Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

With emergency meetings taking place every two days, it is becoming irrelevant to anticipate outcomes of the planned economic events. For this reason, let’s just recap what happened recently and try to have a broader perspective.

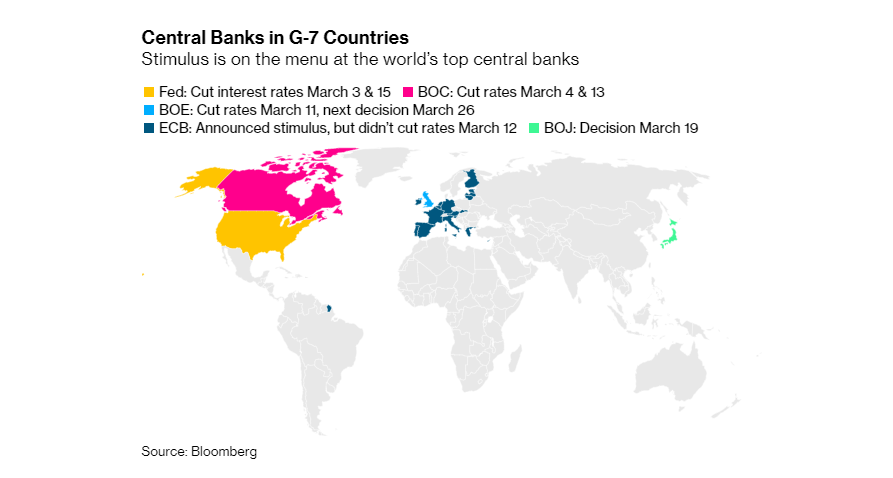

All major central banks have already reacted to the coronavirus fallout by either cutting interest rates or announcing quantitative ease measures – or both. The map below shows what corresponds to the G-7, and note how quickly evolve in the context of the recession fears: this map from Bloomberg’s fresh (this Monday) article only leaves it to the Bank of Japan to take action on March 19 – and the Japanese financial officials have just had an emergency meeting! They left the interest rate unchanged but informed the audience on extensive quantitative ease measures, announcing their full commitment to the G-7 countries to support the level of US dollar liquidity in line with their overseas colleagues.

Quite controversially, the fact the financial authorities reacted to the coronavirus fallout comes with little consolation. Most of the banks have already fired most of the available artillery at the recession risks. That means, there is very little monetary financial capacity left for the financial authorities of the strongest countries – if any. And that’s while the coronavirus has just started its march into the countries of the most developed and wealthy part of the globe. It appears that the true fight for the global economy will be a test for lengthy economic resilience, and there is normally little chance left for a combatant who fires most available ammunitions at the first strike.

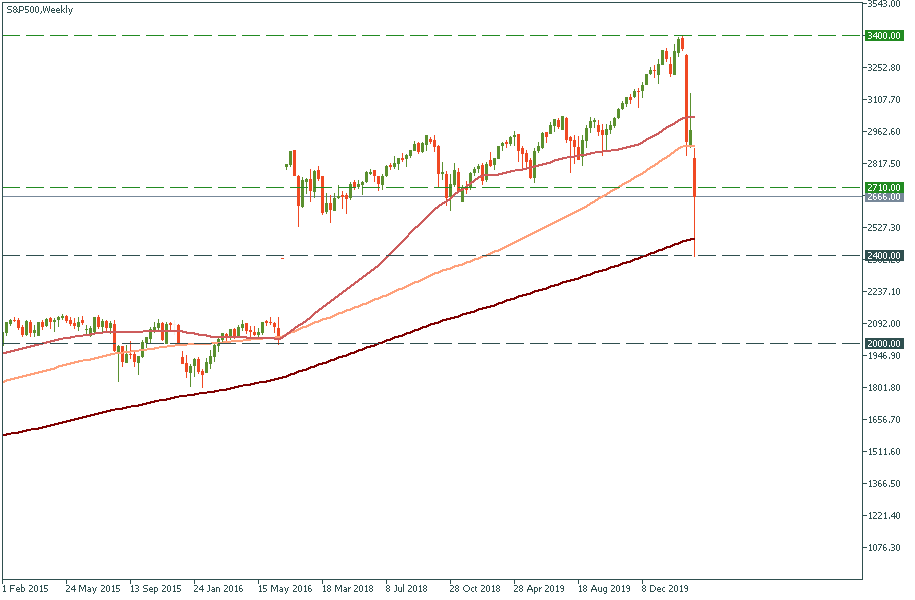

The US President, a strategic supporter of low domestic interest rate, finally expressed his joy seeing the US Fed cutting the rate to the target range of 0-0.25%. Was Wall Street happy as well? Barely so. Most observers either called for more stimulus or blamed the Fed for panicking and bringing even more run-for-your-life mood into the investors’ circles. Obviously, we are yet to see how the situation around the coronavirus develops, but the currently, financial circles prefer a cautiously modest economic view of the nearest future. Most of the media prefer to view the situation as multi-alternative and restrain from direct predictions. In the meantime, Goldman Sachs sees S&P dropping to 2000 as one of the scenarios. Currently, it is at 2666, which is 21% lower than its recently left all-time high of 3400. So let hope for the best, prepare for the worst, and use the opportunities we have now!

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later