The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

We can say that today is a Black Friday for currency markets – the American Non-Farm Payrolls are out. Although that is going to be the major market mover today, it is not the only one. Some more details are below.

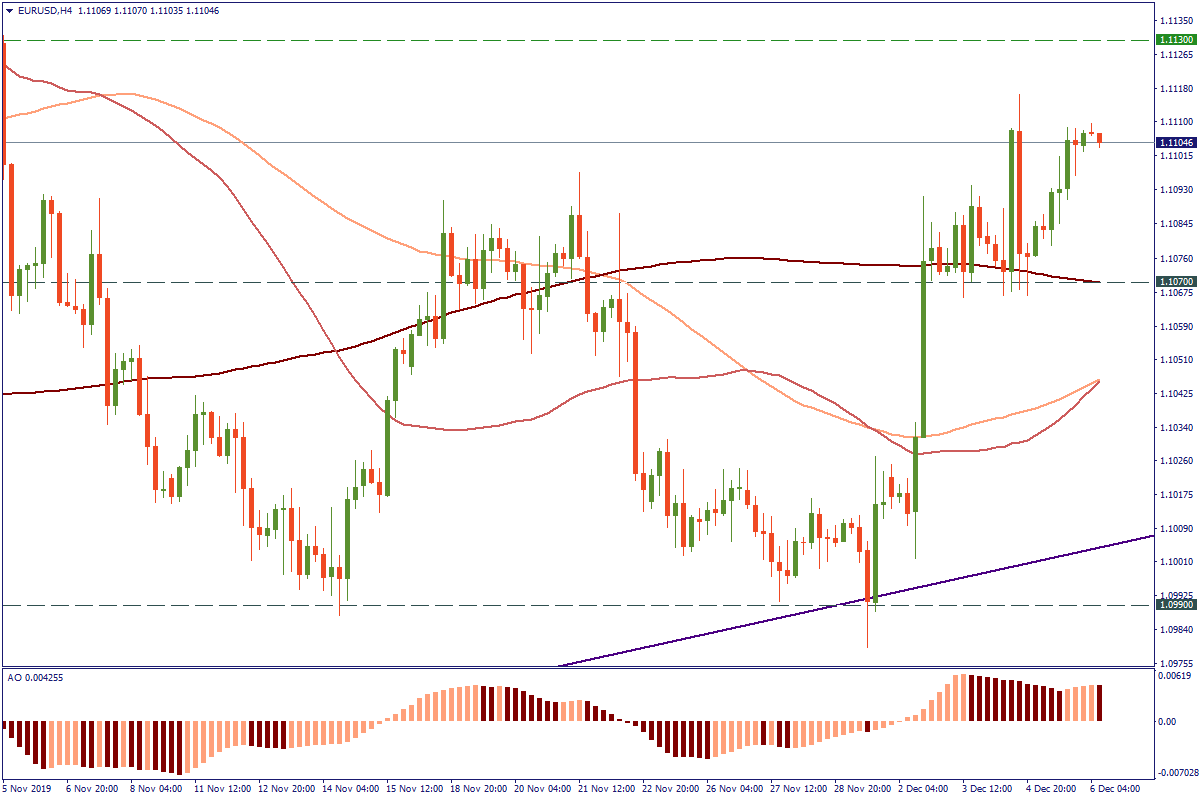

The price of EUR/USD has started this day by reconfirming the level of 1.1104 that it reached on Wednesday. It was a breakthrough of the month as the currency pair has never been that high since the first week of November. On the H4, the pair trades above the 200-period, 100-period and 50-period Moving Averages, which is another sign that there is a stronger bullish momentum than before. However, we still have to see how strong it is, and the resistance of 1.1130 may be a good level to check that. Today, a major factor influencing that will be the volatility of the USD in the context of relatively strong market expectations from the US Labor Authorities for the Non-Farm Payrolls and related data they are about to release.

