The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Wednesday marks the middle of the trading week. Below you will find the useful information for successful trading.

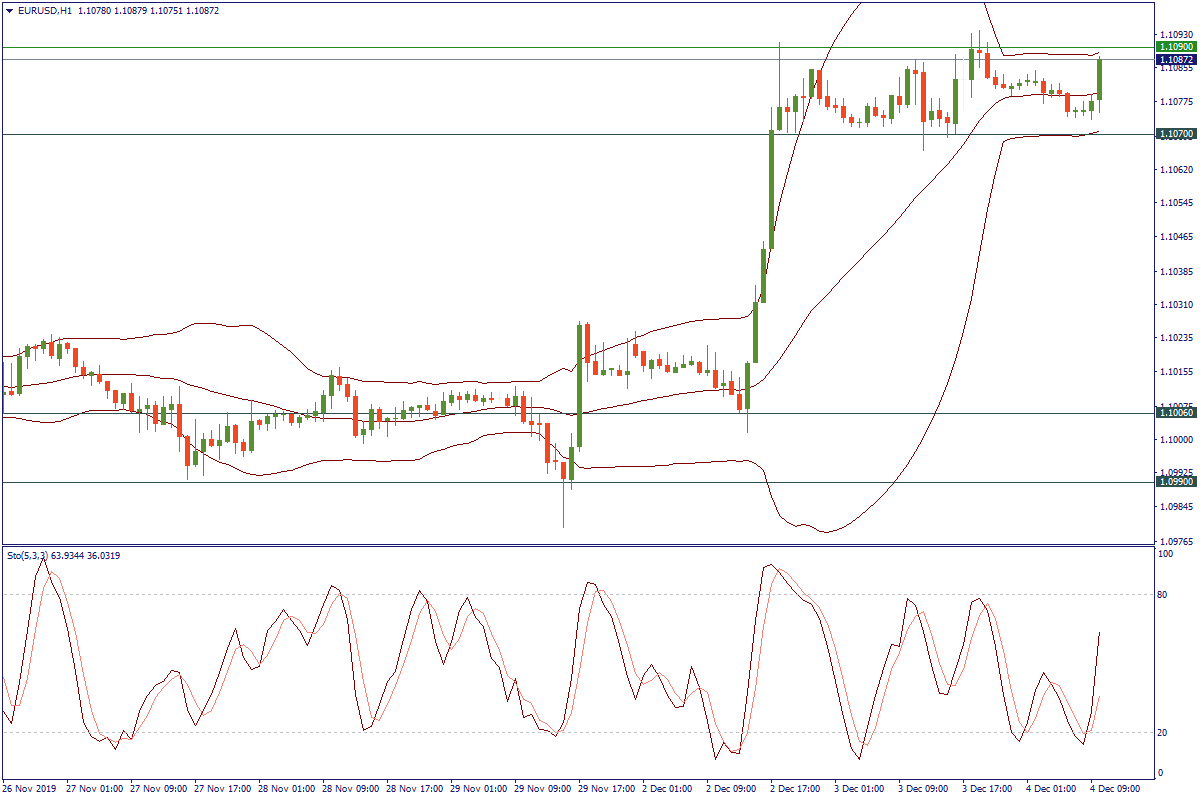

EUR/USD rose above 1.1070 on Monday and has been consolidating under the resistance level of 1.1090 since then. On the H1, Bollinger bands compressed. This confirms that the market is gathering power to make a more decisive move in the nearest future. The resistance level of 1.1090 has been capping the upward movement of the price since the beginning of November and may require extra effort from the bulls to break. However, the Stochastic Indicator’s fast line already crossed the slow one bottom-up within the oversold zone. This may signal a good moment to open longs. Otherwise, if the support level of 1.1070 is broken later, the price may go down to the support levels of 1.1005 and 1.0990, where it has been trading during the last week of November.

