The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The OPEC meeting and the US Nonfarm Payrolls rocked the market last week. The market is torn between optimism about the global economic recovery and concerns about the new coronavirus strains. How will this impact various financial assets in the days ahead?

Check the economic calendar for more news.

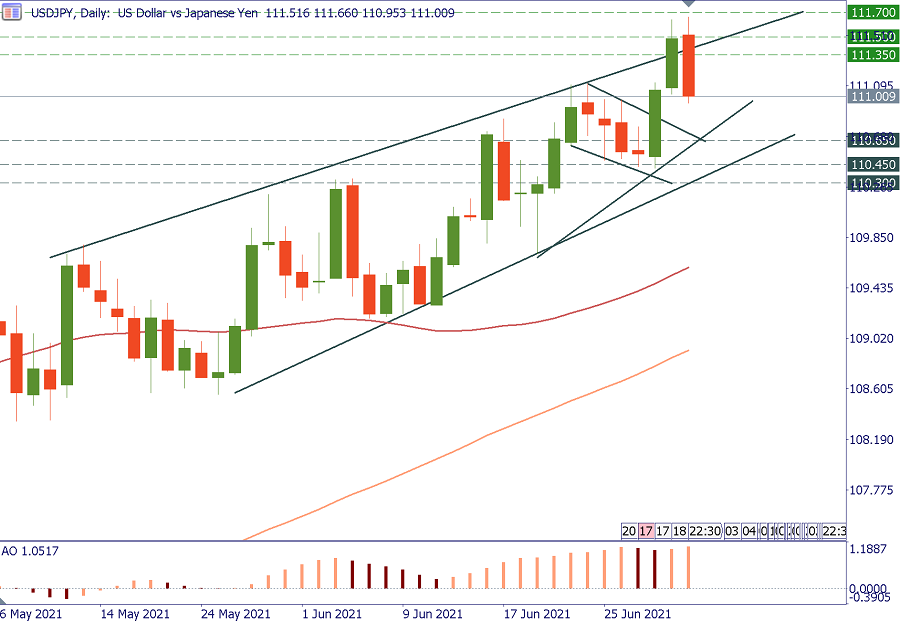

All major currency pairs — EUR/USD, GBP/USD, USD/JPY, and others — are testing important technical levels. The upcoming events will show if the prices are able to enter new areas. The minutes of the Federal Reserve’s June meeting will come out on Wednesday, and traders will be eager to see whether the USD rises as it did after the meeting itself. The heads of the ECB and the BoE will speak on Friday.

Nonfarm Payrolls (NFP) in the US rose by 850,000 in June, better than the market expectation of 700,000. Unemployment rate went up to 5.9%, compared to analysts' estimate of 5.7%, and the Average Hourly Earnings increased by 0.3% on a monthly basis as expected. All in all, the figures are fine, but the USD weakened after the release, probably as traders tok profit on the previous longs.

Pay attention to the bearish engulfing pattern on the D1 chart USD/JPY: a correction to 110.65/30 is now likely. EUR/USD has managed to close above 1.1850 but an advance above 1.1875 and 1.1920 is needed to open the way higher.

AUD/USD awaits the Reserve Bank of Australia’s decision on Tuesday. The pair was stopped on the upside by the 100-month MA at 0.7715 and is vulnerable to a slide to 0.7270 and lower. In Australia, half of the population went into lockdown last week.

S&P 500 has once again visited record highs. Individual stocks are also offering interesting setups. For example, Nike kept soaring after a strong sales report: although there may be corrections to the downside, the future looks bright. Johnson & Johnson claimed its vaccine neutralizes the fast-spreading Delta virus variant, and the outlook for the firm shifted. A break above $166.50 will open the way up to $170.00.

Gold and oil are still investors’ favorites. The precious metal remains a buy on the dips, while oil will continue reacting to the news and showing intraday volatility. The recovery can take XAU/USD to the $1813/1824 area. The level of $1750 will remain strong strong.

The overall uptrend for XBR/USD will remain in place as long as Brent is trading above $71 a barrel. Although Russia and Saudi Arabia were eager to increase output, the United Arab Emirates on Friday blocked an OPEC+ deal demanding better terms for itself. The talks will likely resume on Monday. If the nations fail to reach a deal, the crude price may be squeezed higher in the short term. Then there will be a risk of price war as every producer will want to get more money from the market.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later