The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Russian-Ukrainian conflict is influencing every economic aspect. Due to sanctions, not only Russia is exposed to the catastrophic financial crisis, but other countries, which are dependent on Russia’s commodities as well. Other countries don’t want to risk in this situation and are careful in their domestic policy.

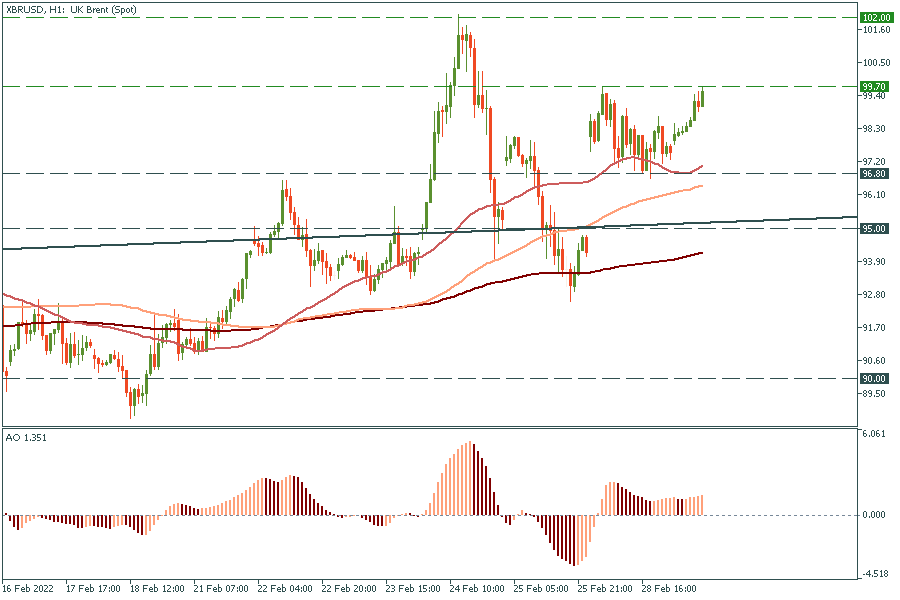

Stocks and oil posted gains on Tuesday amid a lull in volatility caused by the war in Ukraine and sanctions imposed on Russia. Brent’s resistance is at 99.70 and the support on 96.80.

Russian markets remain under pressure after the US and its allies moved to block the Bank of Russia's access to foreign exchange reserves and disconnect some creditors from the SWIFT messaging system for global banking.

The conflict and moves to isolate commodity-rich Russia have hit markets. Disruptions in the supply of raw materials such as grain and energy threaten to fuel already high inflation and slow economic growth as the Federal Reserve is preparing to raise interest rates. Lenders around the world are already making it difficult to finance transactions involving Russian resources. The gas price has jumped on February 24, now it’s descending but any news can have big impact on gas.

Australia's central bank kept the cash rate at a record low and said it would remain calm as it assesses the risks of a Russian invasion and a subsequent surge in energy prices. AUD dipped immediately after announcement to 0.7247, but then returned to the previous level.

In cryptocurrencies, Bitcoin jumped above $43,000 on speculation that digital tokens could be increasingly used for payments due to sanctions against Russia. Now BTC is holding at approximately $43,300.

Have a good trading day!

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later