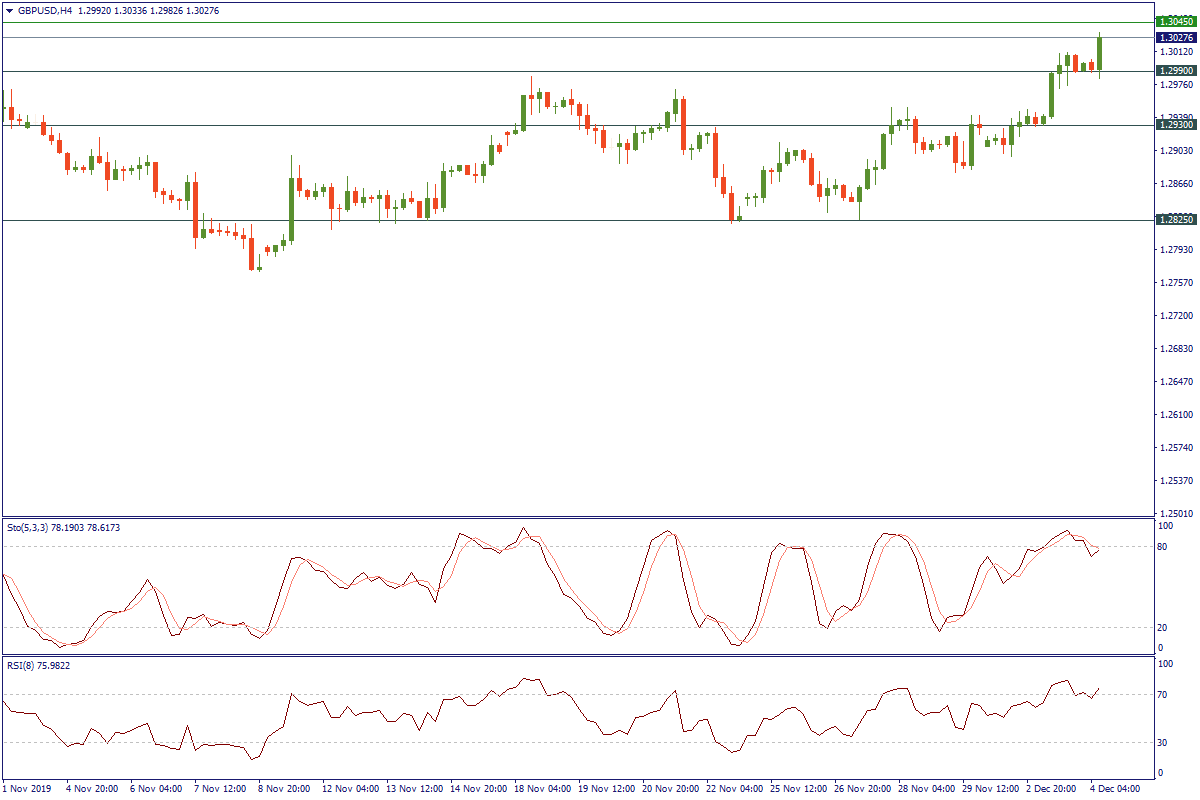

Yesterday, the British pound rose to the resistance level of 1.3008 against the US dollar. On the H4 chart of GBP/USD, since May 2019 this level was reached only on November 21. Today, the price is more likely to decline as the RSI and Stochastic are in the overbought zone and will likely leave it soon. Once the support level of 1.2990 is crossed, the next target for the bears may be located at 1.2926. Otherwise, an additional resistance level to check the bullish move may be placed at 1.3000, being a strong psychological barrier to break.

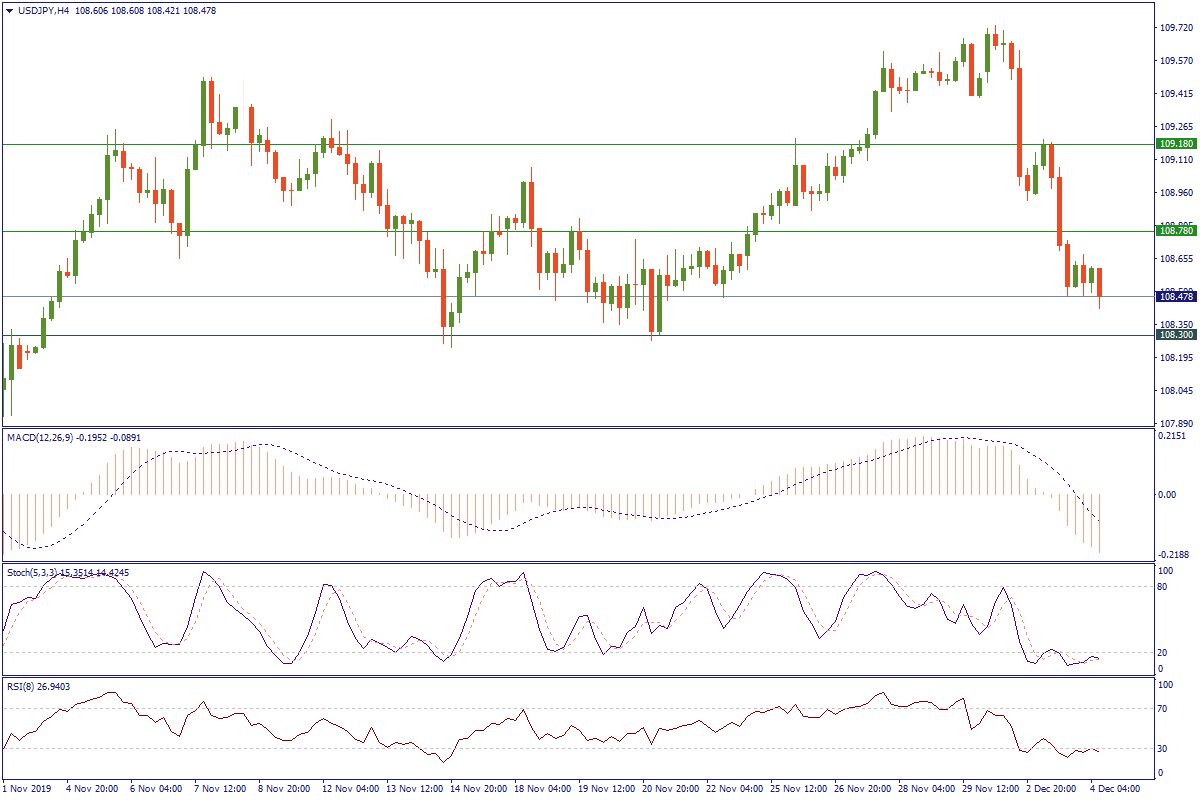

US President Donald Trump announced a trade deal with China might not come until after the 2020 US presidential election. This got traders worried. The demand for the safe-haven Japanese yen rose pulling USD/JPY down.

On the H4 chart, the RSI, MACD, and Stochastic Indicators are all reporting the oversold state of the market. Indeed, the price has dropped to 108.50 yesterday and has been in a sideways movement since then. Very likely, it is preparing for a correction. An intermediary resistance level to check that may be located at 108.78 with the next one at 109.20. Otherwise, the support may be placed at 108.30.

Today, the Bank of Canada will announce the interest rate. During the previous session, it was decided to keep it at 1.75%, the highest level since 2008. The policymakers did not express any inclination to change it. However, the governor Mr. Poloz commented that they would observe how well the dynamics of the Canadian economy perform within the context of the global slowdown. Hence, the steady rate signalling the resilience of the Canadian economy may boost the Canadian dollar.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later