The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The European Central Bank will meet today to discuss the current monetary policy and the fate of the quantitative easing program. As usual, the event will start with the release of the monetary policy statement and the announcement of the interest rate at 14:45 MT time. After that, there is a press conference at 15:30 MT time.

While the interest rate will most likely remain stable at 0%, the main focus of traders will be on the tone of the ECB President Christine Lagarde and the release of the strategic review. The strategic review will provide us the details on factors and which may have an impact on the future ECB monetary policy decisions. During December’s meeting, the data signaled about stabilization in the GDP growth of the Eurozone. In fact, analysts have already told that the current ECB team is far less dovish than the one headed by Mario Draghi. However, the stimulus program has been left untouched yet. According to the words of Christine Lagarde, the global uncertainties keep being the major issue for Europe. Thus, her words may hurt the euro, if she sees the risks increasing.

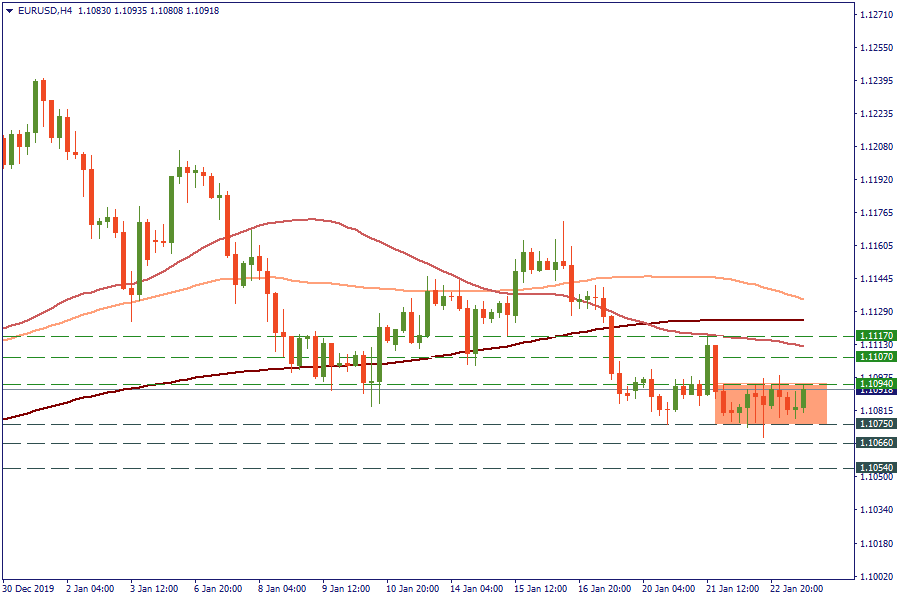

EUR/USD has been consolidating on the H4 chart between 1.1094 and 1.1075 levels. If the ECB is hawkish, we expect the breakout of the 1.1094 level and rise towards 1.107. The next key resistance will be placed at 1.1075. On the other hand, the negative comments by the ECB will pull the pair below the 1.1075 level towards the next support at 1.1066. The next key level will be placed at 1.1054.

So, to sum up today you need to:

1) Wait for the updates on the monetary policy;

2) Review the hints on the further easing in the strategic review;

3) Follow the comments by the ECB President Christine Lagarde during the Press Conference;

4) And, of course, press

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later