Here is the digest with the most interesting news for today

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The US dollar has started the week on the positive footing, while riskier assets are dipping down. Let’s discuss last market movements in more details.

Chinese economic activity has shown signs of a sustained recovery from the virus slump. Manufacturing PMI came out almost as planned: 51.0 vs. the forecast of 51.1. Non-manufacturing PMI turned out even better than analysts anticipated. It was 55.2, while only 54.0 was foreseen. As a result, the Chinese yuan gained significantly. Let’s look at the USD/CNH daily chart. The pair has been confidently declining since the end of May. Today it has almost reached the levels unseen since end of January. If it falls below the 200-week moving average of 6.8100, it will open doors towards the low of January 20 at 6.7500. Otherwise, if it jumps above the high of August 21 at 6.9200, it may surge to the nest resistance of 6.9700.

Let’s move on to Japanese latest news. The country is looking for a new prime minister. Besides, Japanese stocks have surged after Warren Buffet claimed an investment in the country’s local firms. The Japanese yen gained after the positive news, but then the US dollar outperformed it. The pair has bounced off the 23.6% Fibonacci retracement level at 105.51. If it breaks through the key psychological mark of 106.00, it may climb up to the key resistance of 106.00. In the opposite scenario, if it falls below 105.51 again, it may dip down to the low of August 19 at 105.15.

As for the virus, investors have optimistic prospects for a vaccine. China has approved the Sinovac COVID-19 vaccine candidate for emergency use. The US FDA claimed that it is planning to fast-track vaccine approval if benefits outweigh the potential risks.

S&P 500 reached the all-time high of 3 525. If it rises up to 3 550, it will jump to 3 600. Otherwise, the move below the key psychological mark of 3 500 will drive the price to the next support of 3 470.

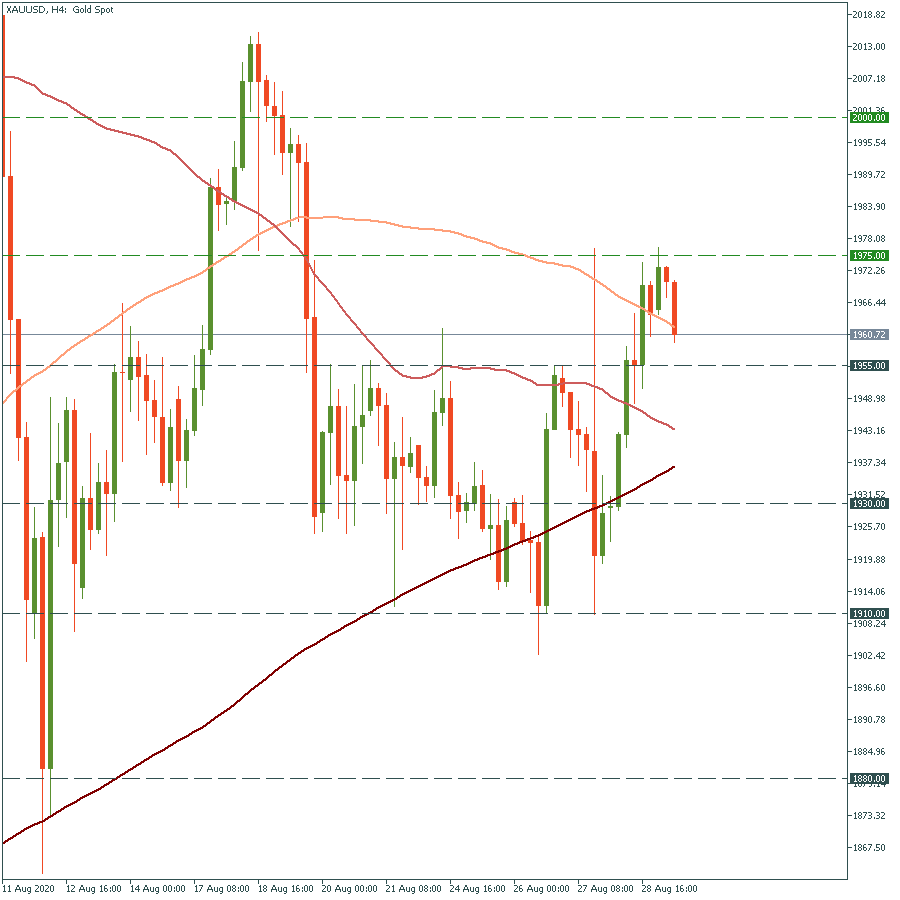

Finally, let’s talk about gold. It has reversed from the resistance of $1 975 and started falling down. If it breaks down the support of $1 955, it will fall deeper to the next one at $1 930. On the flip side, if it jumps above $1 975, it may climb up to the key psychological mark of $2 000.

Fed’s chair, Richard Clarida will make a speech at 16:00 MT time. He may unveil some details of the Fed's new approach to inflation targeting, which sent the US dollar down last week.

Here is the digest with the most interesting news for today

Markets never sleep! Let’s be prepared for a beautiful trading experience by looking at the most important news of Tuesday!

The first week of November promises to be eventful, as we have the Fed meeting, the BOE update, and the NFP release. Read more details here.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later