Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

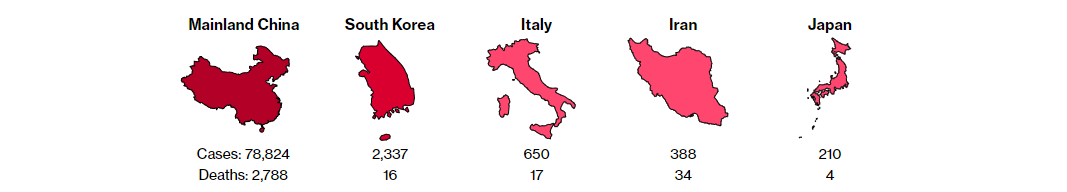

On Friday, the total number of confirmed infections worldwide rose to almost 84,000 with approximately 2,800 deaths. Among those, over 78,000 infections and 2,700 deaths took place in mainland China, while the rest – mostly in South Korea, Italy, Iran, and Japan. Note: the expansion inside China appears to be topping out. In the meantime, how the virus will expand in the other countries – we have yet to see.

Currently, the global GDP is expected to fall by 0.5% because of Coronavirus. That would make it 5.5% and that’s an alarming level. However, if the virus reaches the pandemic classification, the reduction will be even bigger. The stock market is in the pre-panic mode: S&P is down by more than 4%, NASDAQ the same, and Dow lost more than 12% from its February 12 high. Goldman Sachs predicts no earnings growth in 2020 for most of the US companies because of the virus outbreak. Certain US stock market sectors (mostly IT due to higher dependency on Chinese supply chain and production) lost more than 10% during the last week of February. As you can see, the gravity of the situation is difficult to overestimate, and we haven’t yet seen the bottom of it.

The chain of consequences is quite straightforward. As the economies are intertwined and the global trade especially depends on China, the major disruption in the activities of the latter leads to major disruptions in productivity to all the rest. Let’s take just one obvious example: Chinese travelers are banned from half of the world, so they don’t get outside their country and don’t spend their abroad. The airlines don’t get what they were planning for, and the tourism sector is not getting what it was hoping for, and a lot of retailers will see their sales short of what they thought. A similar scenario, even in stronger colors, takes place in multiple levels and sectors of global activity, much more critical than tourism.

In the long term, hedge well: make sure that you have some have havens like gold in your portfolio.

In the medium term, profit from bearish trades while the panic-like mood rules the markets. The time of risk aversion is great for selling S&P index, AUD, and NZD. After, once the bottom is touched (i. e. once there is a global top-out on infection cases and the curve loses vertical momentum), go risk-open and trade bullish.

In the short term, as of Friday, the traditional safe-haven currencies such as the JPY and CHF were in power against the USD. Given the latest virus updates and projections, these are likely to stay in demand as long as there is uncertainty. The currencies which are directly linked to China such as the AUD and the NZD will suffer the most and have little to oppose the USD even if the latter is shaken itself. Gold finished last week in a sideways “confused” mood, but it is a safe-haven asset too so it will keep rising on the Coronavirus until things are confidently resolved on a global level. Oil is on a downslope as there is no guarantee the demand will catch up for it – OPEC is set to respond to this threat during its emergency meeting on March 5 and will try to support the price.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later