The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Brexit tension is likely to take a new level now.

On Monday, the UK Prime Minister Boris Johnson confirmed his commitment to have the Brexit document agreed on by January 31. “No ifs, no buts”, as he said. Consequently, Brexit is going to be over by the end of the next year – at whatever cost.

It means that the optimism of the market, which saw the GBP soar on the victory of the Conservatives last week, will be most likely short-lived. Indeed, everyone was tired of the prolonged uncertainty around Brexit, but there is a difference between being clear and going hard. Now, the investors will almost surely have a hard Brexit – something that they were definitely not looking forward to.

The market will react accordingly.

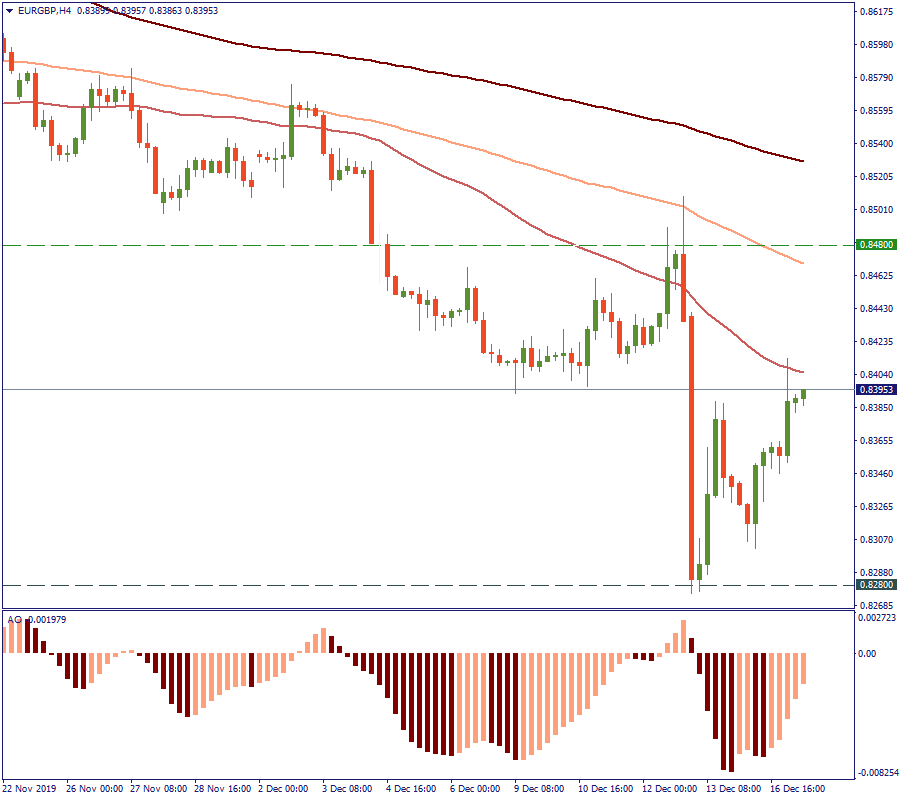

Since August, the EUR/GBP has been declining, making an exception for a few weeks at the end of September and the first half of October. The December 12-13 drop of the euro against the British pound did not reinforce that dynamic much. In fact, the price has been on a rise to test the 50-period Moving Average. On the H4, the question is: will that be another rise like many before, when the price inched above the 50-MA to follow the decline back again, or it will be a trend-changing rise?

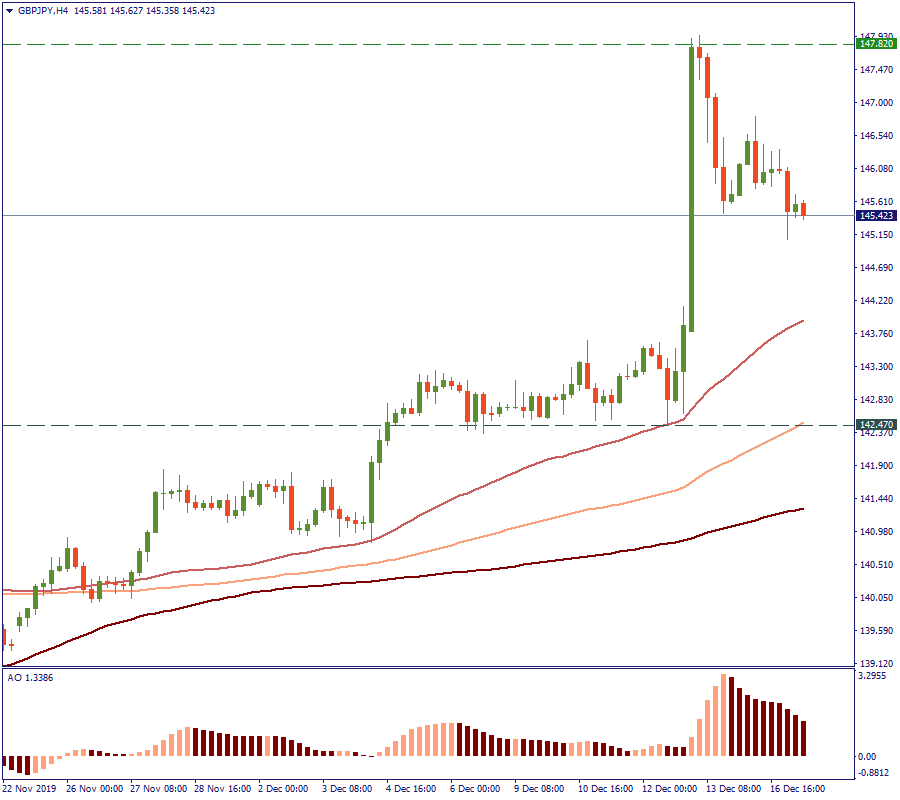

Against the other currencies, the GBP is showing almost an identical picture but inversed.

On the H4, we see that the surge of December 12-13 is followed by a drop to test the 50-period MA against the USD, JPY, and CHF. Although we did not include the charts for GBP/CAD and GBP/AUD, the situation there is exactly the same.

The coming days will show if the GBP wants to break through the 50-MA and keep falling. From the technical perspective, the Awesome Oscillator crossing the zero-line may be another confirmation for that, as we see it approaching there.

Follow the news. As of now, most of the media are predicting hard times ahead for the British pound, with a little to zero probability of a significant upsurge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later