The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The US Bureau of Economic Analysis will publish Core Personal Consumption Expenditures (PCE) on March 31, at 15:30 MT. This monthly release comes out 30 days after the month ends. The PCE indicator differs from the core CPI as it measures only goods and services consumed by individuals. Prices are weighted according to the total cost of a product. It provides essential information about consumer behavior.

Inflation in the US keeps increasing due to geopolitical news. Moreover, logistical problems caused by the boycott of Russian goods and resources accelerate the US market prices’ rise. As a result, the Federal Reserve has to consider faster rate hikes. Expectations of such policy push the USD up. The US dollar index is trading near the highest levels since May 2020.

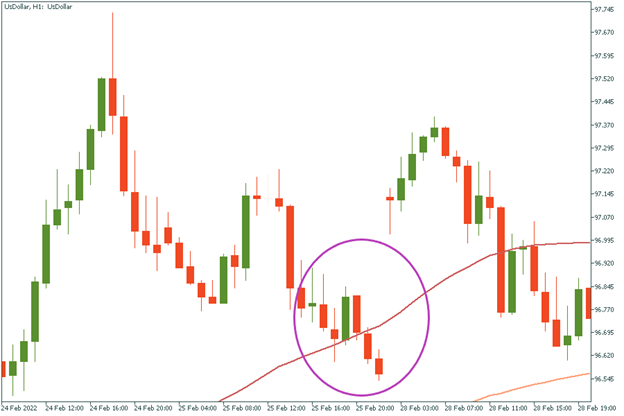

On February 25, PCE rose by 0.5%, the same as predicted. However, the release was overshadowed by the beginning of the Russian-Ukrainian conflict. Due to this fact, the currency fluctuations weren’t significant.

As the PCE index is crucial, it is likely influence gold and the USD pairs. Gold is considered as a hedge against inflation, but PCE high numbers increase the chance of rate hikes. Thus, the metal may fall against the USD.

Check the Economic Calendar.

Instruments to trade: XAUUSD, EURUSD, USDCAD, USDCHF.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later