Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

To start the week, let’s throw a quick glance on the market disposition this Monday.

No big movement so far, with USD and JPY being moderately strong against their counterparts. In general, the overall mood of the market is very cautious. Very possibly, currency investors are not yet sure how to interpret Donald Trump’s recent stepping back from his previous call to resume normal activity by Easter. Now, the virus state is extended until April 30 in the US. So the audience is watching for more fundamentals on the USD to factor it into this week’s movements.

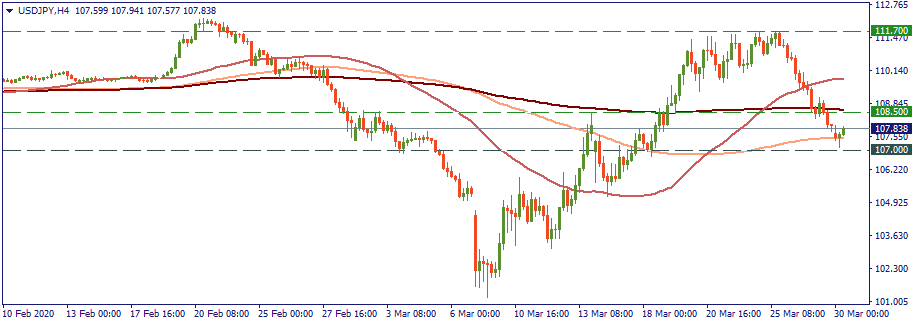

USD/JPY: support 107.00, resistance 108.50

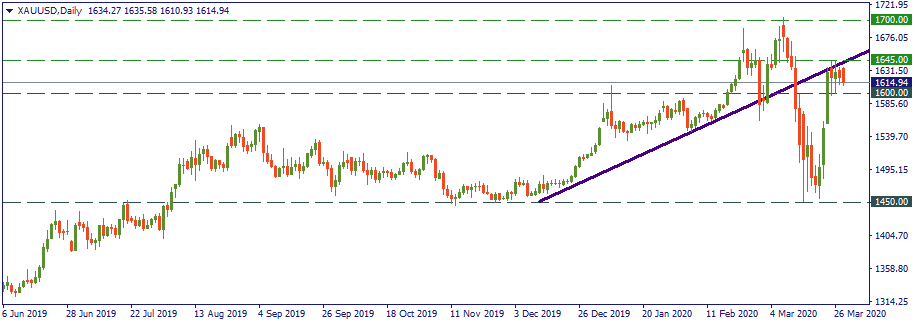

The precious metal has lost its momentum for the upside. Currently, it trades at $1,615 per ounce and is likely to continue the consolidation at this level. As there is no certainty on the market about the nearest perspectives, and the positivity is hardly outweighing the pessimism of what’s going on, so is the gold – hanging there at the ranges of $1,610-1,620.

XAU/USD: support $1,600, resistance $1,645

The oil market is now in a “prepare for the ride” state. Most media reiterate the truth that Donald Trump lost the opportunity to lead the global oil market anywhere, and even if he wanted it now, it is too late. Saudi Arabia and Russia show no more sympathy to each other nor any more concern by the global consequences of the oil price war. These last days of March will end the current period of output limitations following the December agreements of the OPEC+, now obsolete. Hence, Wednesday will be the first day of the truly free oil market. Probably, that is going to be an example that freedom without limitations is no good for anyone. In the meantime, the oil price is at decade-long bottom levels.

WTI: support $20, resistance $28

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later