The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

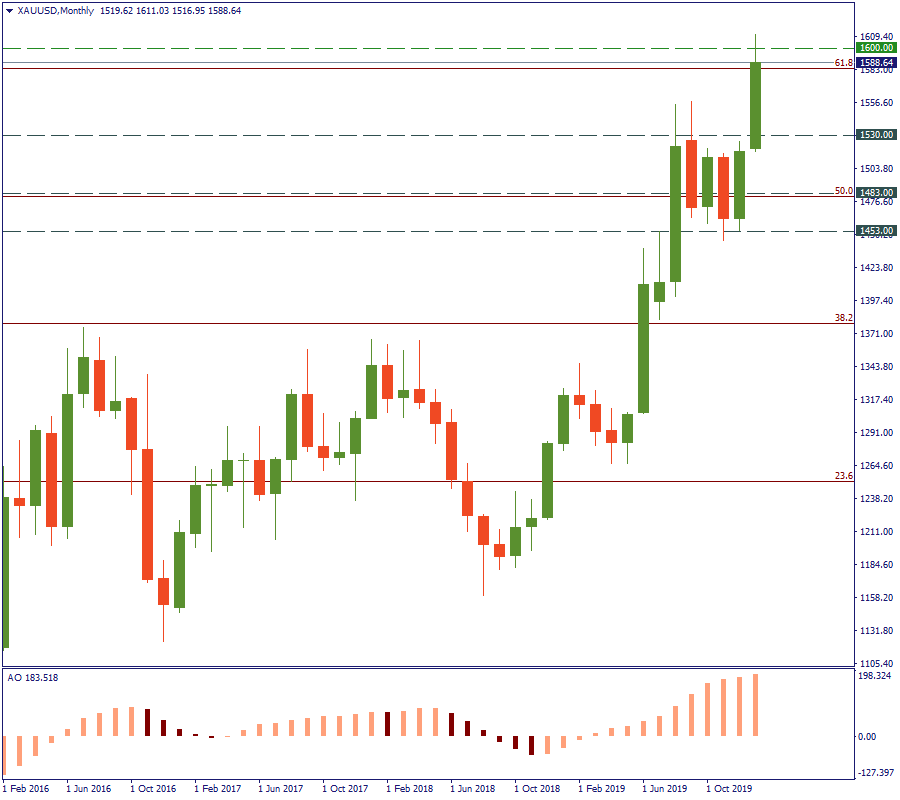

Missiles have landed today at US airbases in Iraq. This was Iranian retaliation for the killing of elite Quds Force commander Qassem Soleimani by American forces. Another piece of news was that a plane bound to Ukraine crashed in Iran with all passengers and staff dying. No surprise, gold rose to $1,600 as investors seek refuge and hedge their risks against market drawdowns.

$1,600 may not be the end of it. Analysts at Goldman Sachs say that gold may reach $1,625 this quarter if the Middle East crisis persists. Notice though that even this forecast may be too modest: if the price fixes above the Fibonacci level at $1,585, the next one will be as high as at $1,730 – that’s $145 above the current price!

The US President Donald Trump did not specify the losses of the US bases. On the contrary, he tweeted “so far, so good!” and promised to give a speech today. Hence, this seems to be the major event to look forward to. At this moment, gold is correcting to the downside a bit, but the situation has all the prerequisites to put further pressure down on the USD and keep pushing the precious metal higher. The medium-term outlook for gold will remain positive as along as the price remains above the 2019 high at $1,557. Therefore, it’s a good moment to buy the precious metal and look forward to what the US president says.

The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

The Organization of Petroleum Exporting Countries will hold a meeting on June 2.

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later