When is Google's stock split? Alphabet, the parent company of Google, will make the 1:20 split on July 15…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

This week Apple, Microsoft, Google, Facebook, Pfizer, and other large US companies will deliver earnings reports. For traders, it means opportunities to open buy and sell trades, as the prices of these stocks will surely make big moves. Here is the earnings schedule for companies that we will discuss in this article.

| Tesla | 00:30 GMT+3 July 27 |

|

23:30 GMT+3 July 27 |

|

|

midnight from July 27 to July 28 (GMT+3) |

|

| Microsoft |

00:30 GMT+3 July 28 |

| Pfizer |

17:30 GMT+3 July 28 |

| Amazon |

00:30 GMT+3 July 30 |

Check the full list of earnings releases and their forecasts

Amazon is a US tech giant company, involved in e-commerce, cloud computing, digital streaming, and artificial intelligence. This earnings release will show the results for the second quarter of 2021 – the last quarter under which Jeff Bezos was CEO.

Investors are quite optimistic over Amazon's report, that’s why its stock price is likely to go up before the release itself. However, the e-commerce giant is facing a tough year-over-year revenue comparison. In 2020, it gained from the long lockdowns as demand for online shopping surged and its stock price skyrocketed. In late 2020 and 2021, the stock has been trading sideways as social-distancing restrictions were eased. Finally, it has escaped the horizontal corridor between $2900 and $3500 and surged to $3800. If it breaks this level, it will rally up to the psychological mark of $4000.

Investors expect Facebook and Google to deliver a year-over-year increase in earnings when the companies report results for the quarter ended June 2021. Why? The main source of revenue for both Google and Facebook is advertising. Since the economy is reopening, businesses are recovering and more willing to spend their capital on ads. Thus, investors expect strong results from these companies, that’s why their stock prices may rally up before the releases.

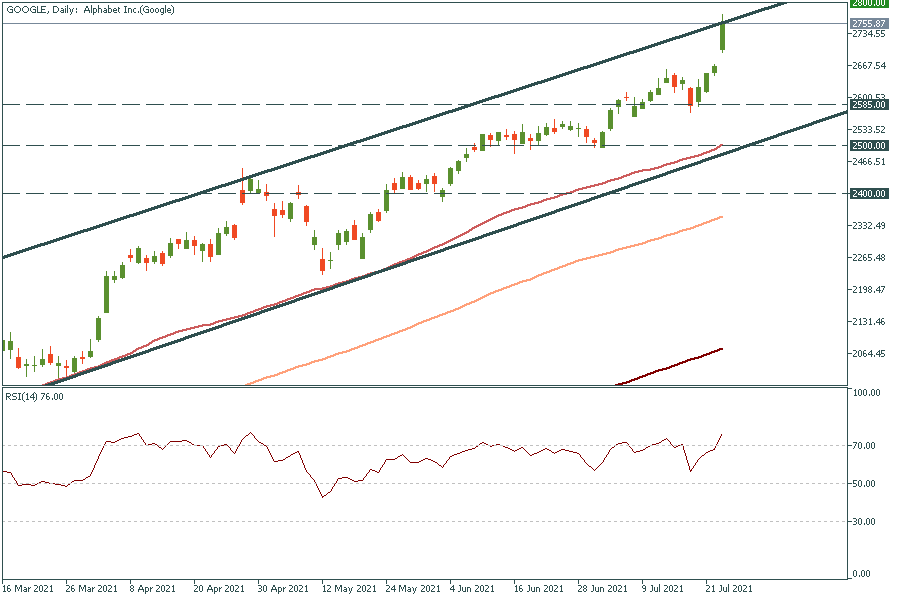

On Google’s chart, you can see the stock’s amazing performance. It’s getting closer to the psychological mark of $2800. It may struggle to break it, but if it manages to jump above it, the rally up to $2900 will continue. The RSI indicator is above 70.00, signaling the stock is overbought, but if Google reports strong results, the price may rise further even despite the fact that the RSI is above 70.00. Support levels are July 19’s low at $2585 and the 50-day moving average of $2500.

iPhone 12 sales have been very good. The series has been the most successful launch of an Apple lineup since the iPhone 6 in 2014! Therefore, investors expect Apple to reveal better-than-expected earnings results this quarter. Analysts at JPMorgan expect Apple’s stock to rise to $170. Perhaps, $170 is a long shot, the stock should break $160 at first. Apart from earnings, the launch of the iPhone 13, expected to be unveiled in September, might push the stock up as well.

Apple is moving inside the ascending channel. When it crosses the psychological level of $150.00, it will rocket to the next round number of $155.00. Support levels are the recent low of $142.00 and the 100-day moving average of $130.00.

Don't know how to trade stocks? Here are some simple steps.

When is Google's stock split? Alphabet, the parent company of Google, will make the 1:20 split on July 15…

The bullish movement in the stock market is gaining speed, and Bitcoin ETFs are closer than they might seem. What do we need to know for the next trading week?

On Wednesday, September 22, Microsoft will be holding a product launch. The event starts at 18:00 GTM + 3.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later