Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

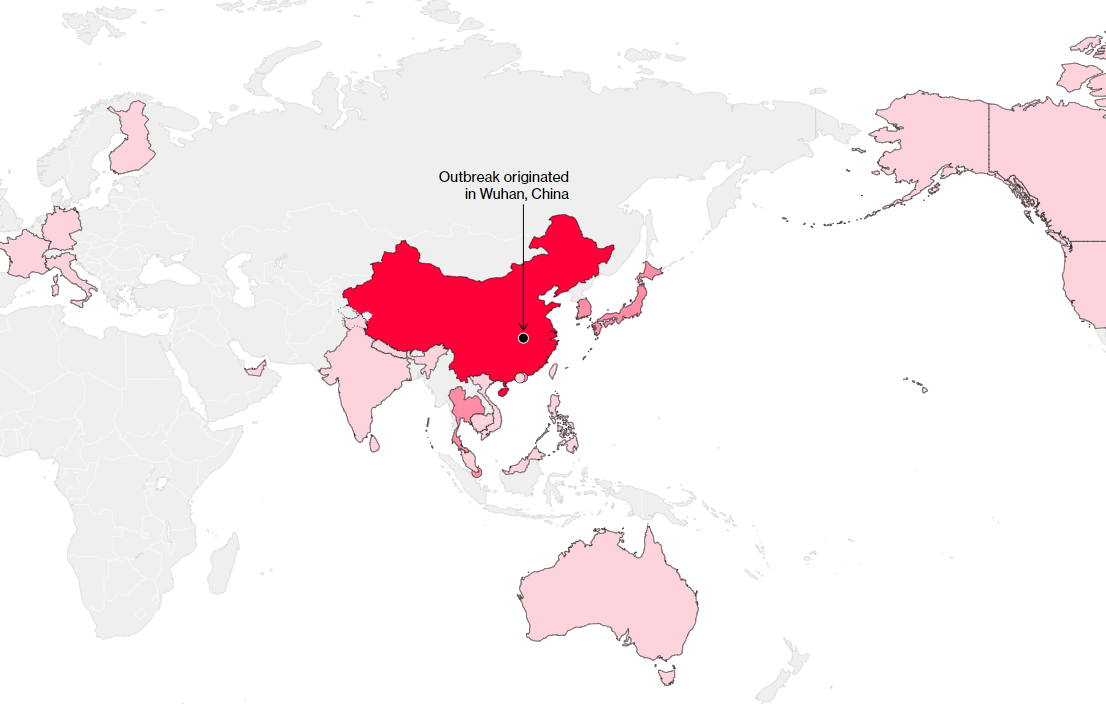

From a “planetary” perspective, an event such as a new virus outbreak is supposed to happen every now and then. The evolution still goes on, and the fact that humans are the most successful and advanced species does not mean that other species have stopped their development in the background. In fact, there are particular beings in the organic world that keep competing with the human race since ages – the viruses. Now, it is Coronavirus. “Came” fast, stroke hard, and reigning already cross-continent in a matter of two weeks.

Source: Bloomberg

As of now, there are almost 10,000 confirmed Coronavirus cases across the world, with the majority registered in China as the initial territorial source. Out of these, more than 200 are deaths and 1500 severe.

As a result, flights were halted, borders were closed, production was stalled, markets were suppressed. Obviously, the Chinese economy has to endure the strongest impact. However, other countries suffer also, proportionately to their ties with China and involvement in the global economic process.

The World Health Organization declared the virus outbreak as a global emergency recognizing the gravity of the situation and the rising toll of the infected. Hence, the crisis is still on, and it is far from being dealt with, but the tone of the announcement by the WHO was more confident than what it could have been. The impression is therefore heavy, but not yet the panic mode. Based on this, we can assume that the flight to safety will keep guiding the stock and Forex markets, but we need to be cautious when predicting the exact levels to which safe-haven currencies can rise and stock fall. In any case, USD, JPY, and CHF are expected to be in the focus of the Forex market investors.

Like there are no concerns, Amazon announced its breakthrough sales during the holidays, to the joy of investors and amusement of the market. The stock is on the rising curve now, trading at the level of $1,871 per share and aiming at the resistance of $1,888. If it crosses that level and climbs to $1,900, we may well interpret it as a mid-term trend reversal. Supports of $1,865 and $1,835 will be there to check the opposite potential.

A very interesting combination of news is keeping the focus around the UK. Yesterday, the EU Council has adopted the Brexit document, which was the last formality concluding the process. Today, at midnight MT time the transition period comes into force. The UK PM will give a speech over Brexit and the UK economy, probably encouraging the population to unite around the country’s advancement in this period (and with this, trying to solidify his political positions as well). Lastly, the Bank of England announced the interest rate unchanged at 0.75% as voted 7-2. However, it pointed out serious economic weakness points – we will see how Boris Johnson will address that.

Amidst all this, the GBP has been growing stronger against the Euro. Currently, the currency pair is trading at 0.8400. The closest support lies at 0.8280, the December low. It seems unlikely for EUR/GBP to go straight to there even with the good information layout, but that will be a mid-term aim for the currency pair. If the GBP loses its positions, the local resistance levels will be at 0.8450, 0.8470 and 0.8510.

Today, Canada announces its monthly GDP growth rate at 15:30 MT time. The tendency over the year was a decline in this indicator. Hence, it would be inspirational for the CAD to see a better-than-expected performance of the Canadian economy.

Since the very beginning of the year, the USD/CAD has been showing nothing but appreciation of the US dollar against the CAD. If there is no good news for the Canadian dollar, there are December high of 1.3265 and November high of 1.3325 before the currency pair as resistance levels.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later