The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Gold has been falling since the start of the week. Despite the increase of the coronavirus fears, the precious metal – a well-known safe haven – depreciated. XAU/USD reversed down from the $1,700 area and dropped to $1,586 at the moment of writing (March 12, 16:00 MT time).

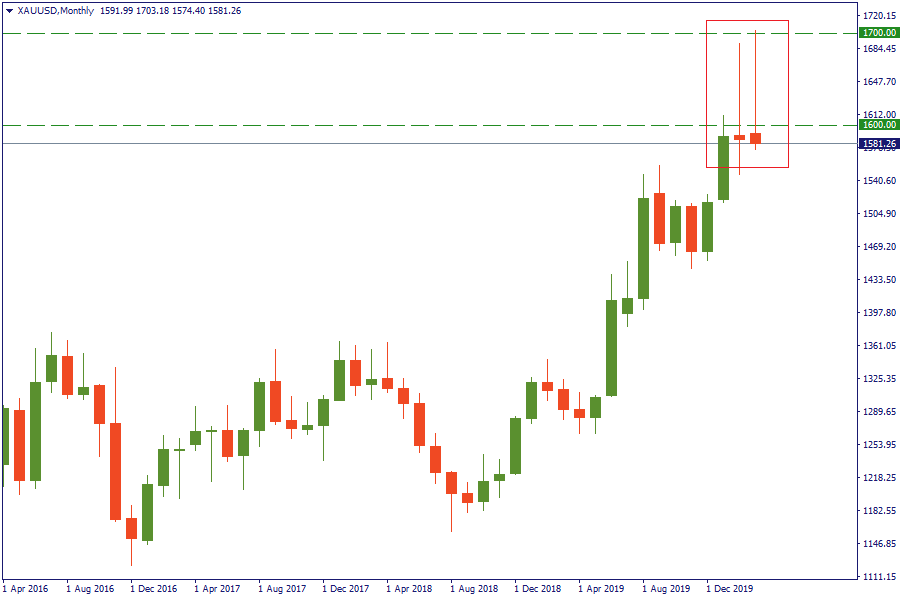

The primary reason of gold’s depreciation is technical correction. Earlier the price has risen to the highest levels since 2012, and that was simply too much too fast, so buyers took profit. The previous candlestick on the monthly chart looks very similar to the one currently forming at that timeframe. February’s candlestick has a big upper wick. This means that the price met resistance and wasn’t able to keep going up.

The natural question now is, “Will gold keep falling?”

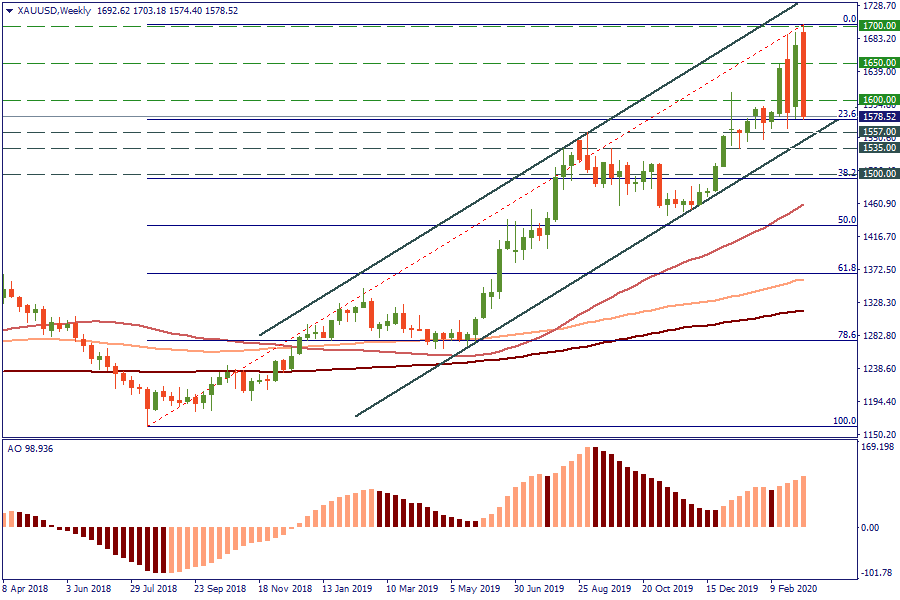

The answer is, “Yes, the price may visit lower levels”. On the W1, there’s bearish divergence between the price and the Awesome Oscillator. A weekly close below $1,590 will produce a bearish engulfing pattern on the W1. Support is located at $1,557 (September highs) and 1,535 (100-day MA). The next key level on the downside will be at $1,500. Resistance is at $1,600 and $1,650.

Fundamentally, the reasons for higher gold prices are still here: the coronavirus uncertainty, the easing of monetary policy of large central banks. As a result, watch technical levels. If the signs of reversal to the upside appear at the mentioned support levels, consider bullish positions.

The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

The Organization of Petroleum Exporting Countries will hold a meeting on June 2.

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later