The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Welcome to the new week! The Asian trading session demonstrated slow action today. The main attention of traders is paid to the news concerning the US-China developments ahead of the US tariffs deadline scheduled on December 15. Let’s wait for further updates for that matter and check the key levels for the pairs.

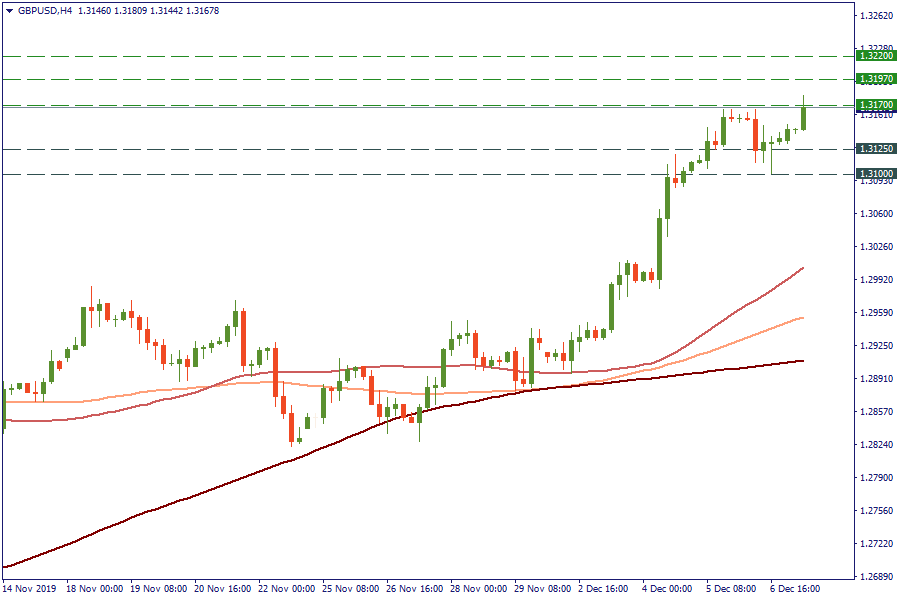

GBP/USD has been trading at the highest levels since May. The bull’s optimism was boosted by the extension of the Conservative Party’s lead in the most recent UK election poll. GBP/USD has been knocking the resistance at 1.3170 on H4. If this level is broken, the next key level will lie at 1.3197 and 1.3220. From the downside, the support levels will be placed at 1.3125 and 1.31.

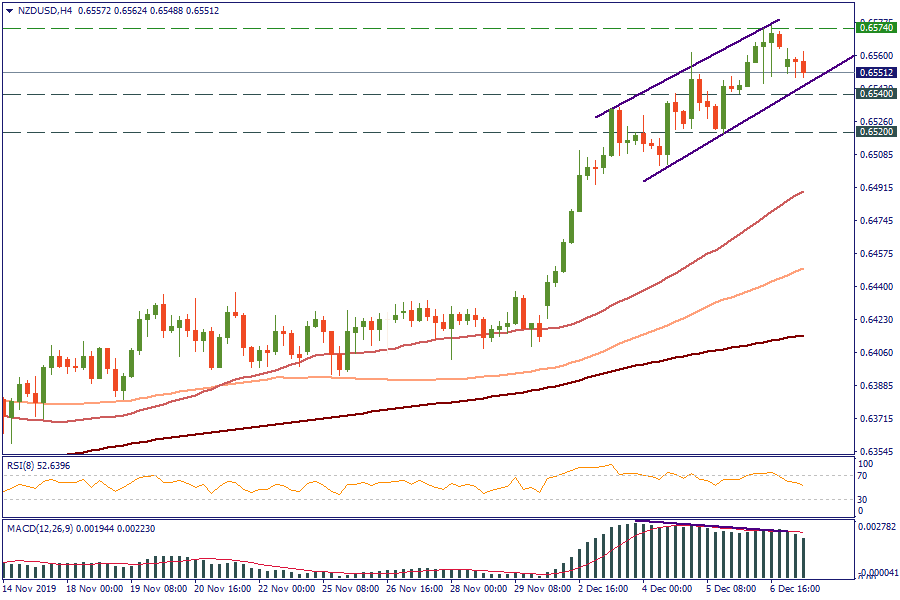

Last week was very bullish for NZD/USD, as the pair has risen to its July highs. On the daily chart, the kiwi broke the 200-day MA on Friday. Now we can see that the pair is facing a correction. On H4, the pair has slid lower to the 0.6540 level. We can see, that the price is trading within the ascending trading channel, that is why traders may open positions on the pullbacks from its lower border. The RSI oscillator is looking down, and MACD formed a lower high, which are bearish signals. In case of a breakout of 0.6540, bears need to pay attention to the 0.6520 level. From the upside, the retest of the 0.6574 level will be attractive for bulls.

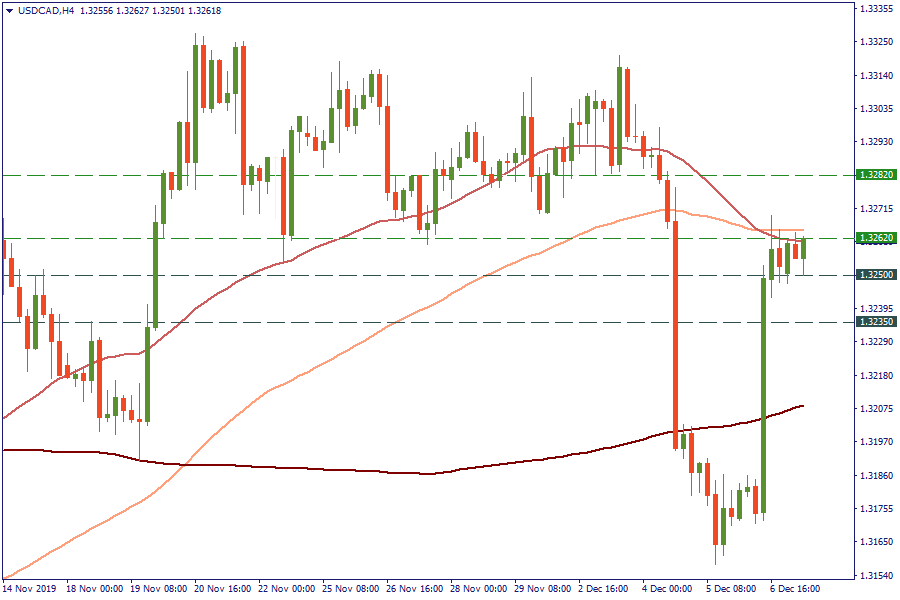

The Canadian dollar weakened against the USD on Friday after a greater-than-expected American job data. That is why it is not a surprise that the pair has started to consolidate today after the increased Friday’s volatility. On H4, the pair has been trading right below the crossover of 50- and 100- period MAs. The key levels for bulls lie at 1.3262 and 1.3282. The downward momentum is limited by the 1.3250 and 1.3235 levels.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later