Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The Federal Reserve Chair Jerome Powell will hold a speech at a symposium hosted by Riksbank in Stockholm on Tuesday, January 10, at 15:00 GMT+2.

As head of the Federal Reserve, which controls the US short-term interest rates, Powell has more influence over the nation's currency than any other person. Traders scrutinize his public engagements as they often give clues regarding future monetary policy. Thus, the markets are always volatile when he speaks.

After the last FOMC meeting minutes, hopes of a slow drop in rates, at least in the 2nd half of 2023, were severely dispelled. The hawks are winning as the Fed members will not change the course of monetary policy. Powell's upcoming speech could refute or confirm investors' fears about the Fed's key rate ceiling.

Last time, on November 30, during the speech at the Brooking Institution, Jerome Powell was more dovish. As a result, EURUSD skyrocketed, gaining 2% within one day.

Instruments to trade: EURUSD, GBPUSD, XAUUSD.

The United States Bureau of Labor Statistics will publish the US Consumer Price Index (CPI) m/m on January 12 at 15:30 GMT+2. The index measures a change in the price of goods and services purchased by consumers.

Currently, price stability is the primary goal of the Federal Reserve. Thus, the release will significantly impact the future Federal Reserve’s decisions. In November and December, the actual CPI m/m underperformed expectations, hitting 0.4% and 0.1% versus 0.3% and 0.6%, respectively. As a result, the FOMC slowed down the pace of the key rate hikes, raising the rate by just 50 basis points in December versus 75 basis points at each of three previous meetings.

Instruments to trade: EURUSD, GBPUSD, USDJPY, XAUUSD.

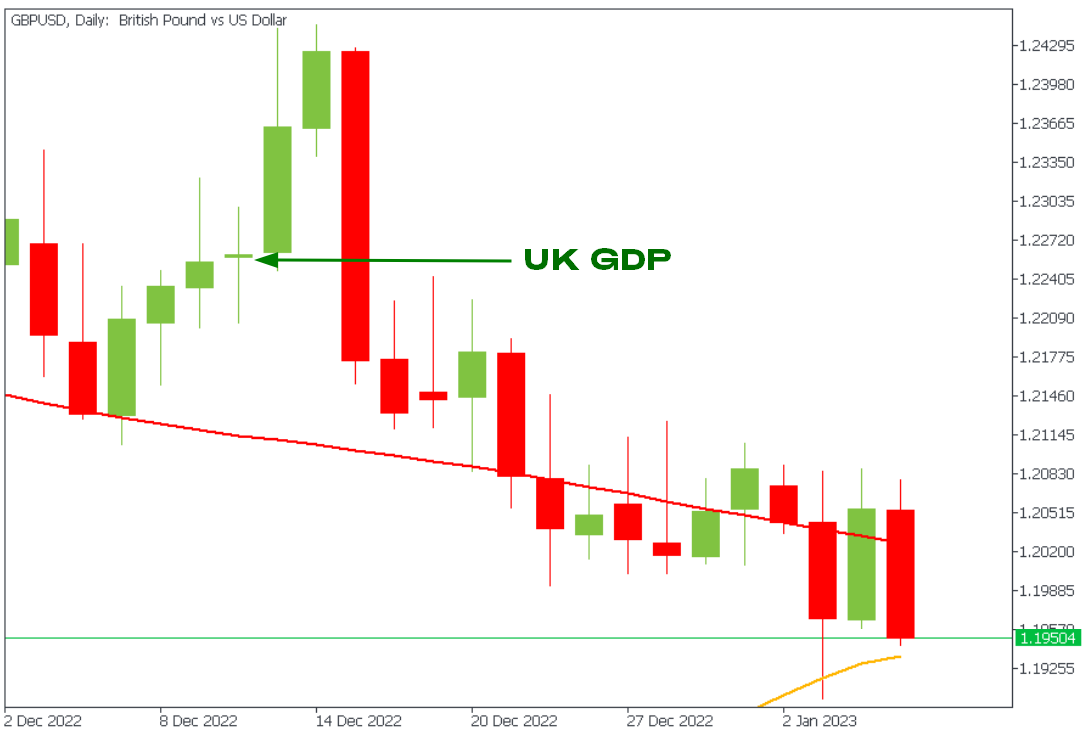

The United Kingdom Office for National Statistics will release the Gross Domestic Product (GDP) m/m on January 13, 09:00 GMT+2. The indicator is the broadest measure of economic activity and the economy's health, as it gauges a change in the total value of all goods and services produced by the economy.

Inflation in the United Kingdom remains one of the highest among the major European economies. As a result, the UK's central bank sets the highest key rate, leaving the central banks of France, Spain, and Germany behind. Under these conditions, the economy of the UK struggled, with GDP declining by 0.3% in September and 0.6% in October. However, the numbers overperformed the expectations in November, delighting investors with a possible economic rebound. As a result, GBPUSD gained over 2000 points within three days after the release.

Therefore, a further decline in inflation may force the Fed to raise rates by 25 basis points at the next meeting on February 1, which will be positive for the stock markets and harmful for the US dollar.

Instruments to trade: GBPUSD, EURGBP, GBPJPY.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later