Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The pandemic and the ongoing recession made us forget about the most triggering topic of the last year (except Brexit, of course). We are talking about the US-China trade war. Back then, the bullish market shrugged every time the US President Donald Trump posted negative things about China to his Twitter. He imposed and then raised the tariffs on Chinese goods and accused the Chinese technology producer Huawei of breaking the intellectual property laws. After several months of thorough discussions between trade representatives of both countries, phase one trade deal was reached. It was a small step towards an improvement in the relationships between the two countries. However, the black swan, the “invisible enemy” called Covid-19 messed everything up and made China the main culprit of the situation. Although the country of the virus’ origin recovered from it very quickly, the outbreak in the US (which is leading in the number of cases and deaths) hurt the American economy very badly. Thus, that’s not a surprise the US investigation team started research to find out the true origin of the new coronavirus. Donald Trump and the US Secretary of State Mike Pompeo have already claimed that China was hiding the actual data about the virus at the beginning of the outbreak. In its turn, China urged the US to stop spreading disinformation. That’s how the two counties stepped on a new warpath.

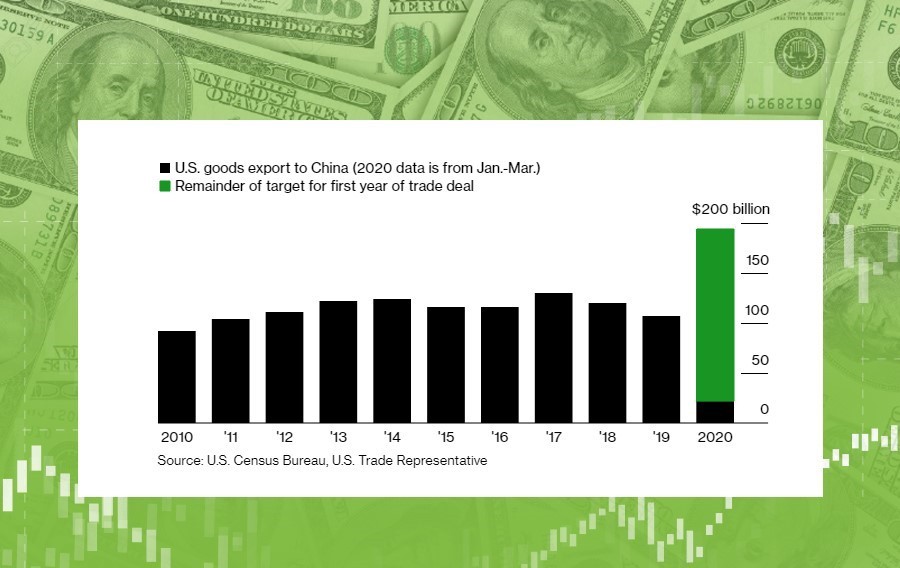

After the massive inflow of coronavirus news during the past three months, we finally got an update on a US-China trade deal. During the Asian trading session of May 8, the US trade representatives Steven Mnuchin and Robert Lighthizer had a phone call with Chinese prime minister Liu He, where they discussed progress of the phase one trade deal and economic issues. The overall sentiment surrounding the outcome of these talks was positive, but later on Friday, the US president Donald Trump spoiled the barrel with a bad apple. He told that he was having a very hard times with China and expressed uncertainty about the future of a trade deal. His worries are understandable. While China reached progress on some parts of the trade deal, lifting the restrictions on the import of the US agricultural products and publishing a guideline on intellectual property protection, the purchases of the US exports remain at a very low level versus the yearly target of $200 billion goods and services.

Sourced by: Bloomberg

We will most likely hear more comments by the US President Donald Trump, as he may report more remarks on the progress of the US-China trade deal at the end of the week.

If his comments are negative or he blames China and threatens with new tariffs, the risk sentiment may fall. Pay attention to the US indices (NASDAQ, S&P 500), as they will definitely react at the opening of the market. At the same time, beware of gaps. Forex traders may prefer to take a look at the risky currencies such as the AUD and the NZD.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later