Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Thursday is on its way. Lots of events happened yesterday, and lots of them are coming. Let’s take a peek at the markets

The US CPI was released lower than expected. CPI YoY rises by 5% (the forecast was 5.2%). CPI MoM showed just 0.1% growth VS the 0.2% in the forecast. EURUSD and XAUUSD reacted immediately. EUR reached 1.0990, and XAUUSD almost touched 2030.

Later FOMC meeting minutes were released:

‘Fed members forecast a moderate recession in 2023.’

‘Fed members were unanimous that there was little evidence of a slowdown in service sector inflation.'

‘Some Fed members stressed the need for more flexibility in the monetary policy, and some considered pausing a rate hike in March.'

The market is sure that soon we will see monetary easing. But according to CME FedWatch Tool, the probability that Fed will increase the rate by 25 bp next meeting is 66.2%

ECB’s F. Villeroy: ‘The lion's share of rate hikes is behind us, but the ECB still has some work to do in terms of rate hikes; there is still the possibility of a rate hike at the next meetings.’ On the one hand, everybody expects the Fed to pause tightening; on the other hand, ECB may continue with the rate hikes. EURUSD is rising.

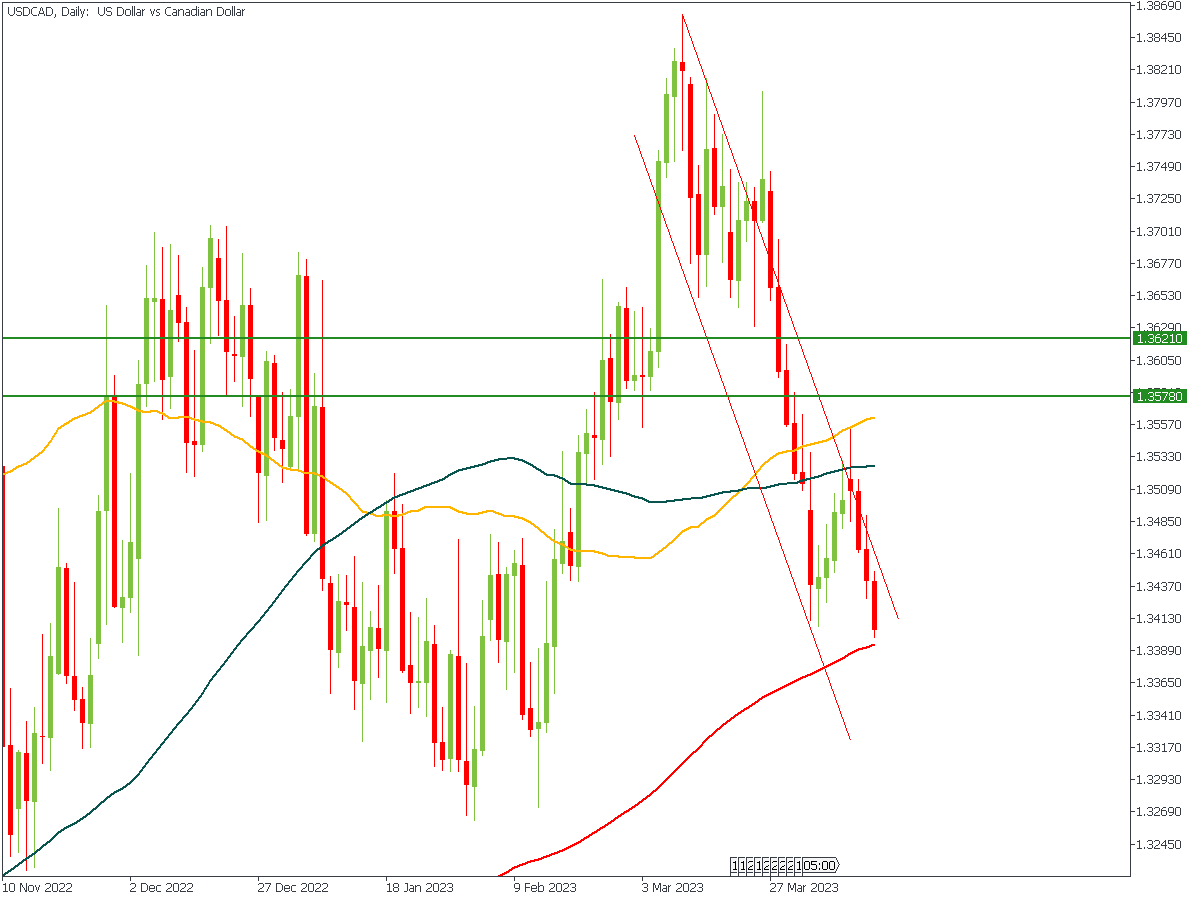

Bank of Canada (BoC) kept the rate at 4.5%. Tiff Macklem: ‘The full effect of previous rate hikes has not yet fully manifested itself’ and ‘The Central Bank considered the possibility of keeping the rate at a restrictive level for a longer time.’ USDCAD is moving down. Support is on 1.3380.

IAE governor expects a tighter global oil market in the second half of 2023, which could lead to higher oil prices - oil could rise above $85 during the last half of the year. XBRUSD is pretty close to MA 200 ($88.40).

BTC is trying to break $30 000. Touching the level is not enough for opening longs. The price may attempt to bounce back.

XAUUSD is again above $2010. The local trend is bullish. The resistance level is in 2030.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later