Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

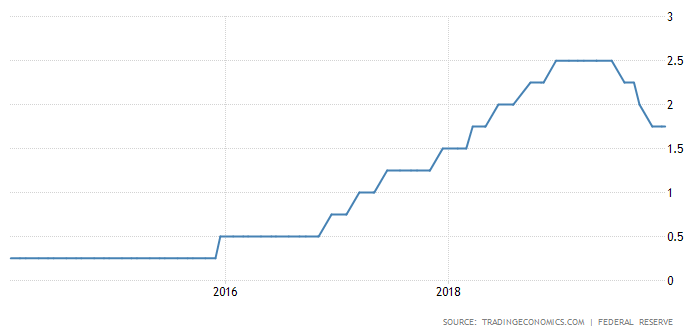

The Federal Reserve had the meeting on Wednesday as planned and announced the steady interest rate in the 1.5%-1.75% range. That was expected by the market so it was not much of the news. More importantly, the Fed Chair Mr. Powell gave a press conference that contained signals on the future outlook.

The main message of Mr. Powell was that “the current stance of monetary policy is appropriate”. The rate is likely to stay unchanged through 2020 as the economy is in a “good place”, as previously noted.

Also, Mr. Powell indicated a possible cut in 2020 as he intends to reach the inflation rate of 2% which is still missed. According to his own words, they “need some upward pressure on inflation”.

Therefore, we have a steady monetary stance of the Fed with a slight inclination to the dovish side. It has to be noted, however, that to some the three rate cuts this year would signal the end of the dovish cycle, opening the door for a new hawkish policy line on the horizon.

At the same time, the “dot plot” provided by the Fed created some misunderstanding in the background. That may have been a consequence of certain inadequacy of how the table represents the Fed’s intentions. For example, the September plot gives an impression of hawkish expectations for 2020, while the latest release clearly shows no such thing. The lesson: the “dot plot” needs to be read in the dynamics against the previous releases and also within the context of the most recent information from the Fed.

In the long-term, the USD will gradually lose value if the Fed inclines to the dovish line of monetary policy and eventually cuts the rate. Otherwise, it will be supported as long as the rate is steady and the American economy is resilient. But that is only one factor out of many affecting the course of the currency, with US-China relations being at the front line. December 15 with Donald Trump’s decision on trade tariffs will give us another clue of what’s going to happen to USD - stay updated.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later