The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Last Friday, the phase-one trade agreement between the US and China has been struck. Both parties confirmed that, the overall tone is positive, so we can breathe better now and discover life at the market once again after almost two years of pressure.

Strategically, of course, it is good news. The fact the agreement has been reached and that no further conflict escalation is going to happen in the observable future is much better than the continuous tension and uncertainty.

However, the devil is in the detail, as usual. While there are no new details incoming from the front, we can make a brief examination of the agreement that took place and try to understand what exactly it brings.

On Friday, the US Trade Representative Robert Lighthizer advised that an 86-page text has been approved to guide the further trade process between the two countries. General document outline was presented, however, it was clarified that no official signing took place – that will happen in January 2020.

That may be nothing more than a rush of both countries to finish up the deal before the end of the year. Which would be a positive sign, in this case. Alternatively, it leaves space for changes in the document and in additional negotiations until the signatures are put in the paper. That would mean that what happened on Friday is more like an intentions agreement rather than a detailed list of mutual commitments.

Halves its 15% tariffs on approximately $120 billion on Chinese goods, suspends indefinitely all the duties previously planned for December 15.

Increases the purchase amount of American goods of up to $50 billion worth yearly in the next two years, invalidates technology transfer for foreign companies as a requirement to access the Chinese market.

Some analysts went as far as to state that the deal reached is hardly comparable to the actual and potential damage brought by the trade conflict with “no clear war aim and no clear endgame”. The conflict itself was described as an “economic Afghanistan” referring to the historical records of what happened to the world empires when they came to the mentioned country resolving their territorial disputes.

Obviously, such a point of view would be the most skeptical end of the analytics spectrum. Most of the observers still see the deal as a significant advancement and hence predict the economic climate in 2020 to be much healthier than in the last two years.

The effect on the currency market, however, was not as strong as it may have been expected.

On the H4, the EUR/USD showed a steep drop on the day of the deal announcement after reaching the October high of 1.1180. But immediately after it started rising again, which follows the mid-term upward trend visible since the very end of November.

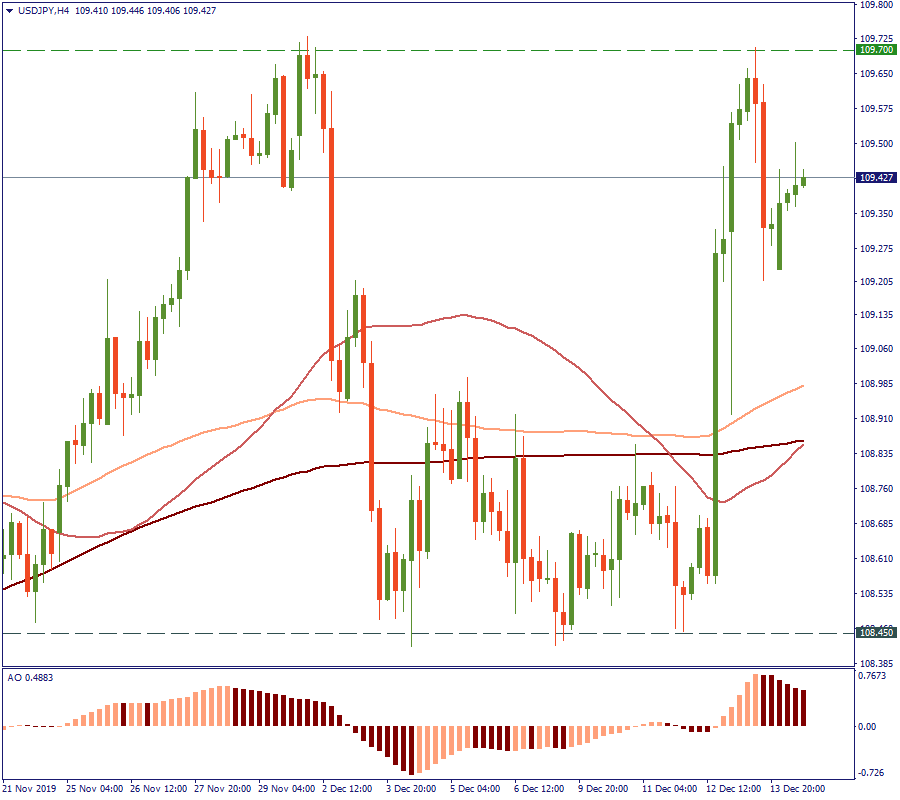

Against the Japanese yen, the USD did surge on Friday, but again, it was right up to the resistance of 109.70 which is there since November 29. Hence, nothing really extraordinary happened here neither.

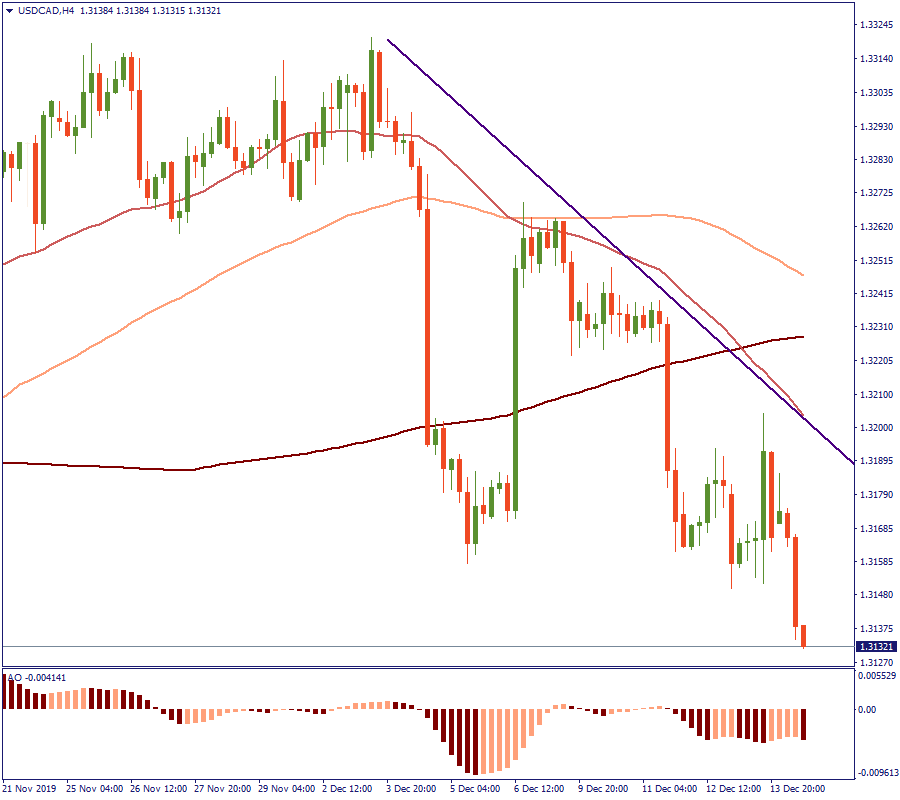

Against the CAD, it is even hard to comment that something notable took place. On the H4 of USD/CAD, the downtrend in place since the beginning of December did not change and shows little evidence to reverse.

In November, one of the Chinese officials revealed that the Chinese authorities saw the trade deal possibility with the US with “cautious optimism”. Apparently, the same approach should be kept for a while when applying the trade talks advancements to the currencies price action: although generally positive, it is hardly perceived as a definite breakthrough by the Forex market.

Follow the news, and make wise trade decisions!

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later