Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

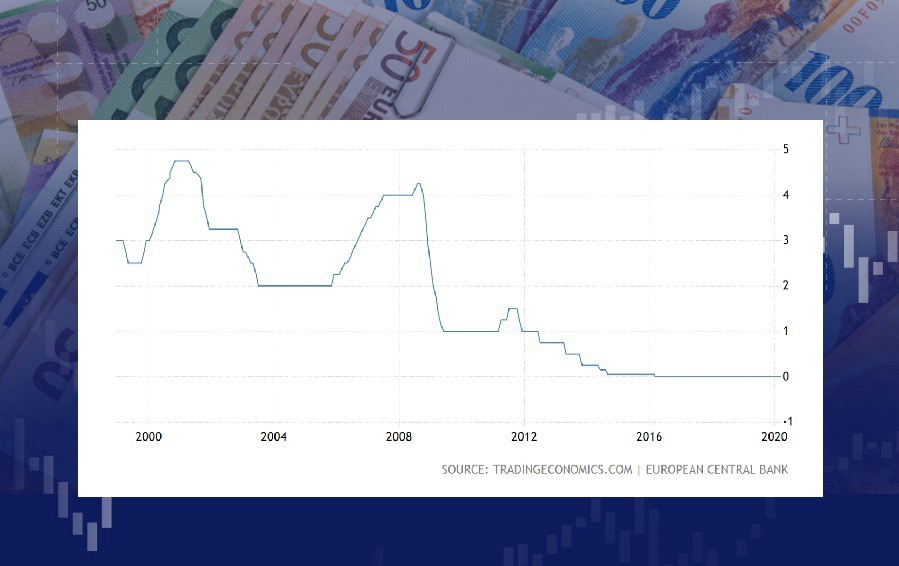

The European Central Bank will unveil the refinancing rate and make the monetary policy statement on April 30 at 14:45 MT.

Instruments to trade: EUR/USD, EUR/GBP, EUR/AUD, EUR/CAD, EUR/CNH, EUR/CHF, EUR/NZD, EUR/JPY

Europe has been enormously damaged by the COVID-19. The IMF anticipates the GDP of the euro area to decline by 7.5% this year. There’s little the ECB can do to prevent the fall but it can mitigate the coronavirus impact.

The ECB has already taken some actions. Last month it effectively allowed Greek lenders to borrow from the central bank. Then, it has started accepting junk debts that shield sovereigns such as Italy from a downgrade. However, the ECB’s coronavirus program might expire by October if the central bank continues buying sovereign bonds at the same rate.

If there is no result, the bank would even have to try helicopter money. Just imagine, money that is falling out of a helicopter to the people below. However, it would not be the same in reality. According to Pictet Wealth Management, the ECB could offer money to banks at -1% under a condition that they grant 0% loans to their customers. Some analysts think that it could be a good option amid the present crisis.

Let’s see what the ECB will propose on April 30. Also the ECB press conference will be that day at 15:30 MT that often creates the heavy market volatility. Stay tune and remember:

If the ECB’s monetary policy statement is hawkish than expected, it will push EUR upward.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later