The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Join Us on Facebook

Stay on top of company updates, trading news, and so much more!

Thanks, I already follow your page!

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

69.21% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The United States will publish the Inflation Rate and Core Inflation Rate, also known as US CPI and Core CPI, on August 10 at 15:30 GMT+3. These indicators show a change in the price of goods and services purchased during the previous month. The main difference between the headline and the core indicator lies in the calculations. The Core CPI excludes food and energy prices due to their volatility.

The inflation rate is the most significant measure of economic health nowadays. Fed uses it to plan future rate changes and change quantitative tightening measures. The release greatly impacts almost every asset, including gold, stock market, cryptocurrency, and all USD-related forex pairs.

In brief, yes. When Federal Reserve released its statement on July 27, Fed chair Jerome Powell stated they had achieved the “neutral zone.” The current US interest rate of 2.50% is neither stimulating nor slowing the economy. Future rate changes will depend only on the economic data. Many analysts believe we have passed the most hawkish point of the Fed’s monetary policy.

Thus, a higher-than-expected CPI release will have a massive impact on the USD and Gold, which tend to move in the opposite direction. High inflation would mean the Fed’s policy isn’t good enough to control the prices, and a chance of a bigger rate hike will rise. As for now, the market expects a 50-basis-point hike on September 21.

Last time, XAUUSD went down by 2300 points after the release, only to soar by 3600 points an hour later. A 1-lot trade would have earned you from $2300 to $3600.

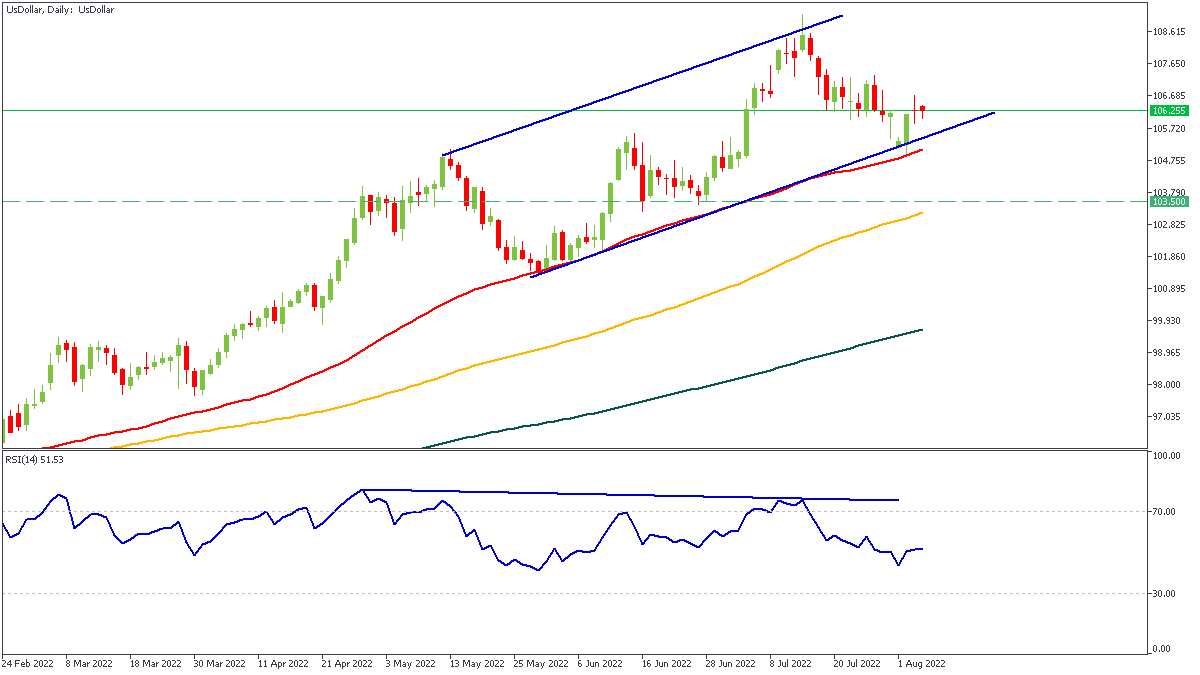

Notice that the USD looks weak on the daily timeframe with a bearish divergence on the RSI. The breakout of the channel’s lower border will send the US dollar index lower to 103.50, pushing EURUSD and gold to the sky. Still, this will happen only in the case of low CPI.

Several companies will release their earnings report this week, so keep an eye on the charts and subscribe to the @FBS Analytics telegram channel to be the first to read the fresh news and get high-quality trade ideas!

Inovio – August 9, after the market close

Coinbase – August 09, after the market close

Novavax – August 11, after the market close

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later