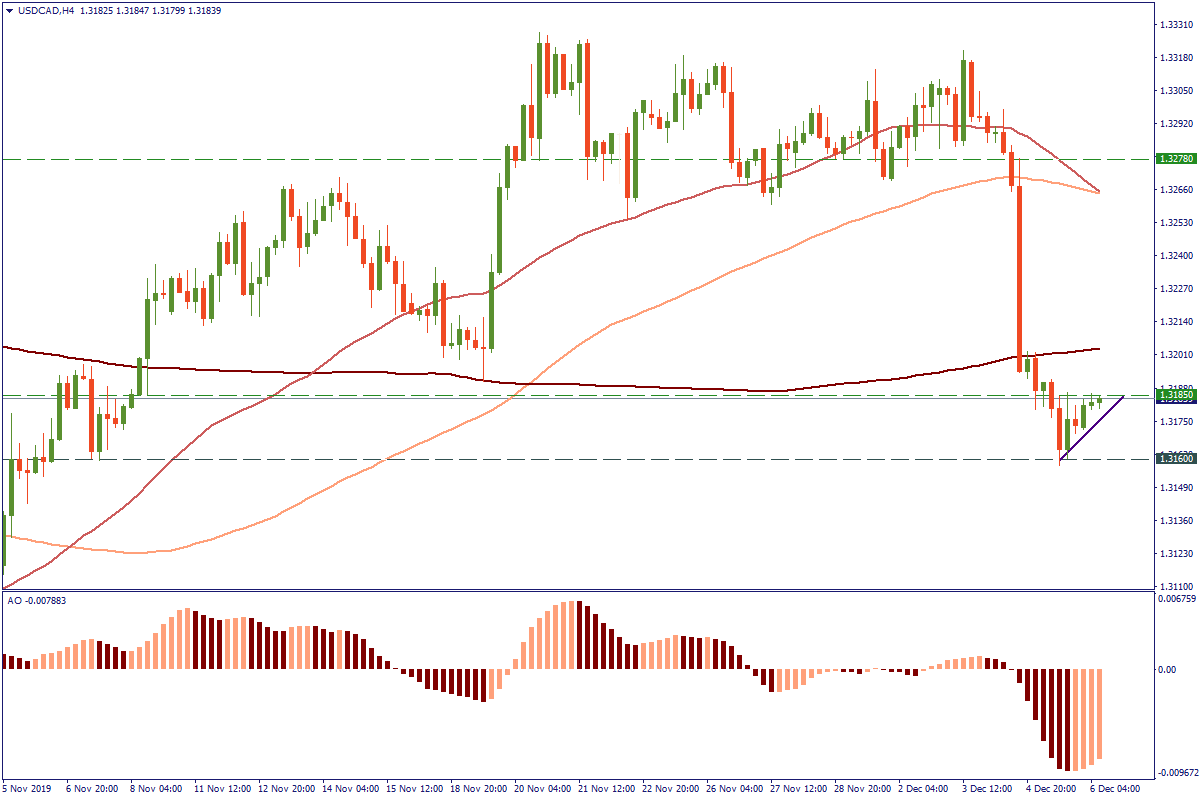

It is safe to assume that the consolidation of USD/CAD at the resistance level of 1.3185 reached on Thursday is a preparation for a more decisive move. There are some preliminary signs of a coming bullish trend to continue the correction after the serious drop at the beginning of the week. The Awesome Oscillator reached the low yesterday and reverted upwards signaling the general upward direction of the price. However, the next step will be defined by the release of the Non-Farm Payrolls due today from the US side and the jobs data due at the same time from the Canadian side. Therefore, watch the news and be careful with the coming price volatility.

