Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The main source of volatility for global markets is US-China tensions. Investors were waiting for US President’s speech on Friday for some hints. But, Donald Trump was not so disruptive as everybody expected. He didn’t impose any direct sanctions on China for its treatment of Hong Kong. According to investors, the US impact on China and Hong Kong is likely to be limited and more symbolic while the financial sector is unlikely to be affected.

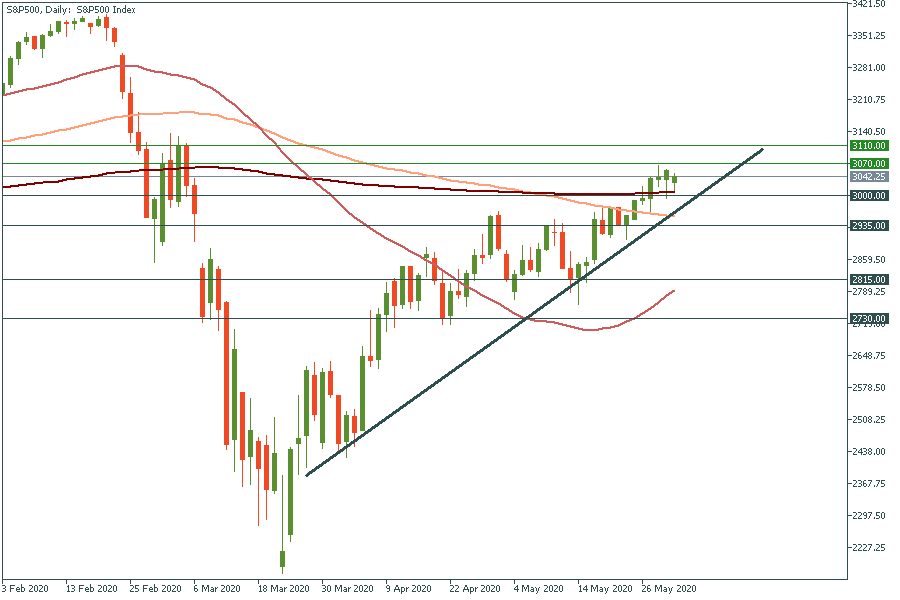

That improved the market sentiment and pushed stocks up. Let’s look at S&P 500. It has been climbing since March 20. It has already passed the 3040 mark. If it breaks through the retracement level at 3070, it will make the way towards 3110. Support levels are 3000 and 2935.

Nevertheless, violent protests in some American cities bothered investors, as crowds increase chances for the second coronavirus wave and economic activity loss.

As a result, EUR/USD rose on the weak greenback. Moreover, investors highly expect the ECB to unveil the rescue program with an additional 500 billion euros of asset purchases. All that played well for the EUR.

The price reached the March high at 1.114. The next retracement is at 1.117. If it manages to break through it, it may go even higher to 1.121. Support levels are at 1.11 and 1.10.

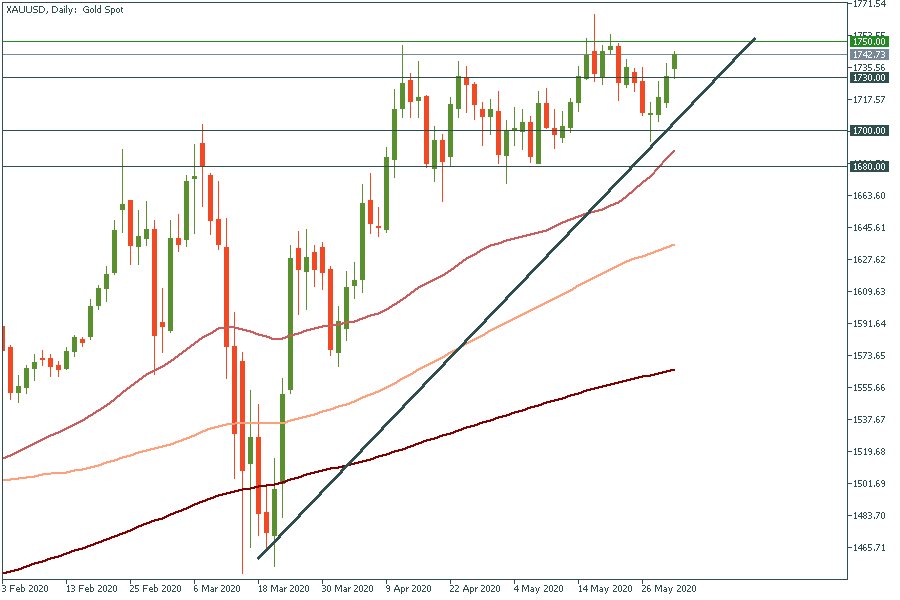

The gold has passed 1740 and it’s moving up to a recent high at 1750. The overall trend is bullish, as you can see. And, the gold is likely to stick to the trend. Support levels are 1730 and 1700.

Let’s talk about oil a little bit. Crude surged a record 88% in May driven by the OPEC+ deal. What’s more, OPEC+ is likely to expand its supply cuts in next months. However, prices are still well below where they have been at the beginning of the year. That’s because the demand yet need to show a sustained improvement for oil to keep rallying. Thanks to China, its oil demand has risen to near pre-coronavirus levels. However, the US demand stays low because of violent protests in the USA. Lrt's look at WTI oil chart. If the price crosses the 100-day moving average, it may go further to 37.5. Support are 31.5 and 27.

To trade WTI with FBS you need to choose WTI-20N.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later