Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

EUR and risky currencies, stocks and oil prices surged on prospect for reopening.

It looks like investors turned a blind eye to the US-China trade war. By the way, violent protests have increased in most American cities after Donald Trump promised to deploy military troops to stop them. Nevertheless, the market is mainly focused on the optimistic outlook for economies reopening as lockdowns eased all over the world and life started to come back to normal.

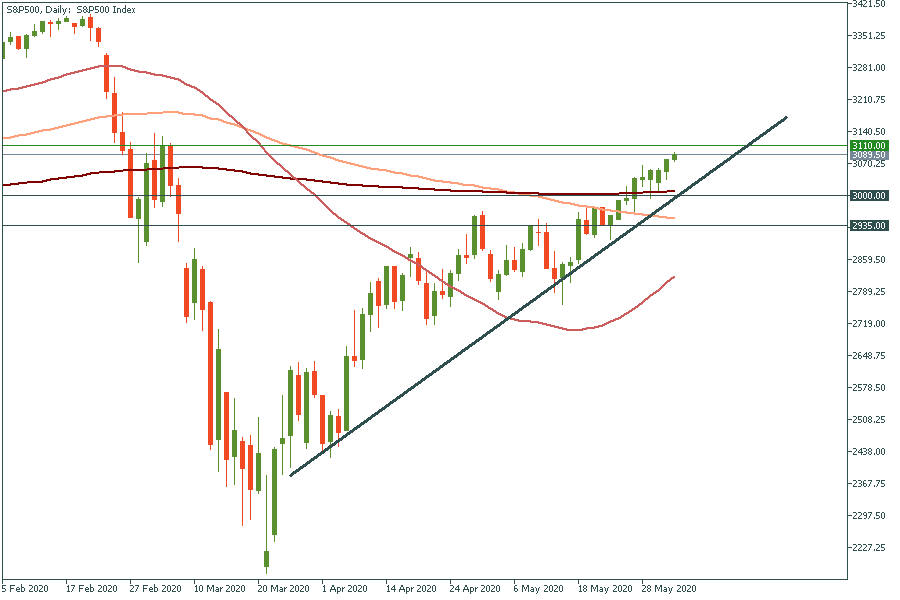

S&P 500 keeps rallying on a high speed. Two shares increased on the S&P 500 Index for every one that decreased. Let’s look at the chart. The price has passed 3080. Now it’s headed to the highest point over three months at 3110. Support levels are 3000 and 2935.

EUR gained on the weak US dollar and the upcoming ECB meeting on June 4 at 14:45 MT time. Analysts expect that the central bank will increase the rescue program by additional 500 billion euros of asset purchases. If EUR crosses the resistance level at 1.121, it will rise further to 1.124. Support levels are 1.117 and 1.11.

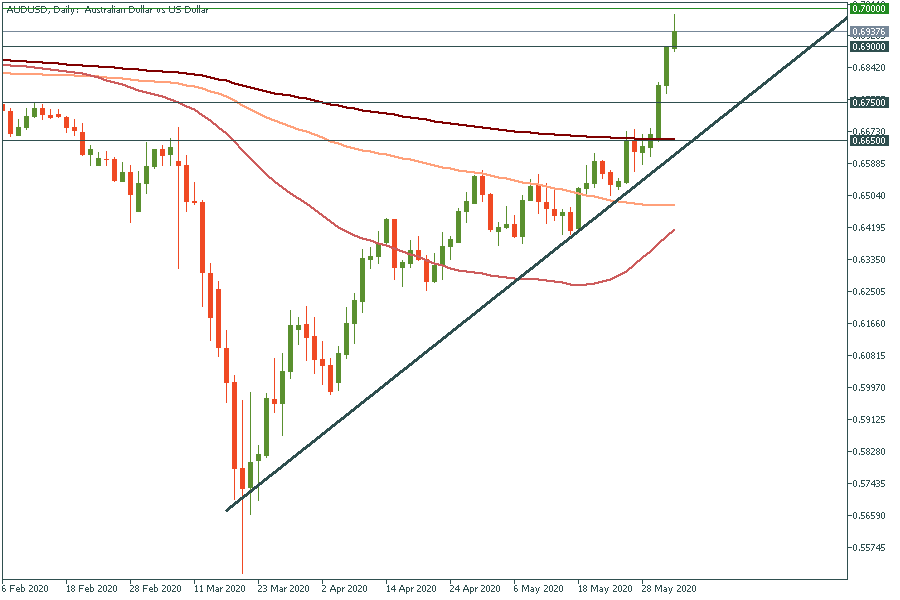

As you know, the Australian dollar is really sensitive to the market sentiment. And, today it’s really risk-on! AUD continues climbing up. It has just passed the resistance at 0.69. Now it’s approaching the highest level of this year at 0.7. Support levels are 0.69 and 0.675.

The market continues surprising us today. The Brent oil price has just crossed the unseen level since March 6 – $40 a barrel. If the price breaks out the 100-day moving average, it even may skyrocket to $45. Support levels are 36 and 34. The reason behind is that OPEC+ heads to expand the output cuts. However, things may not be so sunny. Russia may reject to extend supply cuts as rival shale producers can open their taps again on increasing oil prices.

To trade Brent with FBS you need to choose BRN-20N.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later