Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Today is expected to be a relatively quiet day in terms of economic announcements. The big events start on Wednesday, while at the background the December 15 deadline for imposing new tariffs by the US on the Chinese goods will keep the market dynamics warmed up through the rest of the week. Such a layout represents a future sentiment among many within the financial circles: nothing really disastrous, but a general outlook of uncertainty, misbalance, and slowdown. Essentially, these are the reasons why Goldman Sachs analysts predict the price of gold to rise in 2020.

More specifically, they say it may soar up to $1600, which actually is quite a worrying prediction. The last time gold was in that area were the years 2011-2013, which means crisis and post-crisis period. And the level itself is substantially far away from the current area of $1470 per troy ounce. However, the upward trend is visible since 2016, and it seems that even without any major disappointments in the global economic environment the market would gradually get to the heights of $1600.

Nevertheless, below are some of the noteworthy events of regional impact, which may become the market movers to a certain extent today.

You can have a closer look at these events in the economic calendar.

Since August this year, the euro has been dropping against the British pound and has not made an exception recently. In fact, it may find more reasons to continue the same direction. The pre-election polls show that the Conservative party of Boris Johnson is gaining strength, which in turn supports the GBP. While the questions about the bond purchasing program within the quantitative easing by the ECB keep rising, not leaving much space for positive expectations on the coming press-conference by Christine Lagarde. Altogether, this weakens the EUR/GBP pair. Technically, it is expected to keep falling in any case in the long-term. In the mid-term, however, we may see a surge up to the levels of the 50-period and 100-period Moving Average, to which it came every time before dropping further during the last three weeks. Today, although a recoil up to the resistance of 0.8455 is still a possible scenario, more probably the price will crawl a little further up and then drop. On the H4, we already see that the level of 0.8400 was touched during the trading process previously, and the price is consolidating along the current level in a sideways movement. So watch out for a minor local upswing followed by the continuation of the downtrend.

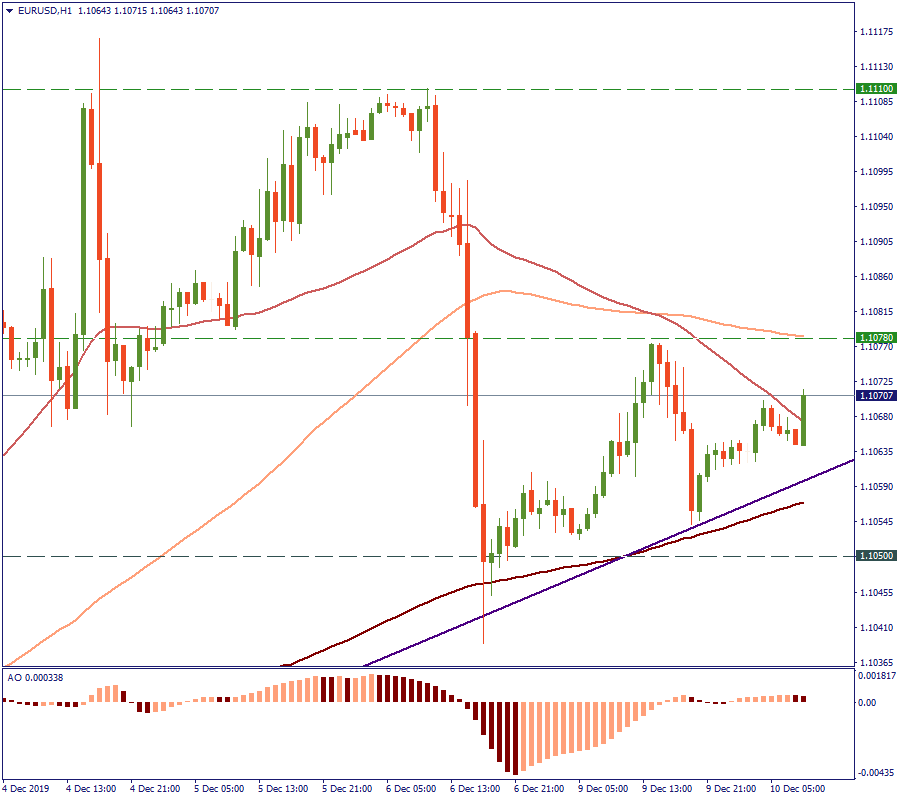

Against the US dollar, the euro has been rising since the end of November, even despite the strong NFP data released by US labor authorities on December 6. On the H1, this marked trend is visible and currently coincides with the 200-period moving average, supporting the price movement. It would be tempting to assume that the price would continue the same direction. However, we have to take into account the news coming. On Wednesday, the Fed will announce the interest rate and give a press conference. That is, after a positive NFP data, showing the resilience of the US economy. On Thursday, the European Central Bank will do the same for the Eurozone, but the expectations are hardly positive. Therefore, it will be safer to price-in the downward reversal later on. But for now, the resistance of 1.1078 is a feasible target for the price to reach.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later