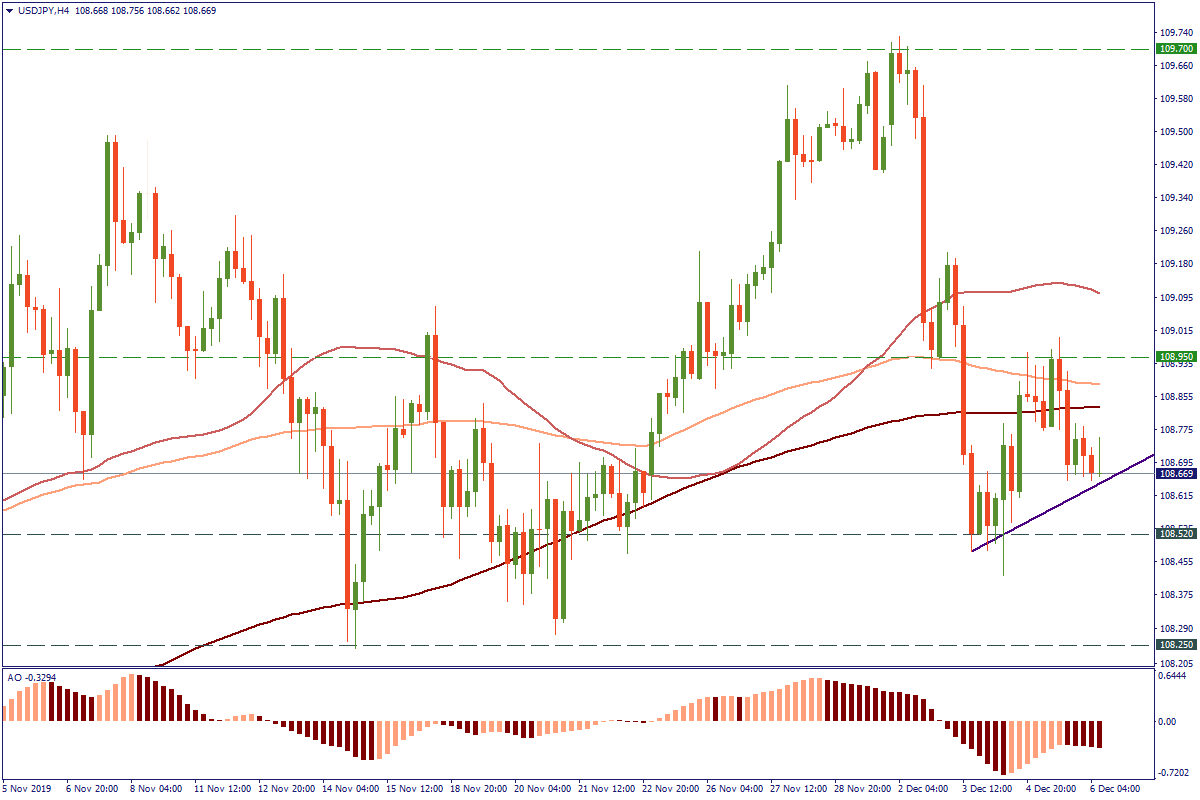

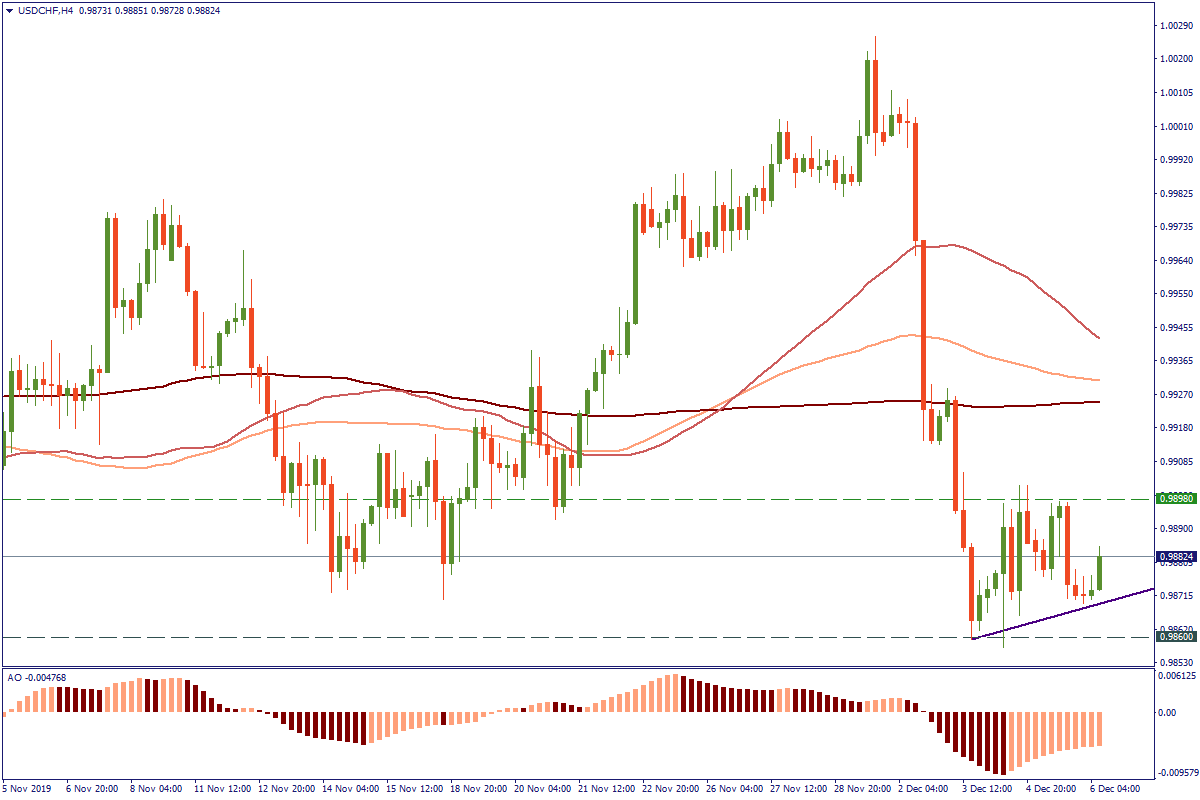

Against the Japanese yen and the Swiss franc, the American dollar shows similar patterns during the last two weeks. Both currency pairs dropped significantly on December 2-3, below the 200-period, 100-period, and 50-period MAs, and both are showing a mild correction since then, having bounced down on Thursday from the local resistance levels corresponding to each one. Although the internal and external contexts for the Swiss and the Japanese currencies are different, the common factors such as the Non-Farm Payrolls moving the USD will affect both in a similar way once again. That effect may be reinforced by the fact that both currencies are safe-haven and gain strength when the market feels uncertainty about the American dollar.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later