The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

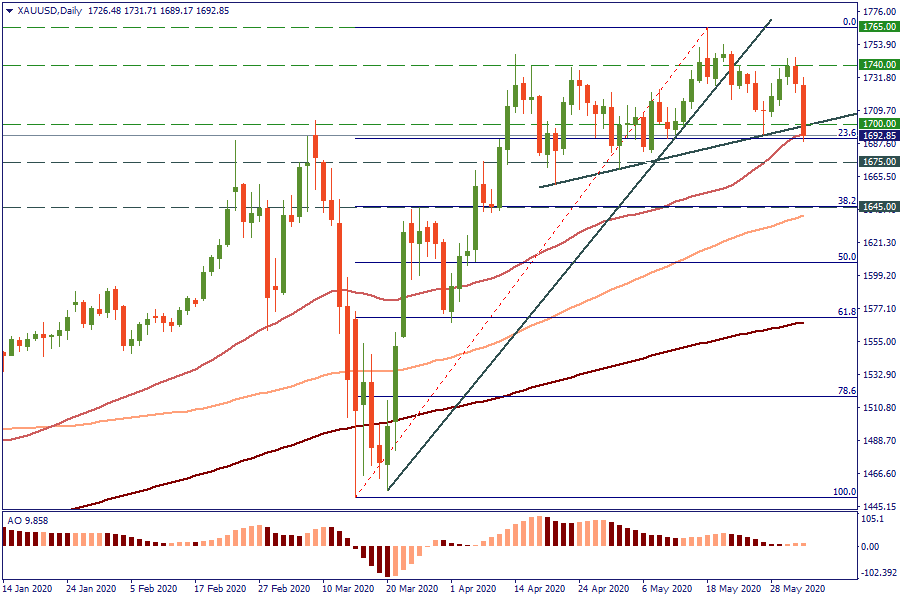

Gold (XAU/USD) is declining for the second day in a row. The reason of such a dynamic is that risk-seeking investors have turned to stocks. It’s hard to ignore the surge of S&P 500, NASDAQ, and Dow Jones. More and more traders and investors want to take part in this rally, so they quit their gold longs and switch to indexes. US ADP employment report released today showed that the number of jobs in the US private sector declined in may less than expected. That has also contributed to the positive mood and reduced the appeal of the precious metal.

Traders can profit in indexes for sure, but don't forget that short positions in gold are also possible. The price is currently testing the 23.6% Fibonacci retracement level in the 1,690 area. The fix below this point will open the way down to $1,670 and $1,645.

At the same time, remember that gold is a safe haven. With various uncertainties that torment the world, the long-term trend for XAU/USD is bullish. As a result, every time the asset reaches support levels, it is necessary to look for the signals of bullish reversal.

Finally, the return above $1,700 (if the break to the downside turns out to be false), will allow bulls to try to push the price back up to $1,715 and $1,725.

The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

The Organization of Petroleum Exporting Countries will hold a meeting on June 2.

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later