The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Today, the UK parliament starts the debates over Boris Johnson’s Brexit plan. This process is planned to end by Thursday. As the Prime Minister has the Conservatives’ majority in the House of Commons, the legislation is expected to be passed smoothly. Hence, financial observers do not see here any source of trouble.

Tomorrow, Boris Johnson meets the European Commission president Ursula von der Leyen. That will be the starting point for the current stage of UK-EU divorce negotiations. Analysts fear that the rigid stance of the British PM on exiting the EU by the end of 2020 at all costs may cause the markets to tremble more than expected. As the no-deal Brexit risk stays above the markets as the sword of Damocles, the GBP is under constant pressure down. Consequently, GBP is foreseen to trade lower over the next months.

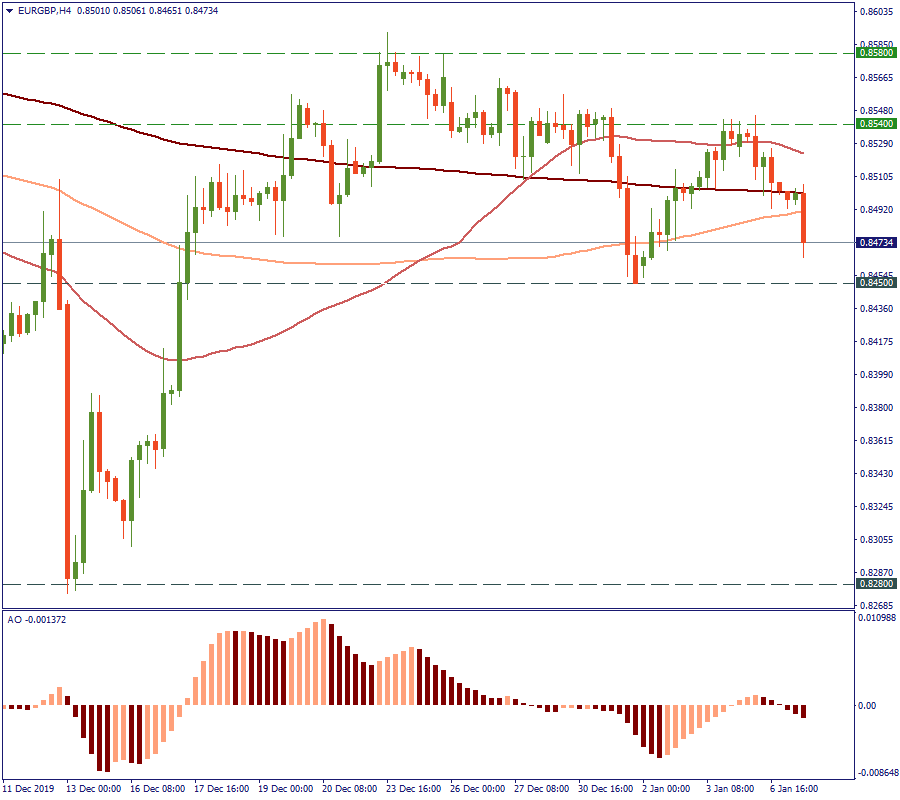

On the H4, the EUR/GBP moved from 0.8450 in the first day of 2020 up to 0.8540 yesterday. Then it dropped to 0.8473, where it is now. Analysts predict that is a short-term drop, and a gradual strengthening of EUR is likely. The December high of 0.8580 serves as a secondary resistance and a checkpoint for the pair’s bullish intentions.

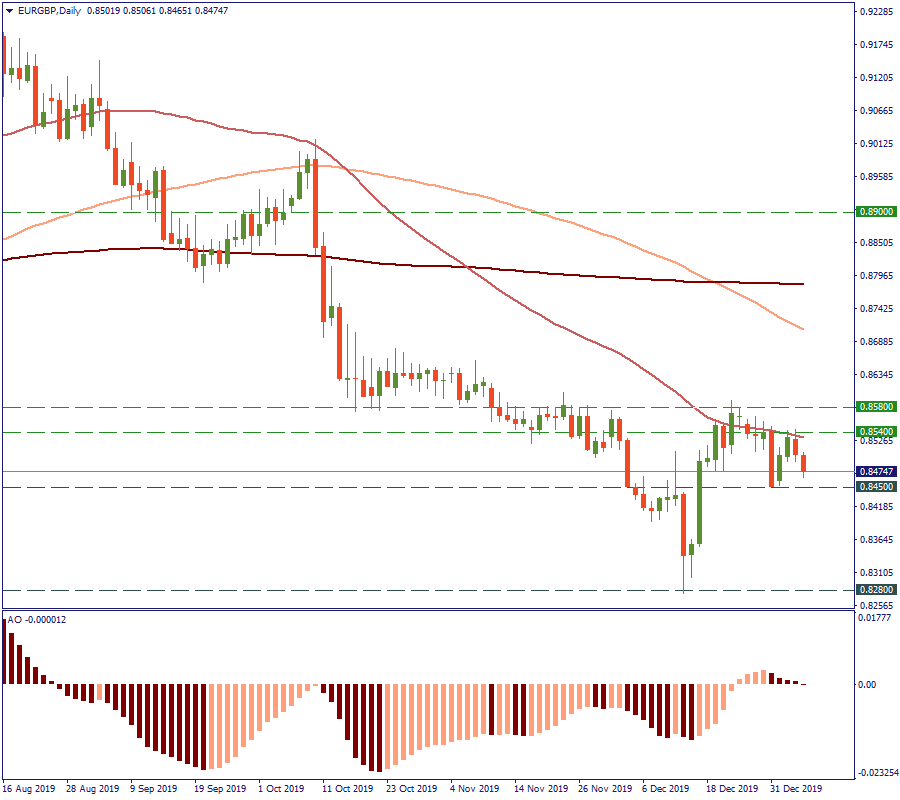

Analysts foresee a strong possibility for the pair to rise up to 0.89 closer to the second part of the year. As impossible as it seems right now, the daily chart shows that this level was just left in October, so that is nothing extraordinary. The question is more “when” then “how”. However, the certainty of this trend should not be taken for granted. The coming months will give us clues on whether there will be a no-deal Brexit or the UK and EU will manage to meet the deadline in good terms.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later