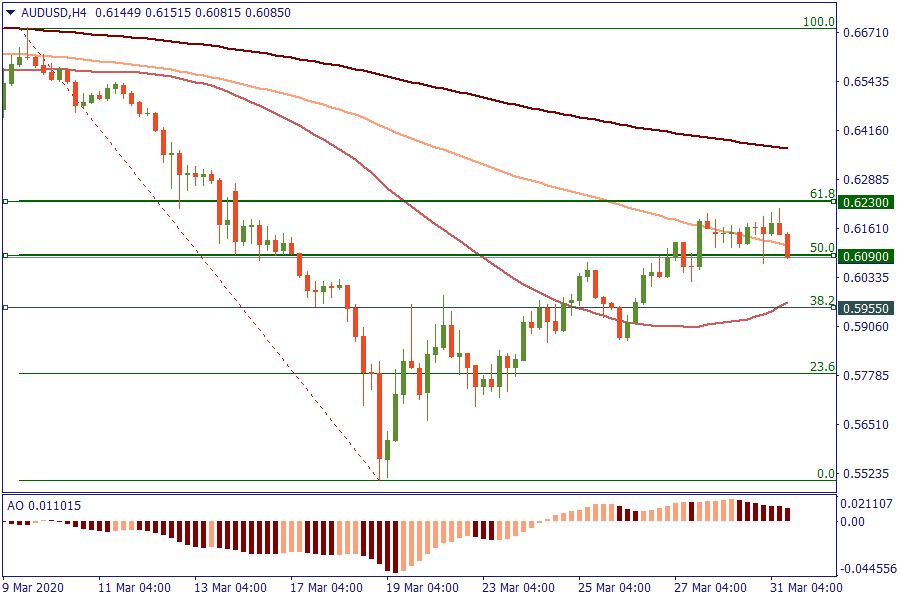

We see the AUD/USD pair on 0.6090 mark now. It almost reached 61.8% Fibonacci retracement level with 0.62300 mark and then turned back to 50%. It’s the decisive moment, will it go down breaking through 50% Fibonacci retracement level or continue its growth.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later