The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

While all eyes are on the trade talks between the United States and China, traders can profit on other events. The British pound has rallied versus the other major currencies on the growing expectations that Prime Minister Boris Johnson would win a majority at December 12 election.

Market’s confidence in Johnson rose after he promised to deliver Brexit by the end of January and a tax-cutting budget within 100 days of winning the vote. He also pledged to review defense, increase funding for schools, and introduce legislation on immigration to Parliament.

The Labour Party, the main competitor of Johnson and Co., issued a statement criticizing the previous policies of the Conservative Party, which has been in power for about “3,500 days”. Yet, this criticism did not waver optimism in Johnson and the GBP.

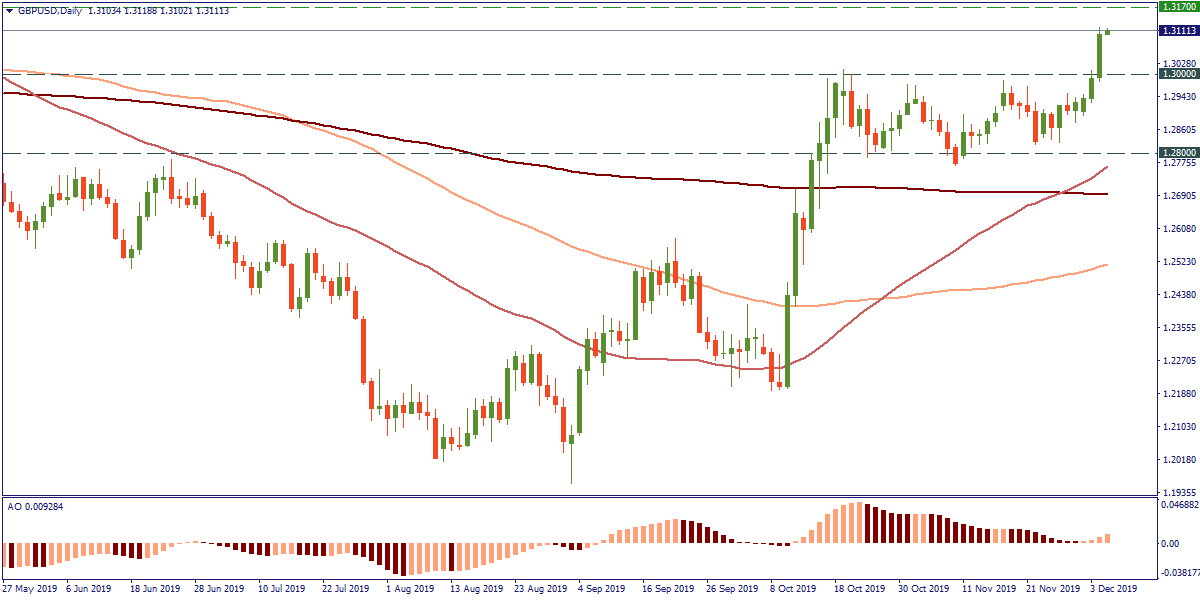

It is obvious that the Conservatives are trying to show the population how much better their majority government would be in comparison with a hung parliament – a prospect that will become reality if the Prime Minister’s party does not get enough support. So far, Johnson is leading in the opinion polls. Investors liked his latest comments a lot: as you can see from the chart of GBP/USD, they are willing to buy the pound right now, without waiting for the actual outcome of the election.

The short-term outlook for the GBP is positive, although the British currency has become somewhat overbought after soaring by more than 100 pips during one day. GBP/USD has the scope to strengthen to the resistance between 1.3170 and 1.3200. The psychologically important level of 1.30 will now offer support.

There are no doubts that GBP/USD will offer superb trading opportunities in the upcoming hours.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later