Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

A $590bln financial emergency package was prepared to aid the European economy by EU finance ministers. It includes a 100bln-euro joint employment insurance fund, 200bln euros of liquidity to be facilitated to commercial organizations, and 240bln euros to support emergency spending programs of the European states.

Sure it is. However, formally, it is now only left to the EU country leaders to approve it. As you understand, that “only” is an abyss to leap over, given the current political and economic disagreements between the European states.

Primarily, because the virus, although biologically indiscriminative to societies, hit Southern Europe disproportionately harder than the North. Specifically, Spain, Italy, and France suffered most losses, while countries like the Netherlands, Germany or Sweden received much less damage.

On top of that, there are clear inter-state political and economic differences between the European countries, which have been there long before the virus came, but the hardened situation over the pandemic just made those differences more severe.

And finally, there are internal political struggles and fragmentation resulting in the fact that each opposing party or politician is trying to use the virus countermeasures to boost their own recognition and agenda.

Altogether, these factors lead to heavy doubt about the real level of the EU functionality and even integrity as an economic and political structure. Needless to say, if the European leaders manage to fail on this step, the EUR will lose much of its value. Otherwise, should they overcome their discords and approve the financial aid, EUR will be boosted in the long-term.

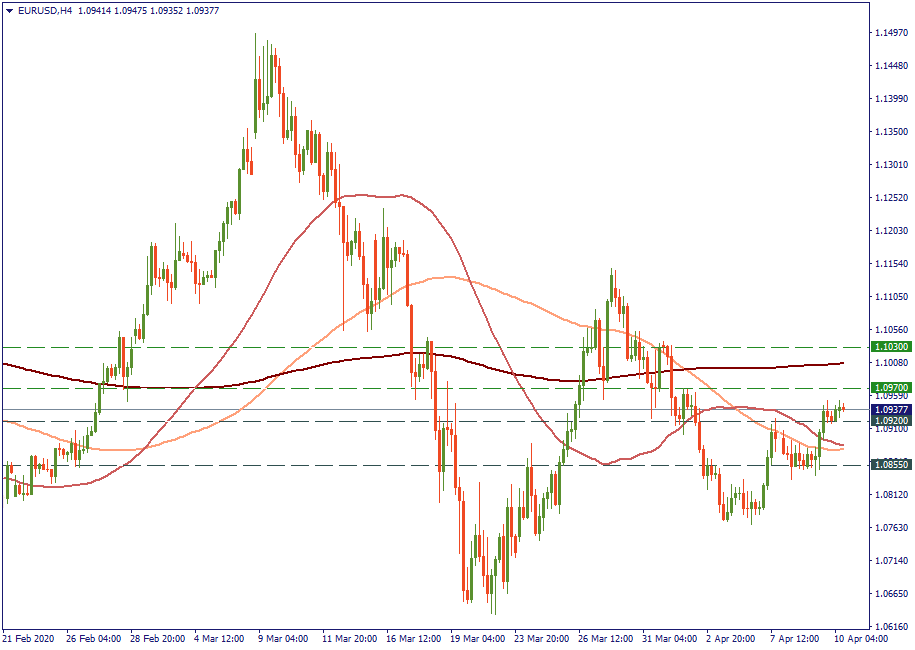

You watch the levels. Currently, EUR/USD trades between the support of 1.0920 and the resistance of 1.0970. Activity on behalf of the US Fed and Trump’s positive “incursions” in the media with regards to the oil talks between OPEC+ countries give support to the USD, however, so far, EUR has been fighting that off. If next week brings some positive news on the progress over the mentioned financial plan, the resistance of 1.0970 should be crossed, and 1.1030 will be the next possible target in line with 200-MA. Otherwise, 50-MA and 100-MA will be there to greet the disappointed euro and walk it to the support of 1.0855. So watch the news and act accordingly.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later